| Katuiscia Laurence Ewane is a General Field Engineer at SLB |

| JOHANNESBURG, South Africa, August 24, 2023/ — While the energy sector has been a largely male-dominated industry, women are gradually taking on a more central role in driving innovative project developments. Individuals such as Katuiscia Laurence Ewane, General Field Engineer at SLB, play an instrumental part in driving the successful development of the industry. Ewane has a vision that Africa not only adopts but creates technology. Ewane is featured on the African Energy Chamber’s (www.EnergyChamber.org) list of 25 Under 40 Energy Women Rising Stars. Please share a brief overview of your journey in the energy industry that led to your current role? What are some key achievements or milestones that you are particularly proud of? I have always had an interest in STEM-related fields and that is what led me to attend Ecole Nationale Supérieure Polytechnique, where I graduated with a Master’s in Industrial Engineering. As a young graduate, I was intrigued by the energy sector and knew very little from the outside; but was all too familiar with the challenges I faced with energy in my day-to-day life. So, when I got the opportunity to work at SLB, I seized the chance! And so, my adventure in the energy sector began. I spent five years between the field and training centers getting a critical understanding of how this sector operates. Some of the achievements I am most proud of are: Pioneering research in SLB on a new approach for the integration of Drilling Fluids and Cementing fluids. This will help eliminate waste, optimize operations, and deliver services more sustainably.Completing a complex cementing operation on Mt Cameroon at 4000m of altitude.Community service under SLB Excellence in Educational Development (SEED) program where I helped deliver a well for a community and created a reading club in a public primary school. Finally, I am most proud the ladies I was able to mentor through SLBs connect women platform. I believe that people are a great investment and that whoever gives back receives more. The energy industry is known for its complexities. What were some significant challenges you faced along the way, and how did you navigate through them to achieve your goals? The first challenge I encountered was culture. The energy sector is a melting pot of cultures (nationalities and company culture) and ideas, but all of them must help achieve a common goal: to deliver energy. To navigate this, I learnt more about how different energy companies I worked with operate and the culture of the different nationalities I worked with. Also, asking questions and repeating myself helped to avoid miscommunications. The second challenge is change. The energy sector is dynamic, and plans change a lot, but this is not an excuse to waste time. You must value people’s time. The key is to always plan and if the plan fails always have a contingency in place that has been agreed with all the key stakeholders. What advice would you give to young females aspiring to excel in the energy sector? Are there any specific strategies or mindsets that helped you overcome obstacles and reach your current position? As a female, I did not have the same perspective as most of my peers and that negatively impacted my self-confidence. Over time, some strategies that have helped me manage this are: Knowing my worth! I am just as good if not better.I bring in a unique perspective and that matters.Work and Network! Both go hand in hand.Do not self-sabotage.It’s okay to ask for help. No one knows it all! A career in energy can be demanding. Could you describe a typical day in your life? Demanding it is, but just as rewarding! The Fluids Engineer’s workday starts the day before with planning for the next day. Top of the morning, I wake up, pray, and do a 10-minute workout. I then consult daily reports and get in touch with the teams on/offshore to get the full picture of the status of operations. Following this, I engage in my daily operations meetings and client engagements. This is the most critical part of my day as communication with the client is key. We agree on what are our outstanding tasks, what task is urgent, and what to expect in the coming days. I must also attend all my internal meetings and distribute tasks to my teams. After this, I can finally start designing cement jobs. I must make myself available and reachable in case any teammate runs into a bottle neck, or a critical decision needs to be made that will affect service delivery. Sometimes, emergencies arise, I need to be flexible and have contingency plans in place. If I can’t find a solution right away, I take a 5-minute break to refresh, it always helps! The day always ends by reconnecting with family and friends to refuel and start all over the next day. Looking ahead, what changes or advancements do you hope to see in the energy sector, and how do you envision your role in shaping that future? The first area where I want to see change is the image of the energy sector. Many still believe it’s a man’s world, but things have changed: I hope to lead the way in showing young women out there, that this is a very dynamic sector, and that their input is much needed. As I grow in my career, my goal is to make room for women and influence other decision makers to open doors for women in this sector. The second area where I want to see advancement is in the adoption of technology. I want to see Africa adopt technology and create technology. A transition to cleaner sources of energy is only possible though technology adoption. As a young African, I believe this is critical in the creation of the future we want to see for ourselves and for the generations to come. This starts from changing mindsets. My plan is to pioneer these conversations, and to keep pushing till we see change. Distributed by APO Group on behalf of African Energy Chamber. SOURCE African Energy Chamber |

Category: COVER

-

I Want to See Africa Adopt Technology and Create Technology, Says Katuiscia Laurence Ewane

