JOHANNESBURG, South Africa, December 10, 2023/ — By NJ Ayuk, Executive Chairman, African Energy Chamber (www.EnergyChamber.org).

There was an era when Africa and Western pop music were closely linked.

Western entertainers spearheaded a number of internationally renowned events to raise awareness about the plight of starving Africans and generate funds for famine relief.

In December 1984, the supergroup Band Aid sang about feeding the world, asking “Do They Know it’s Christmas?” Within a year, the group had raised over USD9 million.

Three months later, USA for Africa released “We Are the World” and banked USD44.5 million after one year for its African humanitarian fund. Then on a hot July day in 1985, the worldwide concert event Live Aid raised more than USD150 million for famine relief in Africa.

These are just a handful of grand and noble gestures intended to lift Africa out of poverty. And these famous events arguably raised both awareness and funds. Unfortunately, the efforts — and others like them — fall far short of making any real socioeconomic change. In fact, some argue that injecting monetary aid into Africa, time and time again, has actually done more harm than good.

I acknowledge that stance may sound ungrateful. At first blush, many might counter that starving people have no agenda. Destitute parents still need to feed their children. Turning a blind eye to their plight is inhumane.

Let me explain why the African Energy Chamber (AEC) continues to push for free-market solutions rather than good-will handouts.

History of ‘Help’

Even aid genuinely given to help Africa tends to do more harm than good.

Since 1960, more than USD2.6 trillion has been pumped into Africa in the form of aid. From 1970 and 1998, when aid was at its peak, poverty actually rose alarmingly — from 11% to 66% — due in large part to this massive influx of foreign aid that counteracted its intended good.

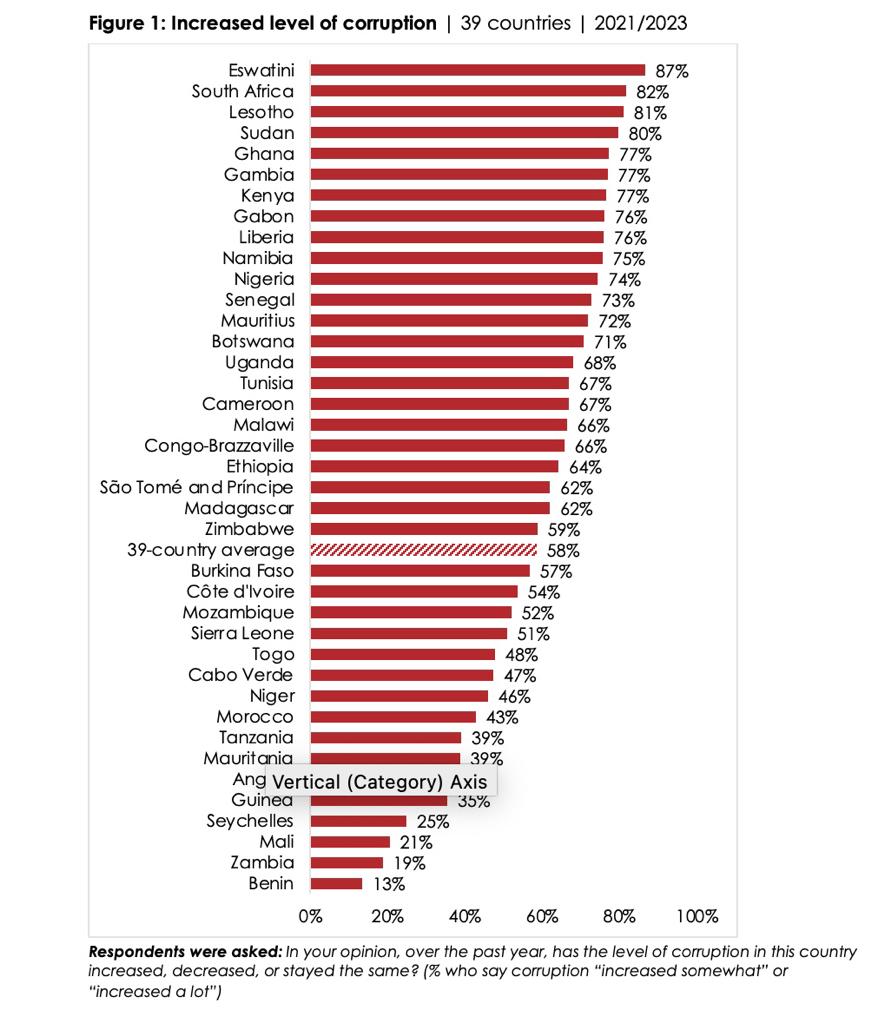

Aid decreased long-term economic growth by fueling systemic corruption, in which powerful aid recipients funneled foreign funds into a personal stash instead of public investment. Many leaders realized that they no longer needed to invest in social programs for their constituents because of the revenues from foreign donors.

Large inflows of aid also caused higher inflation, hindering African nations’ international competitiveness in exporting. That resulted in diminishing the manufacturing sector – which is critical in helping developing economies grow — across the continent. And well-intentioned Westerners who saw the economic shrink just kept pouring more and more money at “the problem” — leading to a vicious cycle that furthered corruption and economic decline.

But here’s the kicker: The World Bank has admitted that 75% of the agricultural projects it implemented to help Africa failed. So why do they and other aid providers continue to fund these failing efforts?

Examples of Failure

Across the continent, we see example after example of failed aid projects, with agricultural projects routinely providing little or no benefit to African farmers.

