Category: Ghana

-

Wa Gold Project, Upper West Region, Ghana gets a Booster

Report: Mohammed A.Abu

A quite impressive mineralisation encountered at the Kpali Gold Prospect under the Wa Gold Project announced recently by Castle Minerals comes as a further boost to the Upper West Region’s image as an emerging gold province

The project with multiple prospects is the single largest commercial gold concession in the entire Northern sector that promises to offer a maiden commercial mining operation in the region.

Castle Executive Chairman, Stephen Stone, commented “The Kpali Gold Prospect is developing into a robust discovery and is a strong indicator that we may be dealing with a new West African gold mining camp in Ghana’s emerging northern region.

“The latest intercepts include some very decent widths and grades at shallow depths with good continuity which can have considerable positive impacts should mining be considered.

“We have intersected a very impressive 12m at 8.29g/t Au from 25m, including 6m at 11.60g/t Au from 31m and a peak 1m intercept of 20.43g/t Au at 36m in a ‘hangingwall’ lode, and also 4m at 4.16g/t Au from 95m in a lower ‘footwall’ lode. Apart from these standout results, very strong mineralisation has been encountered within most holes drilled, implying that with additional drilling we may be able to delineate a decent high value deposit.

“We are very keen to get back drilling and to extend the Kpali Gold Prospect discovery as well as to follow-up historical drilling at the nearby Bundi discovery, 4km north. There are also several other enticing prospects in the broader Kpali Gold Project area.

“These drilling results follow excellent recent results from four holes at the Kandia Prospect, a second and separate gold discovery associated with a relatively underexplored 16km prospective contact between Birimian metasediments and a granite intrusion.

“Recent intercepts at Kandia included 7m at 3.36g/t Au from 149m within 24m at 1.78g/t Au from 139m and 5m at 3.49g/t Au from 82m within 11m at 2.26g/t Au from 79m.

“These deposits lie in a classic setting for major gold deposits in West Africa and in particular northern Ghana which hosts the Cardinal Resources 5.1Moz gold Namdini deposit and the Azumah Resources 2.8Moz gold Black Volta Gold Project.

“The latter’s high-grade Julie deposit is immediately along strike from Kandia. West Africa is where big gold discoveries can be and are still being made. With the gold price now at a level I could only dream of when starting my career, it’s the perfect time to be exploring Castle’s two new discoveries in the very stable, safe and mining friendly jurisdiction of Ghana

“Castle Minerals Limited (“Castle” or the “Company”) advises that a recently completed eight-hole, 1,106m RC drill programme at its Kpali Gold Prospect in Ghana’s Upper West Region (“Project”, “Kpali”) has intersected mineralisation in all holes including 12m at 8.29g/t Au from 25m including 6m at 11.60g/t Au from 31m and a peak 1m intercept of 20.43g/t Au at 36m in an interpreted ‘hangingwall’ lode and then 4m at 4.16g/t Au from 95m in a lower “footwall” lode (24KPRC010).

“Additional intercepts included 7m at 2.23g/t Au from 35m(24KPRC011) including 11m at 2.24g/t Au from 50m, 5m at 3.6g/t Au from 78m (24KPRC012), 9m at 4.81g/t Au from 107m (24KPRC015) and 3m at 3.08g/t Au from 78m (KPRC017).

“These results confirm the Kpali Gold Prospect, just one of several prospects within the broader Kpali Gold Project, as a robust discovery in a completely new district within Ghana’s emerging Northern Region exploration frontier.

“With several other high conviction prospects yet to be evaluated in the area, including the nearby Bundi, Kpali East, Wa South East and Wa South West prospects, there appears to be present all the hallmarks of a new West African mining camp and the possibility of a considerable gold endowment.

“The Kpali Gold Prospect lies within a mineralised corridor associated with a 30m to 50m wide zone of structural deformation immediately west of a granite intrusion.