-

AFSIC 2023: Why it is Worth to be There

Eco-Enviro News Africa AFSIC Feature

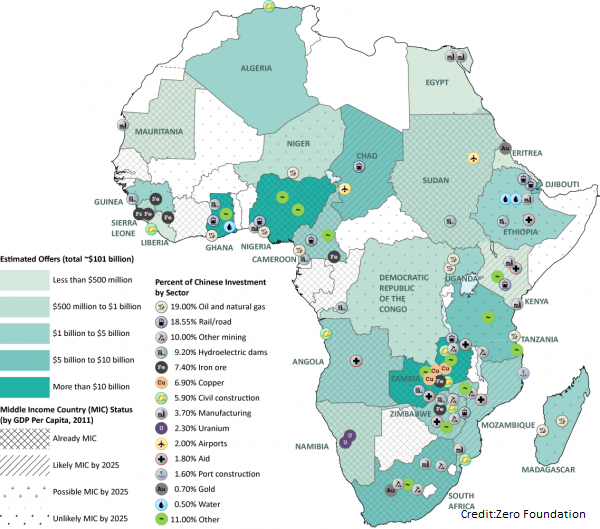

Natural resources rich Africa’s continuous growing economic competiveness within the context of a globalized economy, has for decades attracted and continues to attract international investor attention.

Africa’s Unique Selling Points

Aside accounting for over 60 percent of the world’s total arable land served with more than abundant surface and ground water resources,the continent also holds a huge proportion of the world’s natural resources, both renewables and non-renewables. In addition, the continent is home to some 30 percent of the world’s mineral reserves with particular reference to critical minerals needed for powering electric vehicles, eight per cent of the world’s natural Gas and 12 percent of the world’s oil reserves.

Africa’s population as a whole is very young, with 60% of the entire continent aged below 25, making it the youngest continent in the world, in relation to its population makeup. All of the world’s top 10 youngest countries by median age are in Africa and household incomes and consumption are projected to rise.

Share of World’s Fastest Growing Economies.

Africa has some of the fastest-growing economies in the world, African nations are playing an increasingly significant role in the global economy.

Africa’s pre-Covid-19 top five performing economies are projected to grow by more than 5.5% on average in 2023-2024 and to reclaim their position among the world’s 10 fastest-growing economies. These countries are Rwanda (7.9%), Côte d’Ivoire (7.1%), Benin (6.4%), Ethiopia (6.0%), and Tanzania (5.6%).

Returns On Investments

A report by the UN Conference on Trade and Development states that between 2006 and 2011, Africa had the highest rate of return on inflows of Foreign Direct Investment: 11.4%. This is compared to 9.1% in Asia, 8.9% in Latin America and the Caribbean

According ECA sources, the African continent could become the most profitable region in the world for foreign direct investment (FDI), with a rate of return of 14%, compared to a world average of 7.1%.

Some popular sectors for investment include primary agriculture and agro processing, mining, oil and gas, real estate, technology, tourism and hospitality and infrastructure. The mining industry in Africa is a major contributor to the continent’s economy, with abundant deposits of precious metals and minerals.

African policy makers believe FDI can help to provide technology, marketing and management skills, make up for domestic capital shortfalls, generate both efficiency and technology transfer in local firms, and facilitate access to foreign markets

The importance and relevance of Africa’s leading global Investment event, “Investing in Africa” could therefore be best appreciated against this background.

Scheduled to take place from the 8th-10 October,2023 in London, UK, the event seeks to draw over 1,500 delegates worldwide. In participation are thirty-two (32) African countries, thirty-six (36) other countries five hundred and ninety-nine (599) African delegates, six hundred and fifty-nine (659) delegates from other countries, three hundred and forty-one (341) Speakers and Chairs, twenty-seven (27) Media Partners, fifty-two (52) Sponsors and thirty-five (35) networking stands.

The Managing Director, Rupert McCammon in an interview earlier this year noted that, AFSIC now in its 10th year, is believed to be the largest African investment event taking place annually outside Africa and has become one of the most important conduits of investment into Africa.

Over the past ten years AFSIC, Mr. McCammon intimated, has been entirely focused on bringing together Africa’s business leaders and Africa’s most interesting investment opportunities with the continent’s most important investors and dealmakers to facilitate new investment into Africa.

Wide ranging support from exceptional partners and sponsors AFSIC, over the past ten years, he noted, has led the way in profiling investment opportunities from Africa and providing an excellent forum and associated platforms to showcase these opportunities to investors.

AFSIC is a conference that is very focused on networking and delegates attend year on year as they feel the variety of interactions and the superb content delivered all contribute to getting deals done and investment secured.

Networking Opportunities

Supported and sponsored by some of the leading Africa-focused corporates, AFSIC 2023 will build upon the last ten years’ successes.

The AFSIC 2023 networking opportunities include: matchmaking sessions facilitated through the sophisticated Event and Meeting App which goes live one month prior to the event ,a networking exhibition with key sponsors and partners offering enhanced opportunities to meet with them, numerous sessions dedicated to meeting a wide range of representatives from investor groups including: DFI’s, Impact Investors, Private Equity Investors and Venture Capital Investors, the regularly sold-out Meet African Dealmakers event – this year to be jointly sponsored by the European DFIS,country investment summits focused on the fastest growing African economies with informal networking at the end of each session ,various evening social functions hosted by our partners and sponsors

Speakers and Panel events

The event is broken down into Industry Streams and this year these will include Advancing Agriculture, Building Africa, Banking on Africa, Fintech Innovation, Power Africa, Sustaining Africa and Informed Investing in parallel to country-focused investment summits and quick-fire sessions highlighting exceptional projects.

