Okereke is the Director of the Centre for Climate Change and Development at Alex Ekwueme Federal University Ndufu-Alike, a Professor of Global Governance and Public Policy at the University of Bristol and a Visiting Professor at the London School of Economics, UK

The 28th Session of the Conference of the Parties (COP28) to the UN Framework Convention on Climate Change (UNFCCC) took a significant step by unveiling a bold Global Stocktake (GST) draft that underscored the imperative for nations worldwide to steer away from the use of fossil fuels; marking a fundamental departure from the status quo, along with a call to massively scale up renewables and energy efficiency this decade.

COP28’s outcomes reflect the good, the bad, and the ugly of the COP process in particular, and multilateralism more broadly. Let us explore how, beginning with the good outcomes.

Top on the list of “the good” is that despite the blooper by President Sultan Al-Jaber over his claim that there is “no science” behind calls for a phase out of fossil fuels, he was able to secure a landmark agreement for the world to transition away from fossil fuels. This was, in a way, an enormous feat for a COP that was brimming with over 2,000 oil and gas lobbyists, and a welcome win for climate defenders.

Although the language is not as strong as the “phaseout” many wanted, the GST text succinctly called for “transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner, accelerating action in this critical decade, so as to achieve net zero by 2050 in keeping with the science.”

The United Arab Emirates’ (UAE) establishment of the groundbreaking ALTÉRRA investment fund for transformative climate partnerships to finance the much required energy transition, in emerging markets and developing economies (EMDEs) in the Global South was a good announcement in the right direction. The ALTÉRRA fund, with a $30 billion commitment from the UAE, positions itself as the world’s leading private entity for climate change action.

The fund, possessing inaugural launch partners such as finance juggernauts BlackRock, Brookfield and TPG, aims to mobilize $250 billion by 2030 to help Least Developed Countries (LDCs) and Small Island Developing States (SIDS) finance climate solutions.

It is also good that the GST text emphasized the link between climate action and development and explicitly reaffirms that climate action should be undertaken in the context of sustainable development and poverty eradication. It also reasserted important concepts like international equity, the rights to clean air, and the concept of common but differentiated responsibility. The text, in many places, underscored the importance of global cooperation and solidarity to effectively tackle climate change.

The commitment to triple renewable energy capacity globally and doubling energy efficiency by 2030 presents “a good” outcome and indeed one of the biggest wins from Dubai.

