By: Mohammed A. Abu

Today we bring you the Part Two and final on the efforts of two change agents at re-designing the Togo, rural Built Environment for sustainability. An initiative that was to get full buy-in of Nor “Wester Rotary Grant,US.

Dignity Toilets are zero water usage and are climate smart for that matter. The dwindling water stock levels of aquatic or fresh water systems the result of climate change impact, continue to raise concerns globally and more so, in African rural communities that tend to be the most hard hit.

Leveraging innovation and research driven technological solutions would therefore be highly crucial in re-designing the African Rural Built Environment for sustainability.

Now for the rest of the story, read on

Reaching out to Rotary Club

“By the time we had done eight (8) we had the system down and could duplicate the design consistently. That is when I approached my Rotary Club and asked them to take on the project. They agreed” Doc Reiss recounts

Kathi Jellicoe Pressley, Nor ’Wester Rotary Grant, US, Writer, recounts the humble beginning of the Dignity toilet project in Togo by Tao and Doc Reiss before the Rotary take-over

“Toilet No1 gifted to a friend in Zogbedgi, a poor rural village in Southern Togo, Africa.Neighbours sign up to have one built for their families in 2015. In 2016 eighty (8) toilets for twenty-four (24) waiting families was financed through donations.

Moving the Project Forward by Rotary

In chronological order, Kathi presents the role of Rotary in the Dignity Toilets Togo project since its takeover of the project in 2017 up till date.

“In 2017 Nor ‘Wester Rotary Club hires local men and train them to build eco-san toilet. Dignity Toilet Togo, established as an NGO by the crew to help Rotary get grants leading to the construction of fifteen (15) toilets and twenty-three Dignity Toilets(DTs).

“In 2018 thirty (30) toilets and 53 DTs were constructed through Nor ‘Wester District grants, private and club donations. Nearby Klobathem added to the service area.

“2019, recorded forty-five (45) toilets and ninety-eight (98 DTs) as word continued to spread and building continued, and the outcome was, 700 people no longer “visit the bushes” Area eight (8) global grant also approved.

“In 2020 project work impaired due to COVID-19 impact via border closure, doctor shortage and no work to provide for families. Nonetheless, six (6) Toilets and one hundred and four (104) DTs were added.

“In 2021 sixteen (16) Toilets and one hundred and twenty-two (122) DTs were added while Doc Reiss moves to Ghana and funds donated from Nor ‘Wester. Nor ‘Wester Rotary and six (6) Districts Clubs create new model for global grants. Global Grant received and ultimately cancelled due to failure of Host Club to follow the terms of the MOU.

“In 2023 fourteen (14) Toilets/one hundred and thirty-six (136) DTs added as Nor ‘Wester Rotary receives District grants. One thousand, one hundred (1,100) people were impacted including two male crew members and one (1) woman for education on how to utilize and manage the toilet. Women and children tend to be the most impacted under living conditions lacking toilet facilities.

“In 2023, twenty-eight (28) Toilets and one hundred and sixty-four (164) DTs were added. Area 8 global grant approved, Lomé Racine signs MOU, two crew salaried completed and Quality Program Fertilizer Test done

“As of April,2024 forty-four (44) toilets were added totaling one hundred and eighty (180) DTs positively impacting the lives of one thousand four hundred and ninety-eight (1,498 people

“Eight (8) DTs is currently in process with two crews salaried-an assistant for the Director of Dignity Toilets Togo, Taouvik and one (1) woman for education.

Three (3) professionals, carpenter, Ironworker and plumber on contract” Kathi wraps up her project progress report in a chronological order.

Global Grant Input

“We have a global grant now because of the combined efforts of the clubs in our area and are building at a rate of 8 a month. Much as I would like to take credit for the global grant and the upsurge in building, that has been Kathi” Doc Reiss appreciates Kathi of Nor” Wester Rotary Club.

The Urine Fertilizer Dimension of DTs

Doc Reiss further appreciates the takeover of Rotary with Kathi in charge. “It is under her direction that things have blossomed. A while back I learned that it was possible to take urine and turn it into fertilizer. I sent Tao to Malawi to learn how to do it from a fellow named Goodfellow Phiri.

“Goodfellow has a business that started with five 200 liter tanks. He now has 100. he taught Tao. No one has ever built for the families before. We are truly grassroots.

“People usually show up, do something with their own people and leave. One day Tao told me, “The difference between you and those guys is that they do something for the village. You do something with the village.”

“We never meant to start as a project. We just did what we needed to do to make things work and in the process created a unique project. Now I want to marry the DT (Dignity Toilet) project to fertilizer production” Doc Reiss intimated.

The Urine for Fertilizer Dimension of DTs

“We have had test fields prove successful. We are stockpiling the urine and will soon be selling it to local farmers to help them rebuild their soils at a rate about 40% cheaper than commercial fertilizer.