Speakers are from a wide pool of exceptional African business leaders who are looking to promote their Africa-focused company from an investment perspective as well as some of the leading institutional investors and dealmakers focused on driving investment into Africa.

Sponsors and Partners

Blen Abebe

Africa Investment Advisor

Deji Adebusoye

Sahel Capital

Saadiya Aliyu,CEO

Urban Shelter LTDAFSIC 2023 welcomes British International Investment, FSD Africa, Executives in Africa, 27Four, Icecap, RMB, Fitch Ratings, Bank One, Alpha Morgan, Benchmark International, Pearlbridge Capital Managers, Mitco, Carey Olsen, Proparco, FMO, NIDP and DEG to date and negotiations are still ongoing with many other exceptional companies who see the value of the association with AFSIC in October and the all year round exposure via the digital platforms.

The event media and partners are also critical in raising the profile of both our sponsors and the conference itself.

Digital Presence and Reach

AFSIC has exceptional digital reach with a network of over 140 000 mailable contacts including institutional investors, investment bankers & financial intermediaries, African business leaders, providers and executives. The Group’s 3 websites capture 7,5 million impressions annually with impressive top 10 SEO ranking for over 1600 keywords relating to business, trade and investment in Africa. In addition, AFSIC 2023, like AFSIC 2022, will have all content recorded and live streamed enabling AFSIC to have an exceptional Pan-African reach.

AFSIC Digital platforms

AFSIC boasts two award-winning digital dashboards focused on matching business, trade and investments opportunities across all African countries and all business sectors.

The Africa Business Community provides a vast network of African businesses, global businesses, government agencies and service providers. In 2023 AFSIC is working closely with Prosper Africa, a US Government initiative, to substantially enhance US-Africa trade.

AFSIC’s sophisticated matching algorithm ranks and matches business opportunities and “calls for business” posted on our Africa Business Opportunities Dashboard, allowing interested parties to connect through this free and open access platform.

There is also a closed AFSIC African Investments Dashboard which is catered to matching institutional investors and African companies seeking capital with investor-ready documents.

Expected Traction from Business Opportunities Posts

In 2022 over 2 million personalised business matching emails were sent and AFSIC database sees 30 000 new contacts joining annually, all with an interest in business, trade and investment opportunities across Africa and all business sectors.

AFSIC African Investments Dashboard has a network of 25 000 investors. AFSIC’s recommendation is that, all business opportunity owners make their descriptions as detailed and clear as possible to appear attractive to interested parties and investors.

Business Opportunities Dashboard versus AFSIC African Investments Dashboard

The Africa Business Opportunities Dashboard offers free registration, access and connections for all users using automated matching algorithms and individually customised e-communication strategies. The AFSIC African Investments Dashboard is a closed dashboard only viewable by registered investors and uploads are only available for high quality projects seeking equity, debt or hybrid investment capital. We also offer additional bespoke introduction services for our AFSIC African Investments Dashboard clients.

Country Investment Summits and Networking Sessions

AFSIC 2023 will offer country investment summits for the larger economies in Africa and these sponsored comprehensive summits will comprise: •a panel discussion led by in-country experts sharing their insights on how to successfully navigate the investment ecosystem in each country, Quick fire Pitch Sessions on specific investment opportunities across business sectors in each country, informal business networking to meet some of the countries’ business leaders, government representatives and investors Angola Nigeria Rwanda Egypt Morocco country networking.

Informal country networking sessions at AFSIC 2023 will provide delegates with an opportunity to meet other interested investors and in-country experts to discuss the investment climate

Raising capital for your own fund?

AFSIC provides opportunities for fund executives to attract investment into new funds through introductions to Fund of Fund, DFI, SWF Investors can share their funds’ metrics, mandates and past performance through formal presentation sessions, investor panels, formal and informal networking sessions and B2B meetings supported by the AFSIC African Investments Dashboard digital database of investment opportunities and the sophisticated Event and Meeting App

-

AFRY chosen as the preferred consultant for a large-scale system study project to foster a secure and sustainable energy transition in Egypt

Egyptian Electricity Transmission Company (EETC) has selected AFRY to carry out a pivotal system study to support the fast-paced expansion of Egypt’s national transmission grid according to an AFRY’s official statement in Stockholm,Wednesday.

The studies,it said, will address the challenges arising from the extensive integration of renewable energy sources, focusing on enhancing the reliability and stability of the grid.

Egypt’s Integrated Sustainable Energy Strategy outlines an ambitious vision to substantially increase the renewable energy capacity within the next seven years, aiming for 42% of sustainable energy generation by 2035. While this strategy underscores Egypt’s commitment to a greener future, it also highlights the need for comprehensive measures to ensure grid security and stability.

Following a competitive international bidding process, AFRY has been chosen as the trusted advisor for developing EETC’s master plan for the future expansion of the transmission system.

