|

JEDDAH, Kingdom of Saudi Arabia, November 26, 2023/ — The Islamic Development Bank Institute (IsDBI) (www.IsDBInstitute.org) successfully coordinated and delivered high-level knowledge-sharing sessions under the theme ‘Islamic finance and socioeconomic development’ on 14 November 2023. The sessions were part of the 6th edition of the Saudi-Spanish Center for Islamic Economics and Finance (SCIEF) Islamic Finance Executive Program.

IsDBI collaborated with King Abdulaziz University (KSA) and I.E. Business School (Spain) to organize and support the executive program, held from 13-16 November in Jeddah, Saudi Arabia. During Day 2 of the program, the Institute hosted two technical sessions and one roundtable delivered by the senior leadership and professional staff of the IsDB Group, with 15 participants attending. Mr. Amer Bukvic, Acting Director General for Global Practices and Partnerships, IsDB, delivered the first technical session in which he engaged with the participants on the topic of “Development and Humanitarian Efforts by the IsDB and other Multilateral Development Banks”. This was followed by another interactive session on the “IsDB Group and Its Smart Operational Paradigm”, delivered by Dr. Muhammad Jameel Yusha’u, Acting Director for the Communications and Outreach Department, IsDB. The final spotlight of the event was a highly engaging roundtable session on the topic “Driving Innovative Development: Exploring cutting-edge Solutions by the Islamic Development Bank Institute”, moderated by Dr. Mohammed Alyami, Director of Development Effectiveness Office, ICD. He was supported by three panelists: Dr. Sami Al-Suwailem, Acting Director General, IsDBI, Dr. Hilal Houssain, Associate Manager, Knowledge Solutions, IsDBI, and Dr. Hylmun Izhar, Senior Economist, IsDBI. Overall, the full day involved extensive discussions between the speakers and the panelists on the role of Islamic finance in addressing modern-day challenges and how the IsDB Group is playing its role in supporting the socioeconomic development of its member countries and Muslim communities in the non-member countries. From the IsDB Institute, the program was technically coordinated by Mr. Syed Faiq Najeeb, Senior Islamic Finance Specialist, with the guidance of Mr. Yahya Rehman, Associate Manager, Knowledge Leaders, IsDBI. Distributed by APO Group on behalf of Islamic Development Bank Institute (IsDBI).

Media contact: SOURCE |

Category: Banking & Fianace

-

Islamic Development Bank Institute Delivers High-Level Islamic Finance Executive Program Sessions

-

African Development Bank, African Guarantee Fund Kick Off Affirmative Finance Action for Women in Africa (AFAWA) Finance Series in Kenya to Unlock Financing for Women-Led Enterprises

NAIROBI, Kenya, November 22, 2023/ — The African Development Bank (www.AfDB.org) through its Affirmative Finance Action for Women in Africa (AFAWA) initiative, in partnership with African Guarantee Fund (AGF) and in collaboration with the Office of the President’s Advisor on Women’s Rights, have inaugurated the 6th edition of the AFAWA Finance Series in Nairobi, Kenya.

This 3-day event themed “Enhancing Financial Inclusion for Women”, running between 21-23 November, 2023, is a pivotal initiative aiming to revolutionise the financial landscape and foster an enabling environment for women entrepreneurs, facilitating their growth and contribution to the continent’s economic development.

The AFAWA initiative seeks to increase women’s access to finance in the continent by bridging the $42 billion financing gap for women-led and owned small and medium enterprises.

Since its inception just over two years ago, the AFAWA initiative has already approved $1.2 billion in funding for women-led enterprises in 32 countries across Africa with a goal to mobilise $5 billion in financing for African women-led businesses by 2026.

“Financial products need to be tailored to women’s unique lived experiences, needs and aspirations from the start not later when at scale,” said Her Excellency Governor Ann Waiguru, Chair of the Council of Governors in Kenya and the chief speaker at the Finance Series Kenya opening ceremony.

“Financial institutions face a major challenge in understanding and responding to the unique needs of the women entrepreneurs. We need innovative approaches to improve women’s creditworthiness as traditional collateral requirements only serve to reinforce gender inequalities,” she added.

The AFAWA Finance Series will emphasise the tangible benefits of gender financing for women-led small and medium enterprises, financial institutions, the Kenyan Government and policymakers. The opening conference will be followed by a 2-day training to sensitize lending institutions on gender smart investing.

“Kenyan women are known for their resilience and tenacity,” Harriette Chiggai, Women’s Rights Advisor to the Office of the President of the Republic of Kenya told reporters, when detailing table banking, grants and other Government programs targeting women entrepreneurs.

“The AFAWA Finance Series is an acknowledgement of our commitment to creating an environment where Kenyan women can access essential financial tools for enterprise and development,” Chiggai added.

The Series explores ways to enhance regulatory frameworks that can boost access to finance for women-led small and medium enterprises. The event will also build understanding of AFAWA’s Guarantee for Growth (G4G) mechanism as implemented by the AGF.

“Too many women entrepreneurs across the continent are denied opportunities to grow their businesses. We’re here today to help challenge common misperceptions and emphasize that there’s business to be had in offering financial services to women-led enterprises.

