By Boriss Gubaidulin, Africa Director, Admirals

The global online trading market has witnessed a remarkable upswing, fuelled by technological advancements and the widespread accessibility of the internet. This surge in popularity and increase of the global market size to USD9.32bn in 2022 has been instrumental in democratising investment opportunities, enabling individuals from various corners of the world to partake in online trading.

Based on a comprehensive analysis conducted by Grand View Research in 2020, the global online trading market showcased a valuation of approximately USD15.47 billion in 2019. Notably, this market has been on an upward trajectory, with a projected compound annual growth rate (CAGR) of 9.7% from 2020 to 2027.

With the advent of user-friendly platforms and cost-effective trading options offered by numerous online brokerages, retail investors are increasingly recognising the potential of online investing. This realisation has ushered in a new era of financial inclusion, empowering individuals to take charge of their financial futures.

A closer look at the African Market

Within the realm of online trading, Africa emerges as a market of untapped potential, poised for remarkable growth, as highlighted by the latest quarterly report from Finance Magnates.

While developed markets face saturation due to aging populations, Africa’s online CFD trading market is experiencing significant upward momentum, primarily due to a high youth population ratio, high mobile penetration, and technological improvements. Notably, the continent boasts the presence of the world’s five fastest-growing economies, with Nigeria leading the charge, fuelled by its population of over 200 million.

Even a modest conversion of just 1% of the population into online traders would yield an impressive 200,000 active traders. To put this into perspective, the number of active CFD/forex traders in the United States currently hovers around 200,000, and in Germany, it reaches approximately 100,000.

Africa’s vast growth potential and evolving regulatory landscape makes it a desirable destination for global expansion, with several reputable players such as Admirals steadily moving into Africa.

The Impact on Emerging Markets

Emerging markets are reaping a multitude of benefits from the rise of online trading, which is transforming their financial landscapes in significant ways. One prominent advantage is the enhanced accessibility and financial inclusion it brings. Online trading platforms have opened doors for individuals who were previously excluded from traditional investment opportunities, empowering them to participate in global markets.

Additionally, online trading enables investors in emerging markets to diversify their investments beyond local markets, reducing dependency on a single economy and thus spreading risk.

Moreover, lower costs and fees associated with online trading make it more affordable for individuals in these markets to engage in trading activities. Furthermore, the impact of online trading goes beyond personal finance, contributing to economic growth, job creation and the establishment of new businesses.

This growth, in turn, generates employment opportunities across various sectors such as finance, technology, and customer support services. Overall, the benefits of online trading in emerging markets extend far beyond financial gains, driving inclusive growth, fostering economic stability, and creating avenues for prosperity.