AFRY’s scope of work will primarily focus on two strategic areas: analysing the impact of new renewable generation and optimising the allocation of Flexible Alternating Current Transmission System (FACTS) devices across EETC’s transmission network to increase the dynamic reactive power resources and grid stability, ensuring reliable and secure electricity transmission.

AFRY experts will conduct a thorough analysis of the potential effects of integrating renewable energy sources, such as wind, solar and hydrogen-based, into Egypt’s transmission system. AFRY will identify potential challenges and advise on optimal solutions for a seamless and efficient integration process, thereby improving Egypt’s renewable energy sources portfolio.

“This project encompasses a wide array of advanced technologies, including interconnections with Europe and Saudi Arabia, as well as the integration of cutting-edge renewable technologies like wind, solar, and hydrogen-based generation and storage. Given their proven track record, innovative approach, and range of expertise in the energy industry, we are confident as AFRY won through a fair competitive process and can be relied on for the successful implementation of this pivotal project for Egypt”, Sabah Mashaly, CEO & Managing Director of EETC.

“We are honoured to be the trusted partner for EETC in this momentous system study project. Our extensive experience and expertise in deploying advanced technologies, such as FACTS, High Voltage Direct Current (HVDC) systems and High Voltage AC systems, combined with our proficiency in renewable energy integration, perfectly align with Egypt’s vision for an accelerated and sustainable energy transition”, said Mustafa Ibrahim, Head of System Studies, FACTS and HVDC at AFRY.

“At AFRY, we are dedicated to pioneering innovative solutions that unlock sustainable growth and development for communities and industries worldwide. We take pride in contributing to this ground-breaking project, which supports Egypt in its transition towards greener energy alternatives”, says Tord Karlberg, Business Unit Manager Transmission and Distribution, Sweden.

To support the development of renewable energy generation and secure grid stability in Egypt, Swedfund, the Swedish Development Finance Institution, has provided financial support through a Grant Agreement. This collaboration represents a significant step towards accelerating Egypt’s energy transition and achieving its sustainable development goals.

For further information, please contact:

Mustafa Ibrahim

Head of System Studies, FACTS and HVDC, Sweden

mustafa.ibrahim@afry.comTord Karlberg

Business Unit Manager Transmission and Distribution, Sweden

Tord.Karlberg@afry.comVirginia Ferrari

Communications Manager, Energy Division

virginia.ferrari@afry.com -

New academic year: Dubai school students to get hi-tech buses

School bus services ensure the security of children through surveillance cameras, and a system to ensure that no student is left behind

RTA’s Dubai Taxi Corporation (DTC) will roll out state-of-the-art school buses to serve about 25,000 students across the city.

The school transport fleet has been upgraded to meet the highest quality of safety in local and international standards, reported state news agency WAM.

DTC said the upgraded bus service is part of its commitment to provide quality transportation services in order to meet consumer needs.

Ammar Rashid Al Braiki, director of Fleet Operation, DTC, said: “Using DTC’s extensive experience and resources, combined with investments in advanced technologies in school buses, highlights our strategic drive to boost the confidence of parents and the entire community while providing a safe and secure transportation environment for students during the school year.

“Such a drive which is aligned with the highest safety and monitoring standards observed in Dubai, will also promote the confidence of the Emirates Schools Establishment towards building a long-term partnership in delivering school transport services.”

How smart features are transforming the average school bus

School bus services ensure the security and monitoring of children through surveillance cameras, along with a system to ensure that no student is left behind at the end of each journey.

The buses are also equipped with a system to detect student movement in transit, and an emergency alert system for making immediate contact with the emergency management centre.

“Buses are also outfitted with advanced electronic tracking system using GPS technology and a radio frequency identification (RFID) system to streamline the boarding and disembarkation of students as well as an automatic fire-suppression system for engines,” Al Braiki added.

“DTC is eager to promote safe and responsible driving skills among school bus drivers and attendants by engaging them in specialised high-level training courses. DTC also conducts drills on the handling of emergency cases and first aid to ensure that the team is ready and able to deal with any emergencies that may arise during the school transport process,” he added.

Credit:(GULF BUSINESS)

-

Afrobeats’ Star Ruger to Perform at African Energy Week’s (AEW) Just Energy Transition Concert with a Call to Make Energy Poverty History

It is with immense excitement that the African Energy Chamber reveals Ruger as one of the esteemed performers for the forthcoming Just Energy Transition Concert

JOHANNESBURG, South Africa, August 17, 2023/ — In anticipation of Africa’s premier energy event, African Energy Week (AEW) 2023, the African Energy Chamber (AEC) (www.EnergyChamber.org) is thrilled to introduce Ruger as a headline artist for the Just Energy Transition Concert on October 16, 2023, at Cape Town’s Cabo Beach Club. This exciting concert blends music and the energy sector, uniting individuals from diverse fields to celebrate progress towards a sustainable world.

Ruger, known for hit tracks like “Bounce,” skyrocketed to fame with chart-topping success. His unique Afro-dancehall style combines Afrobeats and dancehall elements, shaping his distinct musical identity. Ruger’s songs, including “Dior,” have garnered millions of views and streams, showcasing his talent for crafting resonant hits.