“Once we have the system up and running we will take the profits from the fertilizer and use it to offset the cost of future toilets which will give us more fertilizer which will give us more toilets.

Creating a Self-Financing System for DTs

“By putting the two together we will create a self-financing toilet project that can be transplanted to anywhere in rural Africa and start rebuilding the soils for a better future and healthier families.

Multiple Benefits of DTs

“One toilet reduces ground water pollution, lowers cholera and other diseases, and provides safety for women and children. and it gives dignity to the family.

“Also women no longer have to wait until dusk for modesty sake which lowers the number of urinary tract infections. Now when a guest needs to go to the bathroom during a visit they do not have to go find a field.

Going Green with DTs,the Economics

“I must confess it is because of Daniel and Agent Konte that I started looking into going green. If you contact anyone I am telling you about and you say you were talking to me about toilets they will know exactly what is going on.

“And by going green we will be able to add another potential funding source (making bricks and blocks) as well as make the toilets more affordable to more families. It also gives us the chance to hire more people” Doc notes with great satisfaction.

Taouvik Boukari, the Director of Dignity Toilets, Togo, on his part, presents the social-economic and, environmental impact of the dignity toilets in the project catchment area in Togo.

Social Impact of DTs in Rural Togo

Taouvik, Dignity Toilet Project Director, Togo says, for the people of the village, kegue ZOGBEDJI, the social impact is that, DTs, has changed many things-no smell, no poop everywhere like before, and the village has become clean. The people like it so much, and more people come to stay in the village

Health Impact

“With regards to the health impact, clean area brings more good health, no much mosquitos like before, no much sickness, people have better life, good health, no more defecations everywhere,

Environmental Impact

“Environmental impact wise, toilets protect environment no offensive odours, save water wastage as DT don’t need water, clean, DT protect the environment too

Economic Impact

“On the economic, impact people will save money from evacuations of their local toilets, because DT is ecology toilet, and they will make more money in using fertilizer which DT gives them.

Rural Community Beneficiaries Response

“The rural community never stop thanking us for this big opportunity we bring, and changed many people lives; we are like heroes in the community

Ongoing Projects

“Now we are building 178th toiles in three villages, Zogbedji, Klobatem and

Yayirakome” Taouvik further updates.

The Way Forward

On future plans of Dignity Toilets Togo, Tao had this to say, “In the future we are thinking to training more people have more crew, give jobs to more people and develop urine fertilizer. We collect urine from DTs and sell to make money and use that more pay people and do new toilets to continue helping communities”

DTs for Ghana

Doc. Reiss also discloses that Ghana is next after Togo for replication of the Dignity Toilet, Togo project and that he is sourcing a UN grant funding for that .In Ghana, he says, he knows of a village with 300 families needing toilet facilities. Another area in Northern Ghana he disclosed need 9,000 toilets.

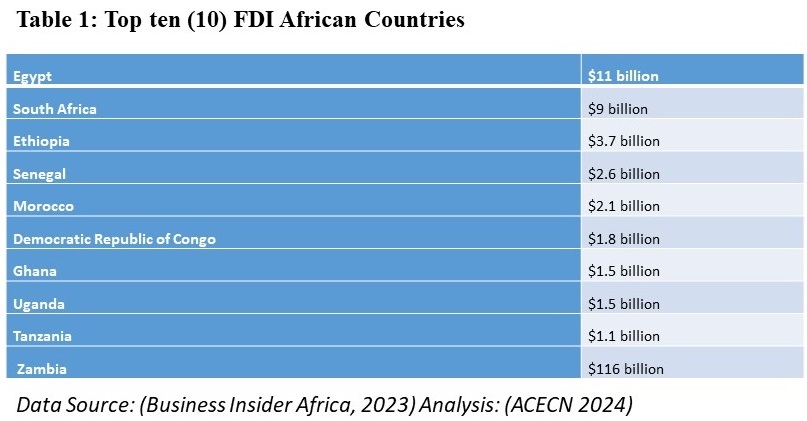

Real estate investment in Ghana has become an increasingly attractive option for investors looking to diversify their portfolios and tap into the country’s promising real estate industry, the country with a stable political environment, a young and rapidly urbanizing population, and rising incomes, Ghana’s real estate sector presents exciting opportunities in all categories of real estate, the residential, commercial, and industrial properties. This is a series brought to you by the Africa Continental Engineering & Construction Network Ltd (

Real estate investment in Ghana has become an increasingly attractive option for investors looking to diversify their portfolios and tap into the country’s promising real estate industry, the country with a stable political environment, a young and rapidly urbanizing population, and rising incomes, Ghana’s real estate sector presents exciting opportunities in all categories of real estate, the residential, commercial, and industrial properties. This is a series brought to you by the Africa Continental Engineering & Construction Network Ltd (