AFAWA understands the challenges women face and the initiative is addressing them head on,” said Marie-Laure Akin-Olugbade, Vice President for Regional Development, Integration and Business Delivery at African Development Bank Group.

Research shows women are better at repaying loans than men, and typically reinvest up to 90% of their income in the education, health and nutrition of their families and communities.

“The question we are addressing is how to support women and increase their productivity to fully participate in the GDP of the African economy,” said AGF Group CEO, Jules Ngankam. “Through the AFAWA G4G program we are derisking financial institutions that on-lend to women-led SMEs increasing their appetite for this target market,” he added.

Previous AFAWA Finance Series have been held in Tanzania, the Democratic Republic of the Congo, Ghana, Angola and Nigeria..

Representing AFAWA’s donor nations at the Kenya launch were His Excellency H.E. Roberto Natali, Ambassador of Italy to Kenya and Her Excellency Caroline Vicini, Ambassador of Sweden to Kenya.

Distributed by APO Group on behalf of African Development Bank Group (AfDB).For further information, please contact:

Alphonso Van Marsh

Principal Digital Content and Events Officer African Development Bank

Email: media@afdb.org

www.AfDB.org/enDiana Aluga

Group Communications & Public Relations Officer

African Guarantee Fund

Cell: +254 732 148 000,

Email: info.communications@agf.africa

https://AfricanGuaranteeFund.com Emily Njagi

Scarlet Digital Limited

Cell: +254 722 615524

Email: emily@scarletdigital.co.keHilda Mwangi

Scarlet Digital Limited

Cell: +254 718 611543

Email: hilda.mwangi@scarletdigital.co.ke SOURCE

African Development Bank Group (AfDB) -

About “Jollof Wars” during IATF2023 in Egypt

Story.Mohammed A. Abu

A subtly spiced and smoky version of Ghana’s jollof rice prepared by Ghanaian Executive Chef Mr. Dediha George, gave him a win over his Senegalese Chef Mr. Abdoulaye Tamsir Ndir, and Nigerian Chef Mrs. Moyosoreoluwa Odunfa contestants.

This was within the context of The African Export-Import Bank (Afreximbank)’s launch of an African Gastronomy and Culinary Arts Programme under its Creative Africa Nexus Initiative (CANEX) as one of the major outcomes of its recently ended 3rd Intra African Trade Summit(IATF2023) in Cairo,Egypt.

The CANEX African Gastronomy and Culinary Arts Programme is the newest vertical within the CANEX programme and featured nine celebrity chefs from Africa and the Caribbean taking part in masterclasses, live cooking demonstrations and conversations with culinary experts.

The inaugural session of the programme, concluded with a live demonstration, dubbed the “Jollof Wars” to highlight the unique flavours and cultural diversity of Jollof rice among Nigeria, Ghana and Senegal

Prof. Benedict Oramah, President and Chairman of the Board of Directors of Afreximbank, said that the introduction of the programme would help to refocus continental efforts towards local food production to ensure food security, reduce high food costs and imports and minimise the impact of external shocks on Africa’s food supply chain. Delegates at the IATF2023 found themselves amidst a delightful culinary celebration, organized by CANEX and African Food Changemakers, and today’s spotlight was on the iconic Jollof rice—a dish that sparks the famous “Jollof Wars” between Nigeria, Ghana, and Senegal among other West African countries.

The chefs behind these delectable creations included Ghanaian Executive Chef Mr. Dediha George, Senegalese Chef Mr. Abdoulaye Tamsir Ndir, and Nigerian Chef Mrs. Moyosoreoluwa Odunfa.

-

Integrated and efficient Payment System for Africa Highlighted

Story: Mohammed Abu

The 2023 edition of Intra African Trade Fair(IATF2023) dubbed, the Africa Continental Free Trade Agreement(AfCFTA) Marketplace has ended in Egypt with emphasis on not just an integrated but most importantly, an efficient payment system for intra African trade In a detailed response during a press conference on the final day of IATF2023, H.E. Prof. Benedict Oramah, President and Chairman of the Board of Directors, Afreximbank, addressed the integration of payment systems among central banks in Africa. He highlighted the challenges and successes in implementing a unified payment system. Oramah pointed out that while some regions already have established systems, the goal is to collaborate or integrate these into a singular, more efficient system.

He emphasized the significant progress made, citing the recent agreement among African Central Banks to adopt a unified architecture for payment systems.

This move, strongly backed by early decisions at the African Union, supports the implementation of the African Continental Free Trade Area (AfCFTA), signaling a major political and economic milestone.

Oramah further elaborated on the ongoing efforts to onboard central banks individually, acknowledging the complexity of the task.

Additionally, he highlighted the collaboration with the Caribbean, mentioning CARICOM states’ agreement to adopt the pan-African system. This decision enhances the potential for increased trade and economic ties between Africa and the Caribbean.

The Intra African Trade Fair or IATF was created as a platform for entry into Africa’s single market of over a billion people joined together through the African Continental Free Trade Area (AfCTA) platform.