In Mali, the U.S. Agency for International Development (AID) injected USD10 million into “Operation Mils Mopti” to increase grain production. The government imposed “official” prices on the grain, which forced farmers to sell their crops at these below-market rates and resulted in grain production falling by 80%.

AID also spent USD4 million to help livestock producers grow the number of cattle in the Bakel region from 11,200 to 25,000 — but ultimately only succeeded in increasing it by 882 head. Another USD7 million was injected into the Sodespt region, but that investment managed to sell only 263 cattle and failed to sell any goats or sheep.

Then we see example after example of Westerners wastefully “helping” without any understanding of the local situation. Norwegian aid agencies built a fish-freezing plant to improve employment in northern Kenya — a region where the local people traditionally do not fish because of their semi-nomadic pastoralist lifestyle. Couple the lack of fishing experience with the unfortunate reality that the plant required more power than was available in the entire region, and the result was that the brand-new processing plant sat idle.

The World Bank financed a USD10+ million expansion of Tanzania’s cashew-processing capabilities, which resulted in 11 factories with the capacity to process three times as many cashews as the country was growing on a yearly basis.

The plants were too efficient for the available workforce and cost so much to run that it was cheaper to process the raw nuts in India. Half the plants were inoperable, and the other half only ran at about 20% capacity.

I’m not saying that we Africans are ungrateful for the outpouring of heartfelt care. The compassion of the West is certainly real. However, the outcome of said compassion is the concern: The more foreign aid African governments receive, the worse they perform.

As long as the aid keeps flowing, government leaders and their employees who administer development programs may prosper while the rest of the citizenry continues to suffer the effects of a mismanaged economy.

Questionable Benefits

We also must acknowledge that, in far too many cases, aid has also been given to African nations and communities in attempts to manipulate and control.

“While hungry faces are used on posters and in media reports to sell the virtues of foreign aid, it is the hungry who rarely see any of the funds,” James Peron, executive director of the Institute for Liberal Values in Johannesburg, South Africa, lamented in a piece for the Foundation for Economic Education.

“Poverty may be used to justify the programs, but the aid is almost always given in the form of government-to-government transfers. And once the aid is in the hands of the state it is used for purposes conducive to the ruling regime’s own purposes.”

And now we witness the international community talking about aid for African countries as a substitute for our oil and gas activities. Western environmentalists argue that Africa should keep all of its petroleum resources in the ground to prevent further climate change.

In exchange for that sacrifice, African nations would be compensated and inject that money into other opportunities like developing their sustainable energy technologies.

I’ve said it before, and I’ll say it again: What a horrible idea!

I‘m offended by foreign stakeholders feeling that providing humanitarian assistance gives them the right to influence our domestic decisions. With Africa poised to participate in the worldwide energy transition, my fear is that international donors will feel justified to dictate Africa’s policy regarding the lengths to which, and speed with which, our energy transition occurs. This would be a huge step backward in our energy, economic, and even individual independence.

Aid packages to incentivize giving up our oil and gas operations will be detrimental to Africans. Because let’s be honest: History has shown that this assistance could never replace the oil and gas industry’s ability to create jobs and business opportunities, grow local capacity, open the door to technology sharing, facilitate economic growth, and alleviate energy poverty.

Instead of continuing a pattern that clearly does more harm than good, why aren’t African nations encouraged to leverage the wealth of resources at our feet?

During the final few days of COP28 — and beyond — the AEC is determined to make a case for African nations harnessing their oil and gas solutions to help themselves. We will not be bullied, or manipulated with aid, into a path that is not in our best interests.

Use What We Have!

One reason why the AEC is an outspoken advocate for Africa’s oil and gas industry is because it represents more than big revenue for African governments. It is a free-market solution that creates pathways for Africans to help themselves. And, ultimately, empowering Africans is our number one goal.

We endorse an energy mix approach that allows Africa to use and sell our own hydrocarbon reserves to alleviate energy poverty, while at the same time moving toward a future in which renewable energy sources power the continent.

The energy mix method can help more people more quickly because it takes a practical, people-first approach to helping those who have traditionally been left behind by the energy sector, while moving us toward greener energy sources.

Natural gas, in particular, can transform African lives and communities. Its potential benefits range from eradicating energy poverty to allowing Africans to develop skills for good jobs to creating hope for our youth.

Ramping up gas production to help alleviate the lack of access to electricity will create thousands of new employment opportunities in Africa. In addition, the new sources of energy can be exported to Western countries to replace Russian energy.

Then, as Europe transitions to sustainable energy, a larger portion of Africa’s natural gas can power domestic needs. By the time other countries complete their transitions to carbon-neutral sources, Africa will have a much more expansive and reliable grid system, which will allow for an easier transition.

And before we argue about the evils of hydrocarbons, let me point out that, although it might seem counterintuitive, it is possible for Africa to make use of its abundant fossil fuels while moving toward a future sustained by renewable energy sources.

In fact, I believe that African nations must do everything they can to ensure that these two things work in tandem. Considering that 600 million people on the continent have no access to electricity and 900 million people lack access to clean cooking technologies, it’s impossible — if not altogether inhumane — to discuss climate change without looking at energy poverty.

As I recently wrote in an article published by Medium, we cannot transition from the dark to the dark. We must deliver energy to the people of Africa and then worry about transitioning to environmentally friendly alternatives, just like we have everywhere else in the world.

This has been our platform at COP28, and we will continue to stand by it in 2024 and beyond.

Distributed by APO Group on behalf of African Energy Chamber.

PS: Opinions expressed in Opinion Pieces represents that of the authors and doesn’t necessarily represent the official Opinion of the Eco-Enviro-News Africa magazine.