As Ruger takes centre stage, his presence signifies more than just a captivating performance. His influence aligns perfectly with the AEC’s vision to encourage and engage youth participation at AEW. By having Ruger at the event, the AEC aims to inspire meaningful discussions about Africa’s energy landscape, fostering empowerment and ownership among the youth.

“We are excited to feature Ruger at the Just Energy Transition Concert. This significant event aligns with AEW23’s focus on prioritizing energy poverty, well-being, sustainability, industrialization, and championing free markets. Ruger’s performance will undoubtedly bring his artistic brilliance to the atmosphere, inspiring young individuals to actively engage in the ongoing dialogue about a just energy transition in Africa. We invite all to join us in celebrating this remarkable fusion of music and energy discourse” states Oneyka Cindy Ojogbo, African Energy Chamber advisory board member.

As participants eagerly anticipate AEW 2023, they can look forward to the vibrant energy and electrifying performance Ruger, and other artists, are set to bring to the stage, creating an unforgettable experience that that resonates with the event’s mission of driving sustainable energy solutions and positive change. This concert provides an exclusive platform, inviting energy stakeholders and music enthusiasts to converge and engage in energy-related discussions. By intertwining music and the energy sector, the Just Energy Transition Concert carves a unique niche as an innovative venture.

AEW is the AEC’s annual conference, exhibition and networking event uniting African energy policymakers and stakeholders with global investors to discuss the opportunities across the continent’s energy industry. For more information about AEW 2023, visit www.AECWeek.com

Distributed by APO Group on behalf of African Energy Chamber.

SOURCE

African Energy Chamber -

Investing in Black-Owned Businesses is Investing in the Future

By promoting investments in Black-owned businesses, the Global Black Impact Summit will unleash a wave of economic equality and societal transformation, heralding a new era of diversity and inclusion in the business world DUBAI, United Arab Emirates, August 18, 2023/ — As the world increasingly acknowledges the importance of fostering diversity, equity and inclusion, the Black Impact Foundation’s Global Black Impact Summit (GBIS) (https://GlobalBlackImpact.com/) – which is organized by Energy Capital & Power (https://EnergyCapitalPower.com/) – emerges as a beacon of change.

With an unyielding focus on economic growth, wealth disparities and generating opportunities for Black communities, investing in Black-owned businesses takes the spotlight as a powerful catalyst for societal advancement.

By magnifying the significance of investing in Black-owned businesses, GBIS will reshape the business landscape into one that embraces inclusivity, advances communities, and drives sustainable economic progress.

Anticipate a multitude of exciting offerings at the GBIS: Championing Growth – The summit rallies entrepreneurs, investors, and leaders to promote economic growth, wealth equality, and opportunities for Black communities.Powerful Catalyst – Investing in Black-owned businesses takes center stage as a driver for societal advancement and sustainable economic progress.

Global Venue – GBIS takes place in Dubai, from November 30 to December 1, offering a prime platform for global engagement and networking.Resourceful Collaboration – Hosted by the esteemed Black Impact Foundation (BIF) and organized by Energy Capital & Power, GBIS connects stakeholders for impactful collaborations.Informative Sessions – Through panel discussions, workshops, and presentations,

GBIS equips Black individuals and companies with valuable insights on financial markets, investment strategies, profitability, and business management.Brand Showcasing – GBIS provides Black-owned businesses unique opportunities to promote and showcase their brands to a global audience, boosting brand awareness.Networking Hub – Unparalleled networking opportunities abound, from cocktail receptions to investor-led lunches, fostering connections across the global economy.Investor-Entrepreneur Confluence –

The event not only provides a platform where leaders and innovators can meet but facilitates opportunities for dialogue and deals. GBIS is committed to shed a spotlight on investing in the global Black community, and through the event’s global focus, will ensure entrepreneurs have access to both resources and capital.Encouraging Insights

Participants gain valuable knowledge and tools to drive meaningful change and realize the immense potential within Black-owned businesses.Advancing Diversity and Inclusion.

Together, attendees promote diversity, inclusion, and prosperity for all, leading the way in a vital global conversation. Collectively, participants champion the values of diversity, inclusion, and shared prosperity, taking a leading role in a crucial global dialogue.

Together, we can drive meaningful change, promote diversity and inclusion, and create a prosperous future for all. Don’t miss this chance to be at the forefront of this important global conversation.

To secure your participation at this important, high-level event, register now at www.GlobalBlackImpact.com. Distributed by APO Group on behalf of Energy Capital & Power.

SOURCE

Energy Capital & Power -

AFRY and Morefish in partnership to enhance land-based aquaculture

STOCkHOLM,Sweden,August 18,2023-AFRY and the Norwegian company Morefish have entered a partnership to respond to the increasing demand for expertise in land-based aquaculture projects. Together, AFRY and Morefish are spearheading the Blue Food sector by offering a comprehensive approach to clients, covering expertise from feasibility studies to farm operations, complemented by a strong focus on project management.

By combining AFRY’s experience in land-based fish farms and project management, with Morefish’ expertise in fish biology and RAS technology (Recirculation Aquaculture System), the companies will support clients in both Norway and internationally, from business ideas to operate finalised projects.