IATF 2023, the third edition of the event, held under the theme “Building Bridges for a Successful AfCFTA”., was hosted by The African Export-Import Bank (Afreximbank), in collaboration with the African Union and AfCFTA Secretariat, that welcomed heads of state, senior government officials; continental/global players in multiple sectors.

The fair was expected to have attracted 75 participating countries,1600 business exhibitors, entrepreneurs, investors, financiers and 35,000 buyers and visitors with $43 billion worth of trade and investment deals expected to be closed.

The African Development Bank played a lead sponsorship role given its active involvement on the IATF Advisory Council, and its commitment to AfCFTA implementation under its “Regional Integration” and “Industrialize Africa” High 5 priorities.

Promoting the competitiveness of African member countries under the AfCFTA agenda also aligns with the Bank’s goal to support private sector development, competitiveness, and strong trade performance for African countries.

The various sectors covered include agri-agrobusiness, health, environment and climate development, infrastructure – power (renewable energy), water, transport and logistics development.

Major Outcomes of IATF 2023

Launch of Intra-African EPC Contract Promotion Programme Afreximbank today in Cairo launched a new initiative that will open doors, allowing African contractors to capitalise on various infrastructure investments available across the continent. Prof. Benedict Oramah, President and Chairman of the Board of Directors of Afreximbank, joined by Rania Al-Mashat, Minister of International Cooperation of Egypt, launched the Afreximbank Intra-African Engineering, Procurement and Construction (EPC) Contract Promotion Programme during the Presidential Summit of the Intra-African Trade Fair 2023 (IATF2023).

Prof. Oramah told guests that the programme was one of the Bank’s initiatives to support the implementation of the African Continental Free Trade Area (AfCFTA), saying that it aimed to enable African companies to successfully bid for, win and execute infrastructure contracts in Africa through capacity building, twinning, market access opportunities, financing, guarantees and technology solutions.

Afreximbank–Somoil Sociedade Petrolífera Angolana S.A.Deal

Afreximbank is thrilled to announce the signing of a transformative USD 570 million Dual Tranche Term Loan and Revolving Facility with Somoil – Sociedade Petrolífera Angolana S.A. (Etu Energias)

Signatories were Mr. Fernando Hermes, Chief Finance Officer of Etu Energias, and Mr. Rene Awambeng, Client Relations Global Head at Afreximbank.

Etu Energias, the largest private oil company in Angola, has been a valued partner of Afreximbank, with a previously arranged and successfully closed USD 190 million facility in 2022. The new proposed USD 570 million Facility is crucial to further enhance Angola’s participation in the vital oil and gas sector, which contributes over 90% of the country’s exports. This initiative ensures the retention and development of local personnel, reinforcing Angola’s strategic position in this sector.

Increase of Afreximbank’s Global Facility Limits for Elsewefy Electric to USD 300 million

Afreximbank has increased its Global Facility limits for Elsewefy Electric to USD 300 million!

This boost is dedicated to supporting contracting guarantees and working capital needs, empowering Elsewedy to tackle its backlog projects across Africa.

The partnership with Elsewedy has been a journey of success, executing impactful projects in over 9 African countries. From Zambia to Tanzania, it’s been instrumental in bringing energy solutions and trade-enabling infrastructure to the continent.

Afreximbank-Oando Deal

Afreximbank confirmed the signing of a Mandate Letter for a USD 800 Million Syndicated Dual Facility with Oando. This financial package comprises a USD 500 Million Senior Secured Reserve Based Lending facility and a USD 300 Million Receivables Backed Term Loan facility.

The aim is to fuel a strategic acquisition of a 20% participating interest in the Nigerian Agip Oil Company Limited (NAOC). This includes Oil Mining Leases 60, 61, 62, and 63, as well as the entire issued share capital of NAOC, acquired from Eni S.A.

This move perfectly aligns with the Afreximbank’s unwavering commitment to supporting indigenous African institutions. The facility underscores our dedication to financing transactions that not only boost Africa’s trade but also empower local companies by transferring capacity from foreign institutions to African hands.

This acquisition is a pivotal moment for Oando, propelling it to new heights in the oil industry by significantly enhancing its production capacity. Beyond that, this financing is a shining example of Afreximbank’s prowess in mobilizing capital for robust transactions within its member nation

Afreximbank- Griner Engenharia S.A Deal

In a landmark move towards fostering economic development in Angola and contributing to intra-African trade, Afreximbank announced the signing of a USD 30 million Corporate Loan Facility with Griner Engenharia S.A., a leading Angolan construction company.

This deal, a term sheet, was signed by Mr. Joao Faria, Board Member of Griner Engenharia, and Mrs. Kanayo Awani, Executive Vice President, Intra-African Trade Bank, Afreximbank and signifies a strategic partnership that aligns with Griner’s remarkable track record and commitment to advancing trade-supporting infrastructure in Africa.

Griner Engenharia, with its commendable presence and activities across multiple African countries, including Angola, Mozambique, Cape Verde, and Ghana, stands as an Intra-African Trade Champion. The USD 30 million facility, split into two tranches, is poised to have a substantial impact on both job creation and trade volumes.