“Three drilling programmes have identified near-surface, shallow plunging high-grade lode-style mineralisation to a depth of at least 100m. Multiple, closely-spaced mineralised lodes have been identified over at least 650m strike.

“Overall, the geological setting at the broader Kpali Gold Project is of typically structurally-controlled, orogenic style mineralisation within Birimian terrane. This is a similar setting as that hosting several worldclass gold mining operations in Ghana and West Africa generally. Orebodies with these characteristics can often extend to considerable depth.

“This latest drilling programme focused specifically on extending zones of high-grade, lode-based mineralisation that appears to plunge to the north. Better intercepts (>1g/t Au, max 2m internal dilution) from the eight holes completed included: • 12m at 8.29g/t Au from 25m (24KPRC010) incl. • 6m at 11.60g/t Au from 31m and • a peak 1m intercept value of 20.43g/t Au at 36m and • 4m at 4.16g/t Au from 95m among others

“These latest results enhance the confidence obtained from the two prior programmes which included 4m at 3.66g/t Au from 26m, 3m at 5.20g/t Au from 125m, 28m at 2.26g/t Au from 81m including 5m at 8.41g/t, 10m at 2.01g/t Au, 5m at 4.53g/t Au, 11m at 1.86 g/t Au from 143m and 3m at 5.20g/t Au from 125m

“Northern Ghana and the Kpali Gold Project A compelling driver for exploring Northern Ghana’s Kpali Gold Project is its advantageous location at the convergence of two major greenstone belts (Bole-Bolgatanga and Wa-Lawra/Boromo) and three regional-scale structures.

“These are all associated with gold deposits. This supports the thesis that the region provides a large and prospective “search base” for the discovery of a major new West African mining camp. Northern Ghana has more recently seen two of West Africa’s better discoveries and success stories.

“The 5.1Moz Namdini gold deposit, discovered by Cardinal Resources Limited prior to its takeover by Shandong Gold Limited in 2020, has just been commissioned and lies on the same Bole-Bolgatanga Birimian greenstone belt as Castle’s Kandia discovery.

The Azumah Resources Limited owned 2.8Moz Black Volta Gold Project (“BVGP”) is earmarked for development in 2025. A majority of this gold was discovered by Castle’s Executive Chairman, Stephen Stone, under his former stewardship of Azumah. Castle’s Kandia mineralised trend is immediately along strike of the BVGP’s high-grade Julie deposit.

The discovery of mineralisation at the Kpali Gold Project’s Kpali, Bundi, Kpali East, Wa South East and Wa South West prospects are essentially “blind” discoveries in that the bedrock hosting mineralisation is largely obscured by extensive but generally shallow soils and alluvium.

This explains the lack of artisanal mining activity which often leads explorers into a new area. Castle’s structured and systematic approach to exploration in this environment is proving highly effective across its extensive tenure.

What’s next at Kpali?

The enormous encouragement from this latest drilling campaign at the Kpali Gold Prospect, and the presence of several other high conviction targets within the Kpali Gold Project, the announcement continues, reinforces Castle’s belief that one or more material discoveries could be made.

“Once the information provided by this latest round of drilling has been fully processed, integrated with existing data and fully interpreted, a follow-up drilling campaign will be designed and implemented.

“Kandia and other Wa Gold Project prospects The Company’s Wa Gold Project comprises extensive tenure prospective for gold within Ghana’s Upper West Region. As well as the Kpali Gold Project and the Kandia Project, there are many other targets worthy of investigation on a prioritised basis.

“Recent intercepts at Kandia included 7m at 3.36g/t Au from 149m within 24m at 1.78g/t Au from 139m and 5m at 3.49g/t Au from 82m within 11m at 2.26g/t Au from 79m (refer ASX release 28 Jan 2025 ‘Excellent Gold Intercepts from Drilling at Kandia Prospect’).

West Africa is one of the world’s premier regions to be exploring for gold, delivering an enviable fifteen discoveries of over two million ounces each since 2012. Ghana’s northern region is now considered one of the best areas to find more of these. Ghana is rated one of Africa’s most preferred jurisdictions for exploration and mining.