”We see this as a unique opportunity to partner up with a team with a proven track record in this specific field, to provide our clients with the right systems, buildings and operations. Entering the Norwegian market is an important step in AFRY’s development strategy for the Blue Food business, and our mission to accelerate the transition towards a sustainable society,” says Claudio Ferro, Leader of Aquaculture Business, AFRY.

“We have witnessed the exceptional ability of AFRY’s expertise and innovation first-hand during our collaborative efforts on the previous blue food project, such as Norway Royal Salmon’s smolt-project project in Dåfjord. Within land-based aquaculture, AFRY gained several references at international level including Swiss Lachs, in operations since 2017. AFRY’s forward-thinking approach has proven to be instrumental in creating significant value,” says Svein Martinsen, Development Manager at Morefish.

“From our side, Morefish aims to be the leading expertise in landbased fishfarming, with a unique knowhow of technology and biology combined. In joint collaboration with AFRY we will be able to engage in projects at any scale and ambition”, adds Martinsen.

The partnership agreement was signed in the beginning of 2023 and the companies will launch the partnership during a technical seminar at the Aqua Nor conference in Trondheim end of august.

AFRY in Norway is an engineering and design company with over 1 000 employees and 12 offices covering all the regions and the major engineering fields. The project management activities are carried out by Advansia, part of AFRY, who has been responsible for the project management of Salmon Evolution’s land based fishfarm in Norway.

Morefish is a consulting company operating in the aquaculture industry, based in Trondheim, Norway. Since 2014, they offer specialist services within recirculating aquaculture systems (RAS).

For more information, please contact:Andrea Giesecke

Head of Sustainability Communication and PR

andrea.giesecke@afry.com -

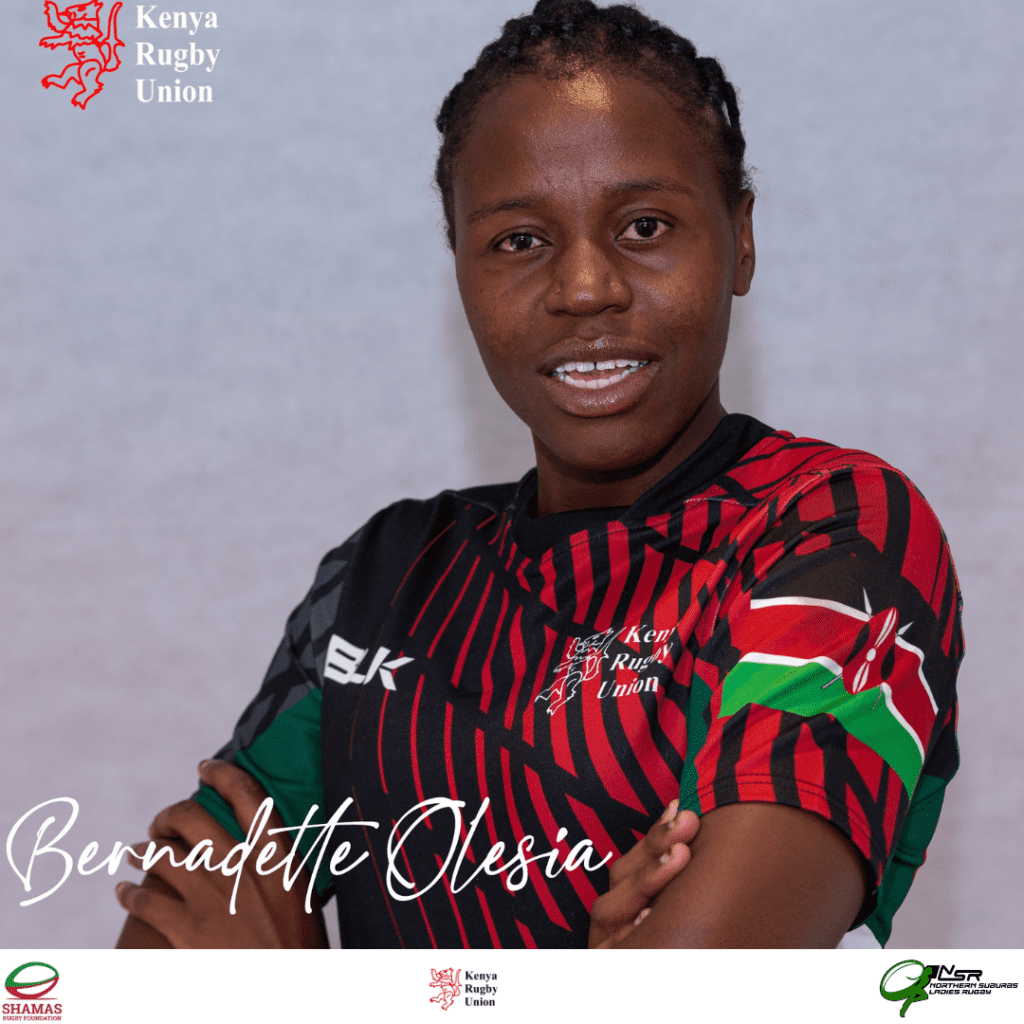

Statement from Rugby Africa President Herbert Mensah on the Passing of Kenya Lionesses Rugby Player Bernadette Olesia

Bernadette’s leadership as the Captain of the Northern Suburbs Ladies Team was a testament to her unwavering dedication CAPE TOWN, South Africa, August 16, 2023/ — With profound sadness, I learn of the passing of Kenya Lionesses rugby player, Bernadette Olesia. As the President of Rugby Africa (http://www.RugbyAfrique.com), I am deeply saddened by the loss of Bernadette, who made a significant impact on our sport.Bernadette’s leadership as the Captain of the Northern Suburbs Ladies Team was a testament to her unwavering dedication.