The provision of this facility is expected to generate over 1,500 job positions, further strengthening Griner’s commitment to fostering employment opportunities in Angola. Additionally, the supported contracts are projected to contribute more than USD 100 million to intra-African trade volumes and an additional USD 135 million to Angolan export volumes.

Afreximbank-Access Bank Plc 500 Billion Naira Deal

In a significant milestone, Afreximbank and Access Bank Plc successfully signed a Framework Agreement for a ground breaking 500 Billion Naira Sub Sovereign Financing Programme, empowering selected Nigerian sub-nationals.

This initiative, realized under the Africa Sub-Sovereign Network Initiative, aimed to bolster economic diversification through the development of trade and trade-enabling infrastructure.

The selected Nigeria states, including Anambra, Ekiti, Kwara, Ogun, and Oyo, are poised to transform into manufacturing and logistics hubs, catalyzing job creation, elevating income levels, and ensuring the enduring diversification of the Nigerian economy.

The deal was signed by key stakeholders, including governors of participating states, such as His Excellency Governor Chukwuma Soludo CFR of Anambra State and His Excellency Governor Seyi Makinde of Oyo State. The signatories from Access Bank Plc and Afreximbank included Mr. Roosevelt Ogbonna, Group Managing Director of Access Bank Plc, and Mr. Rene Awambeng, Client Relations, Afreximbank.

The collaboration marked a monumental step towards fostering economic prosperity and sustainable development.

Afreximbank launches African gastronomy and culinary arts programme

The African Export-Import Bank (Afreximbank) launched an African Gastronomy and Culinary Arts Programme under its Creative Africa Nexus Initiative (CANEX).

The CANEX African Gastronomy and Culinary Arts Programme is the newest vertical within the CANEX programme and featured nine celebrity chefs from Africa and the Caribbean taking part in masterclasses, live cooking demonstrations and conversations with culinary experts.

The inaugural session of the programme, concluded with a live demonstration, dubbed the “Jollof Wars” to highlight the unique flavours and cultural diversity of Jollof rice among Nigeria, Ghana and Senegal

Prof. Benedict Oramah, President and Chairman of the Board of Directors of Afreximbank, said that the introduction of the programme would help to refocus continental efforts towards local food production to ensure food security, reduce high food costs and imports and minimise the impact of external shocks on Africa’s food supply chain. Other deals worthy of mention included the following:

- Afreximbank announced its approval to participate in a USD 130 million Senior Term Loan Facility, contributing to the USD 168 million total, dedicated to Azikel Petroleum Limited

- EVP Ms Kanayo Awaniand President of Basketball Africa League (BAL) Mr Amadou Gall Fall have signed a deal announcing the U23 BAL4HER Basketball Camp

- Afreximbank announced a strategic partnership with the Africa Center marking a commitment of USD 5,000,000 over four years

- Afreximbank confirms a partnership with the Basketball Africa League (BAL), a collaboration between the International Basketball Federation (FIBA) and the NBA, investing USD 750,000

- Afreximbank is set to empower Matrix Energy with a USD 100 million Receivables-backed Corporate Term Loan Facility, solidifying its commitment to fostering growth in Nigeria’s oil and gas sector

- Afreximbank signed a USD 50 million Term Loan Facility in favor of Green Economic Zone Kaduna

- Afreximbank is providing a USD 75 million Guarantee Facility to Sterling Bank Plc

- Afreximbank announced a collaboration with Banque Nationale pour le Developpement Economique (BNDE), Senegal involving a EUR 40 million dual-tranche facility

- Afreximbank announced a EUR 12 million facility extended to SAMAPECHE

- Afreximbank signs a EUR 11.2 million Term Sheet O3S – Oil Senegal Support Servicesa pioneering 100% Senegalese entity dedicated to Offshore Maritime Operations

- Afreximbank signed a Memorandum of Understanding (MOU) with CRDB Bank Plcduring the Afreximbank Africa Diaspora Center Announcement

Two immensely successful editions of the IATF have been held in Cairo, Egypt (2018) and Durban, South Africa (2021

IATF2023 Stand Awards

Celebrating Excellence at IATF2023

Yusuf Daya, Director AU/AFCTFA Relations and Trade Policy, honoured outstanding exhibitors with Stand Awards.

Recognizing innovation, creativity, and impactful presentations, these awards showcase the pinnacle of excellence at the Intra-African Trade Fair.

Winners, whose dedication and ingenuity shine bright at IATF2023, included the following::

- Best Feature Stand Award sponsored by FDH Bank Plc!

- Most Innovative Stand Award goes to ALGERIA

- Best AU Youth Stand Award goes to Africa Design

- ARISE IIPWins Best Business Stand

- CEO of Mota-Engil Africa and the CFO of Africa receive the prestigious Best Individual Award

- Chevron received Best Auto Stand Award

- GEPA wins the prestigious Best Stand Award

Algeria IATF2025 Host

Algeria has been selected to host the fourth Intra-African Trade Fair (IATF2025) scheduled to take place in 2025, Chief Olusegun Obasanjo, Chairman of the Advisory Council of the Intra-African Trade Fair and former President of Nigeria, has announced. Speaking yesterday in Cairo during the Presidential Summit of the third Intra-African Trade Fair (IATF2023), Chief Obasanjo said that the selection followed a rigorous review of bids received by the Advisory Council for the hosting of the continental event.