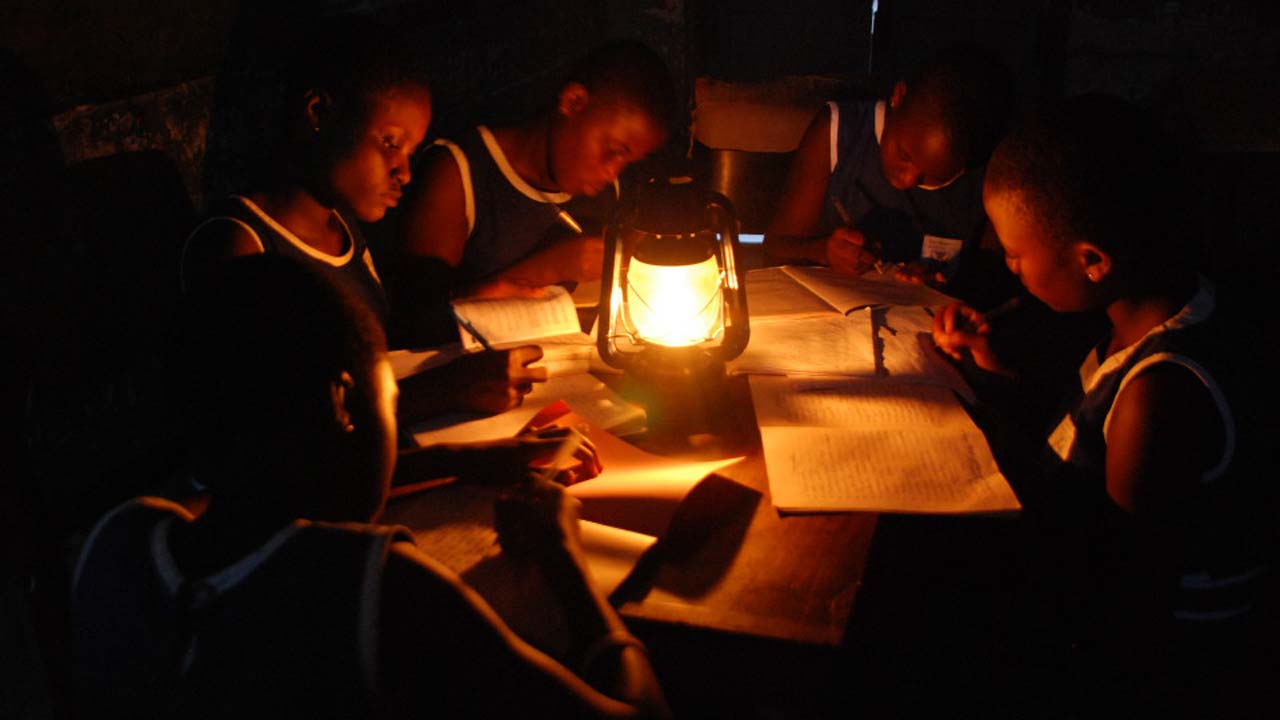

Outlining the immediate need for a rapid transition, more than 125 countries committed to the tripling of renewable energy, working together to boost clean energy capacity to at least 11,000 GW by 2030, and an average annual rate of energy efficiency of 4.1%. In a way, for Africa, I see this commitment as more important than the headline statements on phase down on fossil fuel because the immediate need of the majority of the people is access to energy.

Last year, the International Energy Agency’s (IEA) Net Zero Roadmap released a report showing scaling up renewable energy as an important way to attain global climate goals.

The IEA report projected that a speedy rollout of significant clean energy technologies will lead to a decline in the demand for coal, oil and natural gas this decade, even without any new climate policies. Hence the best route to phasing out fossil fuel is to supply people with clean energy.

However, this is where it gets tricky. Developing countries and emerging markets face myriad problems such as high initial costs of finance for the acquisition and installation of renewable energy technologies. Therefore, they require extensive international support, which is essential for amplifying investments in renewable energy, a key solution to addressing the challenges faced by developing nations in the Global South.

There is a need to scale up renewable energy financing especially for Africa, which in 2022 only received 2% of global investments in clean energy. Sub-Saharan Africa, where 600 million people live without access to electricity, has more than 1,000 times as much renewable potential as energy demand, according to the International Renewable Energy Agency (IRENA).

Hence the fact that the COP text included a general mention on tripling renewable energy generation without making specific commitments on the increase in allocation to African and other developing countries is a major source of concern. This oversight by the parties at COP28 in the GST must be swiftly addressed at COP29, laying the groundwork for renewable energy sources development to be easily accessible by developing countries who are most severely affected by accelerating climate change.

In addition, 123 countries signed the Global Renewable Energy and Energy Efficiency Pledge at COP28 to triple global renewable capacity and double global energy efficiency improvements by 2030 and expand financial support for scaling renewable energy and efficiency programmes in emerging markets and developing economies.

An essential highlight of the pledge’s text is that it acknowledges the role of “transitional fuels” in preserving energy security temporarily.

Although gas as a transitional fuel is climate-friendly and not ideal, in developing countries, it remains a healthier and less polluting alternative for home cooking and heating compared to burning wood or other biomass.

This is particularly impactful for developing countries like Nigeria whose Energy Transition Plan (ETP) aims to utilise gas as transition fuel. Regardless, it is important to establish a timeline for the phased transition away from transitional fuels.

Unfortunately, China and India, two of the world’s leading countries in the uptake of renewable energy, refused to sign the pledge. The contention for both countries centred around the initiative’s calls for phasing down of coal and “ending the continued investment in unabated new coal-fired power plants.”

It is well-known that while China has embarked on a significant expansion in renewables in the past few years and is projected to account for more than 80% of the global solar manufacturing capacity through to 2026, but it continues to burn more coal every year than the rest of the world combined.