Embracing Challenges and Opportunities within the African Market

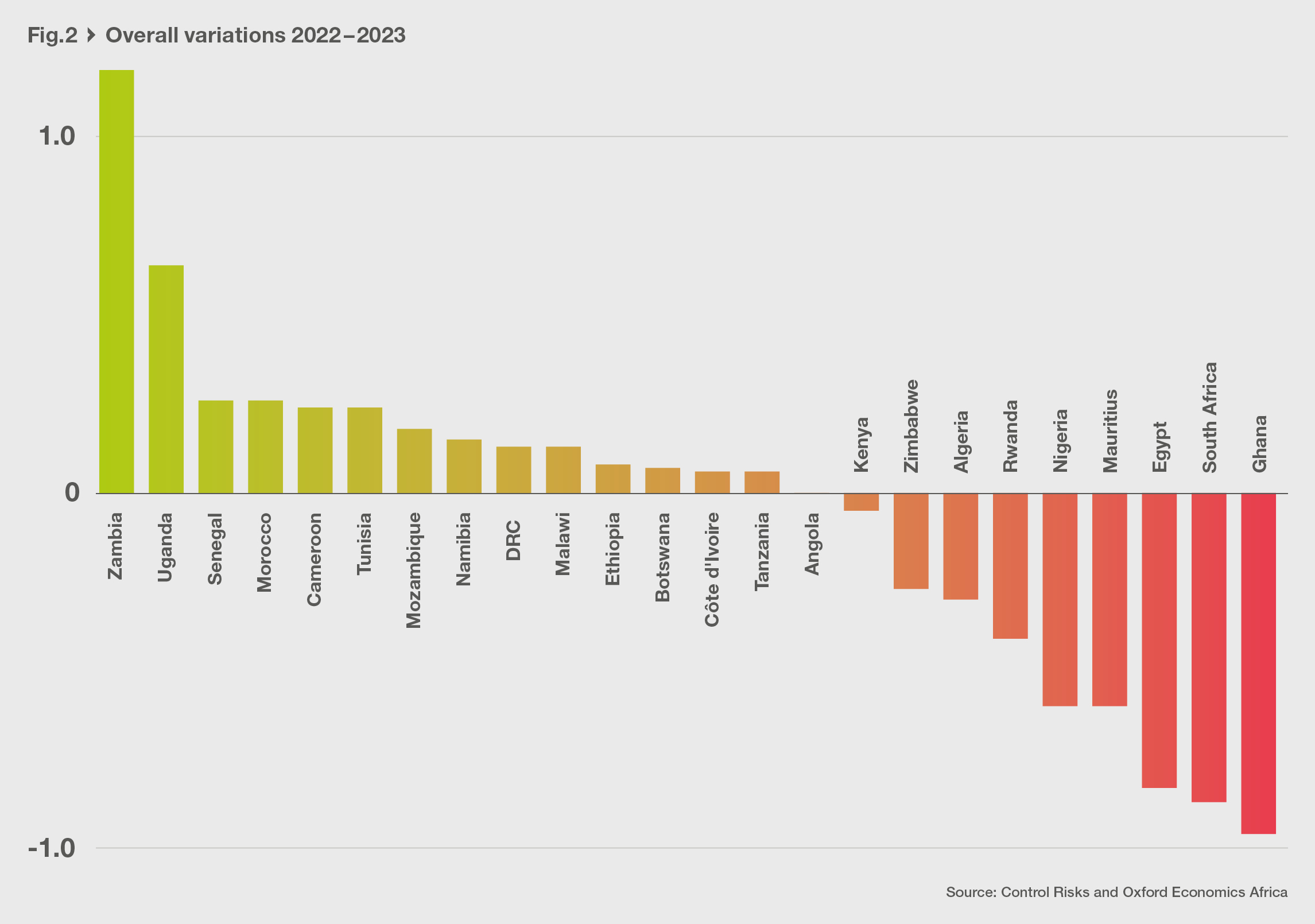

While the African market showcases immense growth potential, it is not without its fair share of challenges, setting it apart from more developed markets. One significant headwind is the presence of political instability, which can create an uncertain investment environment.

Additionally, currency fluctuations pose a risk, making it crucial for investors to carefully manage their exposure to mitigate potential losses. Moreover, the higher levels of risk associated with investing in emerging markets can impact investor confidence, requiring a cautious approach and thorough risk assessment.

Navigating Africa’s often complex and variable regulatory landscape presents another potential hurdle. Whilst regulation across the African regions vary in terms of transparency and sophistication, most countries have been working to refine their regulatory frameworks to promote stability, transparency, and investor confidence.

Unlocking the Power of AI: From Threat to Empowerment

Artificial Intelligence (AI) has emerged as a formidable tool that empowers individuals in the realm of online trading, dispelling the notion of it being a threat. With the ability to process and analyse vast volumes of data, including market news, social media sentiment, economic indicators, and historical trading patterns, AI enhances decision-making processes for traders. By quickly extracting valuable insights from complex data sets, AI equips traders with a competitive edge, helping them make more informed and strategic investment decisions.

Furthermore, AI finds utility in customer support services through the deployment of chatbots, streamlining interactions and providing timely assistance to traders. Additionally, AI plays a crucial role in fraud detection, leveraging its analytical capabilities to identify suspicious patterns and safeguard the integrity of trading platforms.

However, it’s important to note that while AI provides valuable insights and assistance, its effectiveness is dependent on the quality of human input and requires human assessment for accurate decision-making. AI acts as an enabler rather than a replacement for online trading platforms, working in tandem with human expertise to optimise trading experiences and outcomes.

By embracing AI as a powerful tool, traders can harness its capabilities to navigate the complexities of the market, fostering growth and innovation within the online trading industry.

The Rise of Neobrokers: Navigating Innovation and Regulatory Oversight

A notable trend in the online trading industry is the emergence of neobrokers; app-based platforms that have gained traction among investors. Neobrokers represent a disruptive force, offering user-friendly interfaces and streamlined experiences. However, regulators closely monitor this development to ensure investor protection and mitigate potential risks associated with this innovative approach.

As neobrokers simplify access to markets and foster a more inclusive environment, they have the potential to encourage risk-taking behaviours among traders. This balance between innovation and regulatory oversight becomes crucial as regulators strive to strike a delicate equilibrium, ensuring market integrity and investor safeguards, while fostering innovation and accessibility.

The evolution of neobrokers is a fascinating development to watch within the online trading industry, and regulators remain vigilant in adapting to this changing landscape to maintain a fair and secure trading environment.

Additionally, the rise of AI and neobrokers presents new dimensions to online trading, empowering traders with advanced data processing capabilities and innovative platforms.

However, regulatory oversight remains crucial to ensure investor protection and maintain market integrity. By leveraging the benefits of technology, embracing regulatory developments, and fostering a balanced approach, the online trading industry is poised for continued growth, fostering financial inclusion, and transforming the way individuals participate in global markets.

In conclusion, the global online trading industry is undergoing a transformative phase, with remarkable growth and opportunities unfolding. Emerging markets, such as Africa, hold immense potential for expansion, driven by factors such as accessibility, diversification, lower costs, economic growth, and job creation.

Trading involves Risk.