“We congratulate the government and people of Algeria for winning this bid,” he said, adding, “We look forward to converging in Algiers in 2025”.

Two immensely successful editions of the IATF have been held in Cairo, Egypt (2018) and Durban, South Africa (2021

Afreximbank has identified intra-African trade as a critical factor for unlocking Africa’s economic potential. Although the share of intra-African trade as a percentage of total Africa trade has increased from 10 percent in 1995 to around 16 percent, it remains low compared to the levels in Europe (59 %), Asia (51%) and North America (37%).

-

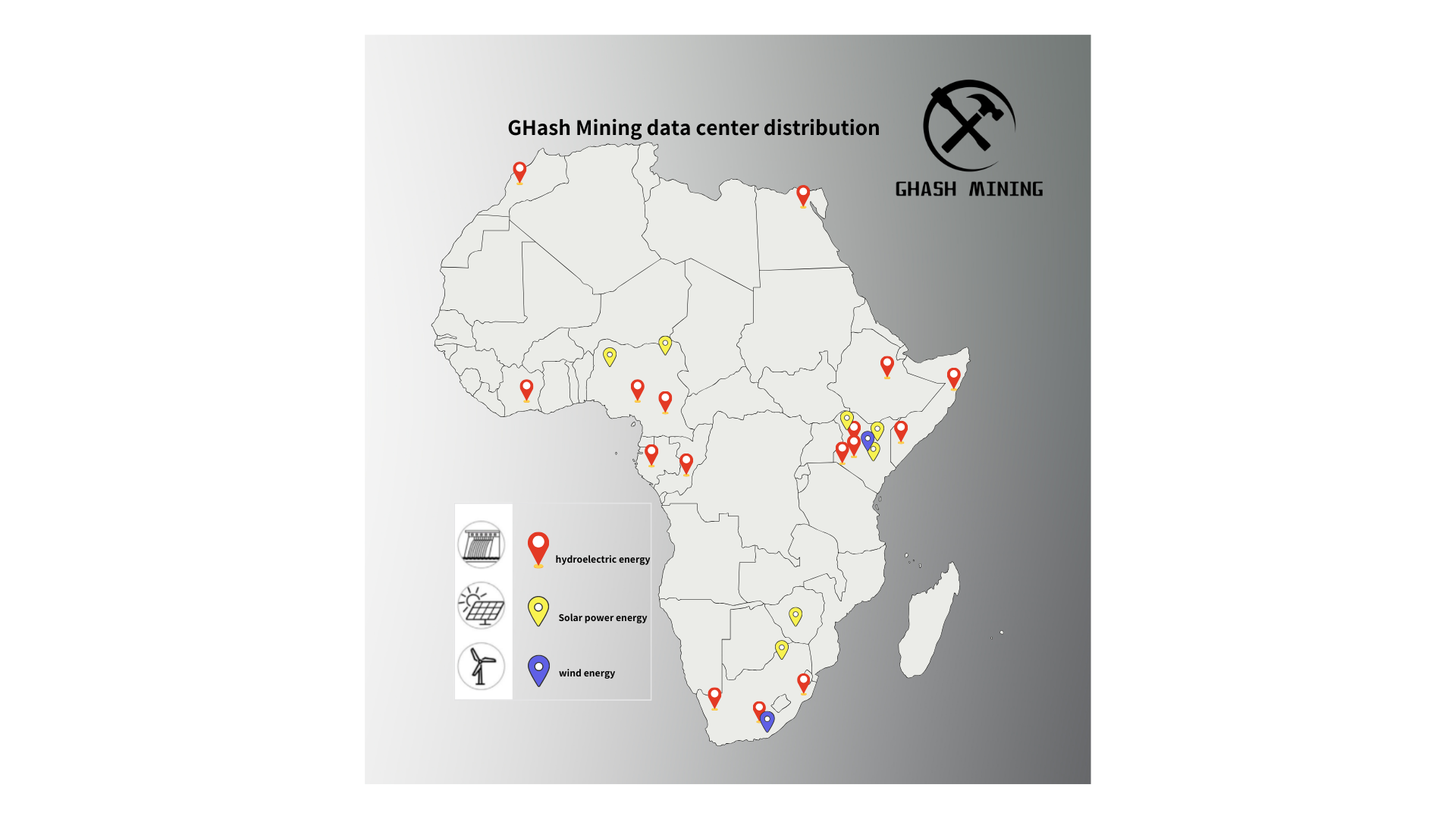

GHash Mining: Lighting up Africa with cryptocurrency mining

NAIROBI, Kenya, November 14, 2023/ — GHash Mining (https://web.vistx.com) is a leading technology-driven cryptocurrency mining company with a vision to create sustainable value across the cryptocurrency industry. Diversified business covers cryptocurrency mining, mining pools, and data center operations. https://apo-opa.co/3QVBaSH

Mini-grids will become increasingly important in bridging the energy access gap that still exists, especially in remote rural areas. In 2010, there were approximately 500 microgrid installations in sub-Saharan Africa.