Similarly, while India is the world’s third-largest producer of renewable energy, with 40% of its installed energy capacity coming from non-fossil fuel sources, coal is an important part of India’s energy needs, and the country depends on coal for 73% of its energy needs. In fact, India is working to add 17 gigawatts of coal-based power generation capacity to meet a record increase in power demand.

The problem is that while big countries with technology and domestic finance are able to fend off international pressure to limit their expansion of fossil fuel generation, poor countries in Africa who have much stronger moral, energy-security and climate-related arguments for using transition fuel in the medium term are made to suffer from a carbon–embargo imposed by foreign countries and investors.

The COP text and outcomes show the gap between proclamations and action when it comes to tackling climate change and putting money where their mouths are. We have known for a long time now that the pledges made by countries will not get us to where we want to be by 2030. Most countries are not on course to fulfilling their pledges. Yet, over and over again, countries gather annually for climate conferences, make commitments only to fail to act on them to assist poor countries at the frontline of the climate crisis to build climate resilience.

Developed and high-income countries most responsible for global warming had committed to raising $100 billion every year by 2020 to fund climate action in developing countries. However, climate finance provided by developed countries for climate action to developing countries only reached $89.6 billion in 2021, according to the Organisation for Economic Co-operation and Development’s (OECD) sixth assessment of progress and $100 billion goal.

Although the final text emphasised that finance alongside capacity building and technology transfer are critical enablers of climate action and urged developed country parties to fully deliver on the $100 billion per year goal through 2025, there was no specifics on whether or how to make up the shortfall. There is an undeniable need to go beyond words and act urgently on climate change and to do so in the context of sustainable development.

It’s been revealed that adapting to the climate crisis could cost developing countries anywhere from $160-$340 billion annually by 2030. That number could increase to as much as $565 billion by 2050 if climate change accelerates, according to a UN Environment Programme’s (UNEP) 2022 Adaptation Gap Report.

It is equally distressing that climate finance, especially for adaptation, has been decreasing instead of growing at a time of worsening climate crisis. And while the operationalisation of the Loss and Damage Fund is a welcome development, failure to scale climate finance for mitigation and adaptation in poor countries represents a big letdown for the climate equity and justice to which countries pay lip service.

Currently, the UN Environment Programme (UNEP) approximates that the adaptation finance requirements for developing countries are up to 18 times greater than the present influx of public finance from developed countries.

This brings us to the ugly in the outcomes of COP28 – the hypocrisy of the West who are either expanding or at least not reducing their fossil fuel exploitation in their jurisdictions but seem to have no qualms in asking developing countries with severe energy poverty to commit to phase out fossil fuels. In the United States, President Joe Biden’s administration has continued to approve more permits for oil and gas exploration and extraction in its first two years – over 6,900 permits – a number higher than Trump’s in the same period.

China has been developing nine new oil and gas fields, including the significant discovery of a major oil field in the Bohai Sea last year. Notably, twenty of the world’s largest fossil fuel companies including BP, Chevron, Saudi Aramco, Shell, and TotalEnergies – are projected to collectively invest over $930 billion by 2030 in expanding oil and gas production.

COP28 ended with some noteworthy strides in the right direction. Since the agreement and pledges are not legally binding, all eyes, as always, will be on how far all parties take their pledges for an intentional, actionable, sustainable and impactful approach to climate change.

Parties must align national climate plans, with ambitious timelines for emissions reductions and backing them with tangible implementation strategies before the next Nationally Determined Contributions (NDCs) submission ahead of COP30 in Brazil, with a timeframe for implementation till 2035.

They must translate the UAE Consensus, a collective response to the GST into their updated NDCs and developmental domestic legislation and policies, including increasing renewables, fossil-free transport systems and decreasing production and consumption of fossil fuels. Azerbaijan’s COP29 needs to provide breakthroughs on prickly and fundamental questions about finance for a just transition.

Developed countries should refrain from self-deception and perform genuine efforts for a globally inclusive and systematic energy transition. It is crucial to address the equity gap by boosting financial and technological assistance to developing countries, allowing them to partake in the clean energy revolution. This requires innovative financing methods, technology transfer initiatives, and capacity-building programmes to empower all nations toward a shared and sustainable future.

SOURCE

Centre for Climate Change & Development,Nigeria