It is Africa’s number one gold producer at over 5Moz in 2024 and is the sixth largest gold producer in the world. It is host to several massive deposits operated by Tier-One companies such as Newmont, AngloGold-Ashanti and Zijin, which recently paid Newmont US$1 billion for its Akyem mine

-

Combating Africa,3rd World Debt Burden

Story: Mohammed A. Abu

Mr. Sohaili Ahmed Zubairi, a globally renowned Islamic Banking and Finance(IBF) and Shariah Consultant, who is also a former Advisor to the Dubai Federal government on Islamic economy, has said that, the current age-old debt initiation system has completely failed.

That is, in providing the economic relief to the people whose countries borrow money from development financial institutions (DFIs).

This outdated method Mr. Sohail intimates, needs to be replaced by a disruptive approach with the help of technology which should work inversely than initiating debt and piling it up over the existing liabilities.

Reasons

“The borrowing by the Global South countries in US$ or any other foreign currency puts pressure on local currency, resulting in its depreciation which in turn increases the inflation.

“Another factor is rampant corruption resulting in massive misuse of borrowed funds. A tiny percentage gets rich thanks to siphoning of funds for their own benefit and the people for whom the money was borrowed never get to see any value and get poorer.

“Another downside element in keep on borrowing is that, since the borrowed funds were not deployed for any productive purpose, the interest becomes additional burden for which the country reduces subsidies if they were there, cuts the development and social budget and indulge in costly borrowing from local central and commercial banks, or goes back to same or another DFI organization to borrow more to be able to pay the interest on existing debt.

“The 3rd major disadvantage of such foreign borrowing by poor countries is the repayment of principal amount for which new borrowing is sought from DFIs.

“I have seen the countries borrowing from a different DFI to repay to an existing DFI. Each time a new borrowing request is made, the country’s credit rating goes down and it gets more and more difficult to get access to new money” laments Mr. Sohail adding, “So, nothing goes right for the hapless sovereign state”

Mr. Sohail was speaking during an exclusive interview with your favourite, the Eco-Enviro News Africa magazine on how IBF could be leveraged for addressing the 3rd World debt overhung with particular reference to Africa. The continent was said to have recorded a public debt of USD1.8 trillion as of 2022, a 183 percent increase since 2010 which was much faster than the growth rate of its GDP.In 2021 with African governments said to have spent 4.8 percent of their GDP on debt servicing compared to 2.6 percent on health and education.

Islamic Sovereign Bonds(Sukuk) to the Rescue?

Contrary to populist view that Sovereign, Sukuk is the perfect panacea to 3rd World debt burden Mr. Sohail notes that, looking at sovereign Sukuk to solve the problem is being naïve since it makes no difference whether you issue conventional bond or Islamic Sukuk.

This is because, Mr. Sohail notes, the legal opinion issued by the counsel representing the potential investors categorize the Sukuk as debt capital market instrument (DCM), same as bond, and not as the equity capital market (ECM) instrument. Same applies to local currency Sukuk which too goes to add to local currency debt.

“It is incorrect to consider that by issuing Sukuk, you would not incur debt. There is no difference between bond and Sukuk when it comes to initiating the debt instrument. By issuing Sukuk, you reach the same result as when you issue bond.

“This is unfortunate that Sukuk is considered DCM although it is markedly different from bond in that former is asset based instrument whereas the latter is clean borrowing. It is a condition that the return to the Sukuk investors is generated by the Sukuk asset whereby there is no such condition in bond which pays interest irrespective of the application of bond proceeds.

“Moreover, the Sukuk investors become pro-rata undivided owner of the Sukuk asset and thus are exposed to diminution in the value of their investment upon the Sukuk asset incurring any damage or total loss.

“Another aspect is that all African countries are situated in Global South and most of them have no country rating. Those who are rated have junk grade and will not find any international institutional investor for their Sukuk. Even if they are lucky to attract some investors, due to non-investor grade rating (or junk rating) they will be demanded very high pricing.