Although the number has increased significantly, there is still greater acceleration. There are currently over 3,000 installations. According to one estimate (World Bank, 2023), more than 160,000 mini-grids are reportedly needed to meet access needs.

The International Renewable Energy Agency (IRENA), an intergovernmental organization that supports African countries, noted in its Annual Review of Renewable Energy and Jobs 2023 that “Kenya plays a significant role in the region, deploying mini-grids across Africa. A big part of it.” their transition to a sustainable energy future.

Commercial financiers often view mini-grids as not worth the investment.

They are not economically sustainable under the current funding model, particularly as community energy demand remains low so soon after commissioning.

Such huge capital expenditures are the reason why the dominant model for energy development in Africa to date has been through concessional funding – donations, grants and low-cost debt.

However, GHash Mining is changing the game by using cryptocurrency mining to help electrify the continent.

Changed game rules:

GHash Mining has established 25 small cryptocurrency data centers across the continent to supplement mini-grids. These mini-grids are critical to delivering power to rural communities that are far from the central grid.

The plan to build 140 small cryptocurrency data centers is expected to be completed in 2024.

Energy developers do not have to deal with excess stranded energy based on future community needs. Financial Sustainability Collocated mini-grids and small Bitcoin data centers can see financial ROI immediately upon commissioning.

As anchor tenants, miners provide energy developers with consistent, predictable, and paid energy needs, narrowing the gap in risk-return expectations between energy developers and financiers.

As primary customers, Bitcoin mining data centers provide initial and ongoing power needs, turning mini-grids into profitable enterprises even during the critical initial stages.

This new financing model justifies the large initial capital outlay of renewable energy infrastructure, while the demand unleashed by Bitcoin miners benefits households and businesses that previously lacked access to electricity.

As anchor tenants, Bitcoin mining data centers facilitate sustainable and profitable private investment, driving electrification for hundreds of millions of households in Africa currently living in darkness.

It’s a win-win-win situation for energy developers, local community businesses and households, and the national utility grid to which these microgrids are ultimately connected. Bitcoin mining data centers facilitate sustainable and profitable private investment needed to power hundreds of millions of households in Africa currently living in darkness.

The development of microgrids can help provide electricity to rural communities, thereby boosting economic development and improving education and health outcomes. At the same time, cryptocurrency mining operations can generate profits for investors, which can then be reinvested back into the mini-grid to expand its coverage and scale.

In addition:

Affected by many factors, the “Economic Outlook for Sub-Saharan Africa” released by the International Monetary Fund (IMF) shows that the inflation rate in the region has reached “a level not seen in decades”, with more than half of the countries having inflation rates exceeding 10%. As of May 2023, Nigeria’s inflation rate reached 22.3%, and the inflation rates in Sao Tome and Principe, Egypt, and Ethiopia were 23.5%, 31%, and 32.7% respectively.

Decentralized cryptocurrency holding and mining can effectively fight inflation. Protect residents’ wealth.

In conclusion:

All in all, GHash Mining is making a significant contribution to the growth of cryptocurrency mining and the spread of electricity in Africa. By leveraging cryptocurrency mining operations to fund mini-grids, GHash Mining is providing a sustainable solution to rural electrification, benefiting both investors and local communities. As Africa continues to develop, we expect GHash Mining’s approach to energy investment and green energy innovation will continue to play an important role in the continent’s development.Distributed by APO Group on behalf of GHash Mining.

-

Afreximbank announces $1-billion African Film Fund

CAIRO, Egypt, November 10, 2023/ — The African Export-Import Bank (Afreximbank) (www.Afreximbank.com) is working on the establishment of a $1-billion African Film Fund to be launched in 2024 to support the continent’s film industry, Kanayo Awani, Executive Vice President, Intra-African Trade Bank, at Afreximbank, announced in Cairo today.

Addressing the opening of the 2023 CANEX Summit held as part of the third Intra-African Trade Fair (IATF2023), Mrs. Awani said that the fund would oversee film financing, co-finance with large studios, finance African filmmakers and finance producers and directors of film projects across the continent.

She noted that during CANEX WKND 2022, the Bank had increased the financing it was making available to the creative sector from US$500 million to US$1 billion and that the Bank currently had a pipeline of over US$600 million in film, music, visual arts, fashion, and sports deal.

“The very first film we financed recently premiered at the Toronto Film Festival,” Mrs. Awani said, adding, “The Bank has several in the pipeline from Nigeria, South Africa, and Kenya, which should be on streaming platforms in 2024.”

Acknowledging that the film and audiovisual industries in Africa accounted for US$5 billion of the continent’s GDP and employed an estimated five million people, with the potential to create over 20 million jobs and generate US$20 billion in revenues annually, Mrs. Awani noted that the sector faced several challenges, including limited access to financing and copyright infringement due to weak copyright laws, enforcement mechanisms and a lack of awareness.

The sector was also confronted with infrastructure and technology gaps, lack of capacity and shortage of skilled professionals and limited market access and international exposure, as a result of which African creative and cultural products often struggle to gain exposure and access to international markets.