Her recent contributions to the 2023 Rugby Africa Women’s Cup, coupled with her commitment to the Shamas Rugby Foundation, highlighted her exceptional skills and relentless spirit. Bernadette’s absence leaves a void that will be deeply felt across the rugby community.On behalf of Rugby Africa and myself, we extend our heartfelt condolences to the Kenya Rugby Union, Bernadette’s family, friends and teammates. We offer our unwavering support and sympathy.

Let us remember Bernadette not only for her accomplishments but for her kindness, determination and passion.With deepest sympathy,

Herbert Mensah

President of Rugby Africa

Distributed by APO Group on behalf of Rugby Africa.

Media contact:

Nicole Vervelde

Communications Advisor to the President of Rugby Africa

rugby@apo-opa.comAbout Rugby Africa:

t

SOURCE: Rugby AfricaDistributed by APO Group ReplyForward -

First-ever ESG executive education programme for hospitality sector leaders

LONDON,United Kingdom,2nd August 2023-King’s Business School and the hospitality sector’s Energy and Environment Alliance (EEA) are launching an executive education programme developed with input from the industry’s leaders to help them to embed Environmental, Social and Governance (ESG) measures in their businesses.

The programme was developed through discussion with over 40 senior hospitality leaders who emphasised the role of COVID and recent energy price spikes, alongside the new IFRS® Sustainability Disclosure Standards, in providing both an impetus and an opportunity to accelerate progress on environmental measures ahead of the commitment made by over 100 countries to reach net zero CO2 emissions by 2050.

According to the Urban Land Institute, hotels and lodging are the least energy and water-efficient buildings in commercial use. The research conducted by the Energy and Environment Alliance and King’s Business School to develop their new education programme highlighted the scale and complexity of the task leaders face in developing a plan to reduce reliance on fossil fuels.

Explains Ufi Ibrahim, Chief Executive of the EEA: “It’s inevitable that energy use and energy costs are much higher on the agenda given recent price increases. But COVID also played a part. Many hotels had zero occupancy, yet found they were still needing up to 60% of their usual energy consumption just to prevent issues with damp and to maintain hygiene. The majority of investors in the sector believe that at least half of the measures needed to improve energy performance will involve capital expenditure[i]. Taking the necessary steps may mean accessing new forms of green finance and there is a need for education if they are going to do so successfully.”

The EEA point out that COVID and energy price fuelled inflation have also changed the investment environment in the hospitality sector. Relative to other forms of commercial property, such as offices and retail, the sector is increasingly being seen as resilient to the trend towards online work and shopping. Additionally, its dynamic pricing models can act as a hedge against inflation.

“As a result, hospitality is becoming a more mainstream asset with scope to attract new investment and financing, as long as the industry can reliably convince investors of its long-term attractiveness, which increasingly means, its ESG credentials,” adds Ufi Ibrahim.

The ESG programme has been tailored to the needs of the leadership in the hospitality sector, including asset owners, brands and franchises. Starting in September 2023, it will give an overview of current and planned regulation and ESG reporting requirements, with a particular emphasis on climate change and the sector’s social impact through its employment practices and the interaction between staff and guests.

The programme will also cover green financing options and look at how to align consumer preferences and behaviour to achieve more sustainable outcomes through marketing. Through teaching, guest speakers, case studies and discussion, leaders on the programme will develop a personalised action plan that will enable them to lead and inspire complex, comprehensive change across many areas of their business.

The partnership will develop further through the creation of a complementary ESG course for general managers and hotel operating teams.

Comments Giana Eckhardt, Vice Dean for Engagement and Executive Education at King’s Business School: “it’s exciting to be offering a programme for a sector that has such a significant global impact and such a compelling and immediate opportunity for change. We are proud to work with the EEA to provide a programme that will forge a network of engaged, proactive industry leaders with the knowledge, connections and ambition to drive sustainable business practices forward across the sector.”

[i] Survey conducted with JLL.

Find out more:

Energy and Environment Alliance Executive Education

King’s Business School Executive Education

Media contacts:

Catherine Sirikanda at King’s Business School at Catherine.sirikanda@kcl.ac.uk / 07957 340 795 / comms@kcl.ac.uk

Anja Spice of the Energy and Environment Alliance on +44 7418608166 / anja@tarsh.com

About the Energy & Environment Alliance (EEA)

The Energy & Environment Alliance (EEA) is a not-for-profit coalition of hospitality investors, developers, asset managers and operators, working as a collective to transition the industry to Net Zero Carbon and ESG leadership in a scientifically robust and commercially sustainable way.