“This is the capital market norm that any investment made by an institutional investor or a bank must be cleared by their board of directors. The board only approves investor-grade instrument for investment, starting with AAA and ending at Baa3 (Moodys), BBB- (S&P and Fitch).

On what is his expert recommendation for African countries struggling to make the ends meet, Mr. Sohail said, he will strongly recommend that instead of over focusing on foreign direct investment which is a far cry, they must pay attention to deepen their domestic capital market.

“Here, they could consider issuing local currency Sukuk with entry threshold kept low to mop up the liquidity from grass root level. The household in any country have great potential to contribute but are never given importance.

“The local currency retail Sukuk shall also reduce the dependence of public and private sector on to the banking industry which in turn shall be able to divert funds towards projects of national development.

“Also, the demand and supply equilibrium shall come into play since thriving local currency capital market would force the banks to reduce the rates at which they lend money.

“A thriving example is Malaysia where the domestic capital market is so strong that the country hardly issues a foreign instrument” he added.

Islamic Asset Tokenization Option to Sukuk

On what sharia compliant option other than sukuk would he recommend, for debt ridden 3rd World countries struggling with the never ending debt spiral Mr. Sohail said, the disruptive approach, or otherwise termed as Islamic Asset Tokenization.

The Islamic asset tokenization, he says, could be used for any Sharia compliant asset, be it immovable or movable.

In simple terms, Mr. Sohail explains, the asset tokenization means fractionalization of the ownership of an asset in bite size tokens e.g. Ghanaian Cedi 100/- per token and the sale of tokens through blockchain. “Following shall be the benefits of such transaction”

- It would not be classified as DCM but ECM, hence, there shall be no increase in the sovereign debt. To the contrary, the tokenization funding can be diverted to retire the debt, starting from most expensive borrowing.

- Instead of relying on foreign assistance, the country shall stimulate its own domestic capital market and mobilize local resources to do large fund-raising by selling tokens to public. The amount shall then be first diverted to eliminate local currency debt followed by FC borrowing.

- The small size of tokens shall enable the state to mop up the liquidity from grass root level which has never been done.

- The Sharia compliant assets for the purpose of tokenization may include the government owned real estate whether rented or self-use, monetization of future road toll, airport, sea-port, fleet of planes, railway, road transport, or any other Sharia compliant asset.

- Enormous amount of funding has gone into making these large hard-core assets and the annual revenue generated from them stretches the recovery period to over a decade. The tokenization shall enable the release of massive liquidity which can be prudently utilized to reduce debt which in turn shall curtail debt servicing, thus sparing the funds for public service causes, which hitherto were assigned to payment of interest.

- If the private sector also follows the course and resorts to tokenization, there shall be less dependence on banking sector which shall indirectly result in diversion of spared funds to the developmental projects undertaken by the state at lower pricing.

- A government-owned or supported digital platform shall be needed for higher credibility. Several tokens can be traded at the platform at one time similar to various shares traded at a bourse.

- The investors can offload the tokens at any time third party buyers from within the country or the overseas diaspora

. Future Projections

Citibank anticipates tokenization to grow by a factor of 80x to reach $4T by 2030 whereas BCG puts it at $16T by 2030. Deloitte estimates 10% of global GDP to be tokenized by 2027 and JP Morgan states that tokenization is the killer of traditional finance.

On what is his expert opinion with regards to the clarion call made by Africa’s Islamic finance advocates and enthusiasts on governments of African countries to adopt Islamic finance as an alternative financial system, he notes as follows:

“Adoption of Islamic finance by the African states will offer an alternate financial system with the parameters embedded in honesty, fairness, justice, sharing and caring besides no hidden fine print.

“The Islamic financing principles are God made and not man made, hence they are free from exploitation, greed, dishonesty, misrepresentation, deceit and cruelty. To the contrary, man-made systems is heavily protective of the lender and harsh to the borrower.