Earlier, Boris Kodjoe, a celebrity actor of Ghanaian descent, highlighted how the creativity of Africans had influenced various aspects of modern life, including music, fashion, art, design, social consciousness, business, sports, film and TV. He said that the exploitation of black creativity by the West had had lasting effects and that, despite admiration of black excellence, Africa still faced branding challenges due to external perception fuelled by the traditional media’s depiction of poverty, famine, civil wars and migration on the continent.

Mr. Kodjoe said that the world craved culturally specific global content and that Africa was a key player in meeting that demand. With the continent’s young population and high connectivity, studios, networks, promoters and brands were investing in solutions to reach diverse audiences. Films and TV shows with diversity performed better than others by 30 per cent and Afrobeats was taking over global airwaves. By 2030, Africa was projected to produce up to 10 per cent of global creative goods export worth roughly $200 billion or four per cent of Africa’s GDP.

Also speaking, H.E. Albert M. Muchanga, Commissioner for Trade and Industry of the African Union Commission, said that the creative sector in Africa was rapidly growing and making a significant contribution to the inclusive growth and sustainable development of African economies.

“I reaffirm my belief that the African creative industry has huge potential to be a source of employment and revenue to create the Africa we want – revenue from intra-African trade as well as revenue from the rest of the world.”

Ambassador Muchanga urged African nations to convert their vast potential into plans and projects that yield tangible results, stressing the need to also invest in protecting international property rights.

CANEX is an Afreximbank initiative to support Africa and the African Diaspora’s creative and cultural industries by providing financing and non-financing instruments to boost growth. The seven-day CANEX Summit is intended to further develop conversations and provide additional business-to-business and business-to-government opportunities. It includes a fashion show featuring a range of bold and exciting designs from across Africa and the Diaspora and a CANEX Music Factory, hosted by renowned South African producer Oskido, which will provide songwriters and beat makers with the opportunity to record their work.

Creative Africa Nexus (CANEX) programme set up by Afreximbank seeks to facilitate the development and growth of the creative and cultural industries in Africa and the diaspora. The programme provides a range of financing and non-financing instruments and interventions aimed at supporting trade and investment in Africa’s creative sector.

IATF2023, Africa’s largest trade and investment fair opened on 9th November and will run till 15th November 2023.Distributed by APO Group on behalf of Afreximbank.Media contact:

Deborah Ross

Senior PR Account Director

BrandComms

+44 (0) 759 3602 128

deborah.ross@brandcommsgroup.com -

The Caribbean Community (CARICOM) Central Banks adopt Pan-African Payment and Settlement System (PAPSS) for intra-regional trade transactions

CAIRO, Egypt, October 26, 2023/ — The Pan-African Payment and Settlement System (PAPSS), a groundbreaking initiative developed by the African Export-Import Bank (Afreximbank) (www.Afreximbank.com) to revolutionize cross-border payments and boost intra-African trade, celebrates a significant milestone as it receives a historic endorsement from the Governors of the Central Banks in the Caribbean region. All eleven Central Banks have unanimously adopted PAPSS as the preferred system for processing the settlement of intra-regional trade transactions. The Governors have indicated their recognition of Afreximbank’s experience and skill in using PAPSS to streamline cross-borders financial transactions throughout Africa. Consequently, Afreximbank will provide valuable guidance and support throughout the entire implementation process of PAPSS in the Caribbean region.

Operational in the six countries of the West African Monetary Zone (WAMZ) – and with transactions initiated daily by traders, SMEs and individuals – PAPSS is gaining traction on the African continent as a transformative solution enhancing the operational efficiency of cross-border payments, while promoting economic integration and trade facilitation. Indeed, more African Central Banks stand poised to join the network, and recently five major African multinational commercial banking groups present in almost 40 countries have decided to implement the system in all their subsidiaries across Africa. With the inclusion of the CARICOM region, the system’s reach expands beyond the African continent, and its status as a global payment and settlement platform is solidified.

In adopting PAPSS, the Central Banks in the Caribbean region have recognized its immense potential for unlocking new opportunities for trade growth and cooperation within their respective jurisdictions. By streamlining and expediting the settlement process, PAPSS will eliminate the complexities and inefficiencies that often hinder intra-regional trade, promoting monetary stability and economic development across the Caribbean.

Professor Benedict Oramah, President, and Chairman of Afreximbank, commented: “In keeping with the bank’s Diaspora Strategy and the African Union’s designation of the African Diaspora as Africa’s sixth region, the Caricom Central Banks’ endorsement of PAPSS vindicates Afreximbank’s efforts to promote and enhance trade between Africa and the Caribbean. With this historic decision, we have moved closer than ever before to achieving economic parity between Africa and the Caribbean Community (CARICOM).”

Also commenting on this collaboration, Dr. Kevin Greenidge, Governor of the Central Bank of Barbados, said: “The Caribbean region looks forward to working closely with Afreximbank to further explore and implement the PAPSS model for intraregional trade transactions. This joint endeavor has the potential to elevate economic cooperation between Africa and the Caribbean to new heights, fostering lasting partnerships and mutual benefits for our respective regions.”