For more information, please visit www.EEA.International

-

Online trading: What does psychology have to do with it?

By Boriss Gubaidulin, Admirals Africa Director

The term “behavioural finance” which took hold in the 1990s examined what role emotions play in investment decision-making. Why should psychology and trading be linked?

The simple answer is that we are hard-wired as humans to be emotional, and – let’s face it – when it comes to financial matters, emotional consideration come into play.

In investing, the two most powerful emotions have been identified as fear and greed. So much so that CNN Business created the Fear & Greed Index to measure exactly how emotions influence how much investors are willing to pay for stocks.

The index assumes that fear drives stocks lower while greed boosts stock values. In more recent years, similar indices have been developed, such as the Fear & Greed Index for Cryptocurrency trading.

If emotions are an inevitable part of trading, how can we harness the power of emotions to help and protect us instead of holding us back?

The first step is to understand your emotions. On a practical level, here we look at various behavioural biases which come into play. Once we understand these biases, we will be more capable of recognising unhealthy psychological patterns and states of mind, and better equipped to react in a way to protect ourselves.

The overconfidence bias

Watch out for trading euphoria. It’s not uncommon for traders to complete a winning streak and then believe that they can’t get anything wrong in the future. To believe this would be unwise and will only end in failure. Make sure you always analyse your trading sessions and look at your wins and losses in detail. Reviewing your trades in an honest way is a key aspect of beating your emotions in trading psychology.

Learn to be comfortable with accepting that mistakes are inevitable, especially in the early stages. It’s all part of the learning curve and the development of your trading psychology.

The anchoring bias

Anchoring is a tendency to rely on what is already known to a trader for decision making in the future, instead of considering new situations and the changes that they can bring.

At times, anchoring tends to cause traders to rely on obsolete and irrelevant information, which of course won’t help you trade successfully. In practical terms, the anchoring bias manifests itself in traders holding losing positions open for too long, simply because they fail to consider the options that are outside of their comfort zone.

The confirmation bias

The confirmation bias means looking for information to support a decision you have made, even if it wasn’t the best decision. This is simply a way of justifying your actions and strategies. The problem is that, by doing this, you’re not actually learning and improving your methods, and are likely to continue making the same trading mistakes.

The loss aversion bias

The loss aversion bias can be explained as such: when considering options before making a choice, we are likely more willing to give preference to a lower possible loss over a higher possible reward.

Fear is a much more powerful motivator than greed. In practice, a trader with a loss aversion bias is more akin to cutting profits when they are still low, while allowing bigger drawdowns.

It is important to note that emotional self-knowledge cannot be done in isolation – make sure you support your trading journey and personal development with continual learning through a reputable partner, with a solid reputation backed by superior knowledge.It is also important to know that online trading carries risk – make sure you deal with a reputable broker

Risk management and education: the role and importance of a licensed, reputable broker

Risk management and education are vital components when trading in Contracts for Difference (CFDs). Admirals, the global neobroker who recently established its presence in Africa, emphasizes the importance of choosing a reputable broker to help guide you through your trading journey.

With more than 20 years’ experience, Admirals offers a comprehensive educational package, that can help you learn how to properly mitigate your risk. Here’s how:

1. Solid risk management

Develop, implement, and adhere to sound risk management strategies based on setting stop-loss orders, healthy portfolio diversification, and the appropriate position size according to your risk appetite. Admiral’s four-point risk management process involves the following:

- Identify the risks

- Analyse those risks

- Find solutions to minimise those risks and

- Consistently manage and apply those solutions to your trading.

2. Continuous learning

The financial markets are constantly evolving, and staying updated on market news, economic events, and trading techniques is important. Admirals offers a wealth of educational resources, including webinars, articles, and video tutorials to help traders stay informed and improve their skills.

3. Practicing with a demo account

Before diving into live trading, it is essential to practice in a risk-free environment. Admirals provides a demo account that allows you to test your strategies and familiarize yourself with the trading platform without risking real money.

4. Advanced trading platforms

Admirals offers MetaTrader 4 and MetaTrader 5, providing you with powerful tools and features to optimize your trading strategies and stay on top of market movements.

5. Dedicated customer support

Admirals offers localized support to assist you on your trading journey and to help you navigate the financial markets with ease. A team of customer support representatives is available to assist you.

6. Wide Market Access

Admirals offers a range of more than 3700 CFD assets to trade, including CFDs on forex, stocks, commodities, stock indices, bonds and ETFs, allowing for a diversified portfolio and access to global markets.

Admirals continues to expand globally to provide its clients around the globe with advanced trading tools, access to financial security and various customer care policies. Admirals is licensed in the Seychelles, UK, Cyprus, South Africa, Australia, Jordan, Canada and Kenya.

In conclusion, risk management, continuous education and choosing a reputable broker like Admirals are important components in CFD trading. By prioritising these elements and leveraging the education and support provided by Admirals, you can embark on your journey in the ever-changing financial markets with more confidence.

Trading involves risk.