Mr Mike Ogbalu III, Chief Executive Officer of PAPSS, expressed his enthusiasm over this endorsement, emphasizing the importance of such collaboration in fostering closer ties and enhancing trade relationships across continents. He stated: “This development showcases the adaptability and scalability of PAPSS, and its role as a catalyst for economic growth and prosperity in the African market and beyond. The adoption of PAPSS by the CARICOM Central Banks paves the way for further engagement between Africa and the Caribbean, stimulating trade diversification, economic resilience, and sustainable development for all participating countries. As PAPSS continues to expand its reach and impact, it reaffirms its commitment to promoting financial inclusion, reducing trade barriers, and enhancing cross-border trade across the globe.”

The Caribbean Central Banks and Afreximbank have decided to start a pilot project to guarantee the seamless deployment of the PAPSS system and its efficacy in the Caribbean region. The goal of this pilot project is to identify any problems with the system before it is fully implemented. An official commercial launch of the system in the Caribbean region is expected to occur in Q4 2024.

Distributed by APO Group on behalf of Afreximbank.

-

Ecobank Day 2023 focused on the acquisition of digital skills by Africa’s children and youth

LOMÉ, Togo, October 24, 2023/ — The Ecobank Group (http://www.Ecobank.com), the leading pan-African banking group, celebrated the 10th anniversary of Ecobank Day, its flagship social impact event, last Saturday, October 21, 2023. To mark the occasion, Ecobank launched a three-year ‘Transforming Africa Through Education’ campaign, which it kicked-off with a focus on digital education and equipping children and youth with the digital skills they need for the jobs of tomorrow.

Jeremy Awori, Chief Executive Officer of Ecobank Group, said: “Ecobank Day reflects the giving spirit of all 14,000 Ecobankers across the Group. For 10 years, it has given us an opportunity to manifest our commitment to making a positive impact in the communities we serve. This year, we focus on digital education, which is critical for Africa to leapfrog and accelerate its development.

For several years, Ecobank has embarked on a journey of digitalization – consistent with our deep belief in the transformative power of digital technology for a more inclusive future in Africa. It is only natural that on this Ecobank Day, we have supported the launch of a series of training programmes and provided the necessary infrastructure to offer basic digital education to youth across Africa.”

Ahead of the Ecobank Day celebrations, Ecobank Foundation, in partnership with the Global Partnership for Education and UN Women, organised a webinar entitled ‘Igniting Africa’s Digital Future through the Power of Coding’.

The webinar was well-attended with over a thousand participants, and featured experts and the youth, discussing the importance of ensuring that all African children and youth have access to digital skills, mostly coding and programming, that are essential for jobs of the future and a fulfilled life. You can watch the webinar here (https://apo-opa.info/

3Q1PjMs). Ecobank’s affiliates across 33 sub-Saharan African countries continue to hold a range of activities to raise awareness and knowledge of the importance of digital skills for Africa’s children and youth. These activities include creating or equipping IT Labs, refurbishing schools, providing youth digital skills training workshops, partnering with schools to improve digital facilities, mentoring initiatives and more.

Ecobank Day has supported a wide range of causes over the years since 2013. These have included Education for young people in Africa (2013); Malaria prevention and control (2014); Every African child deserves a better future (2015); ICT education in schools and improving maternal health (2016); Safe water management (2017); Orphanages (2018); Cancer (2019); Diabetes (2020); Mental health (2021) and financial literacy and financial inclusion (2022).

For more information about Ecobank Day, please visit https://apo-opa.info/497yZT1

Distributed by APO Group on behalf of Ecobank Transnational Incorporated.Media Contact:

Christiane Bossom

Group Communications

Ecobank Transnational Incorporated

Email: groupcorporatecomms@ecobank.com

Tel: +228 22 21 03 03

Web: www.Ecobank.com -

Leveraging Islamic Finance to address Impending Economic Slowndown

The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) together with the Islamic Development Bank Group (IsDB), represented by IsDB Institute (IsDBI), is set to host the 18th edition of its annual Islamic banking and finance conference under the auspices of the Central Bank of Bahrain.

The two-day conference will be held physically at the Crowne Plaza, in Kingdom of Bahrain, on 29-30 November 2023, with the theme “Strategies for the Impending Economic Slowdown and a Post Oil World: Through Economic Diversification and Leveraging Islamic Finance”.

The two-day conference will feature keynote addresses from dignitaries and policymakers, as well as, seven panel discussion sessions. The panel discussions will examine the role of Islamic finance and Islamic fintech in diversifying economic activity in the Muslim countries, challenges and opportunities resulting from Inflation and high benchmark rates, and the use of Islamic finance in the development of infrastructure for climate change mitigation.

In addition, the challenges of Sukuk Shari’ah compliance and governance and Islamic finance accounting for hyperinflation will be discussed.

AAOIFI is also organising the first-ever ‘Capacity Building Week’, which will begin on 28 November 2023 and run through 04 December 2023, after conference on 29-30 November 2023. The five-day celebration of human capital development in Islamic finance is expected to attract more than 200 trainees from at least 30 countries to participate in 17 concurrent workshops led by around 25 master trainers.