“The reason for such cruelty is that the conventional system treats money as commodity which creates rigidity since money is on both sides i.e. lending and the repayment.

“To the contrary, the Islamic principles treat the money simply as a medium of exchange and not the commodity hence the money is only on one side and the on the other side you will find good, assets and services.

Introduction of IBF by first time Countries

“Any African country willing to roll out Islamic finance must make its banking, taxation and legal system accommodative to Islamic finance. This requires review of existing statutes and making changes wherever deemed necessary.

“The reason why the changes need to be made is that as opposed to conventional finance where ‘one size fits all’ i.e. all clients’ needs are met through interest based lending, the Islamic finance is comprised of sale contracts and investment contracts.

“Introducing Islamic finance without amending the laws may incur double VAT or GST, hence making the transaction unattractive due to overloading of levies at both ends” adds Mr. Sohail.

On what is his comments on Ghana’s President John Dramani Mahama’s recent announcement that the country plans to introduce Islamic banking instruments, Mr. Sohail notes,

“It is a great development and exhibits strong political commitment. The top-down approach is always effective for any new initiative. I would hope that the president makes it clear that the Islamic finance is ethical finance and therefore, open to all citizens of Ghana irrespective of religious affiliations.

What is Islamic Finance?

Islamic finance is just another financial system with the difference that it is based on trading and investment and derives profit from such transactions rather than lending money and earn interest.

Another feature of Islamic finance is that its principles are ‘cast in stone’ and have not changed since 7th century AD when Prophet Mohammed (peace be upon him) had perfected them before passing away.

These principles are based on morals and ethics embedded in Quranic teachings which is the last word of God Almighty to humans and has been preserved in the sense that not a single letter has been replaced, changed or amended.

This is possible since God has Himself guaranteed protection of the entire Quranic text. Many efforts have been done to alter the glorious Quran but all have failed since the text is guaranteed by no one else but the author of Quran – God Almighty.

In Quran, God instructed Muslims to obey Him and obey Prophet Mohammed (pbuh) in order to achieve impeccable belief (Iman). Hence, the first source of guidance is the holy book Quran, followed by the Sunnah – sayings, actions and traditions of Prophet Mohammed (pbuh) and the approvals he granted to sayings or actions carried out by his companions – men and women.

Since all Islamic financing and investment contracts were finalized by Prophet Mohammed (pbuh) in his lifetime, they became the cornerstone of Islamic finance without any compromise on their principles. Thus, a Murabaha contract is currently executed in the same sequence and manner as it was carried out during the life of Prophet Mohammed (pbuh).

There is a saying that the only constant in this world is the change, meaning nothing is constant. Islamic financing principles have proved the saying wrong since there has been no change in the Islamic contracts during last 14 centuries and they will continue to remain steadfast in the future as well.

I have observed this phenomenon several times since I joined Islamic banking in 2001 that pressure was brought on by the market forces on to the Sharia scholars to allow some changes to Islamic contracts to match with conventional financial system but no scholar could accommodate even a minor change since that would have tantamount to going against Quran and Sunnah.

Even if a scholar tried a minor change, the other scholars did not agree to it. The peer pressure work as a good check and balance measure in Islamic finance.

-

Ghana gets African and Global Spotlight

Story: Mohammed A. Abu

The people of the West African nation of Ghana during the country’s 2024 elections, demonstrated their collective commitment towards the use of their thump power in the change of political administrations bolstered by the long established transition order of peaceful transfer of political power from one administration to another.

Flashback

Following the restoration of democratic governance in Ghana by a former military ruler J.J. Rawlings in 1992 became a civilian ruler under the forth Republic Constitution and was in power for two terms from 1992-1996.

He was to lose power during the 2000 elections to former President J.A. Kufuor-led opposition, the New Patriotic Party(NPP). This marked a turning point in Ghana’s democratic governance-change of political power through the ballot box and transfer of political power from one political administration to another.

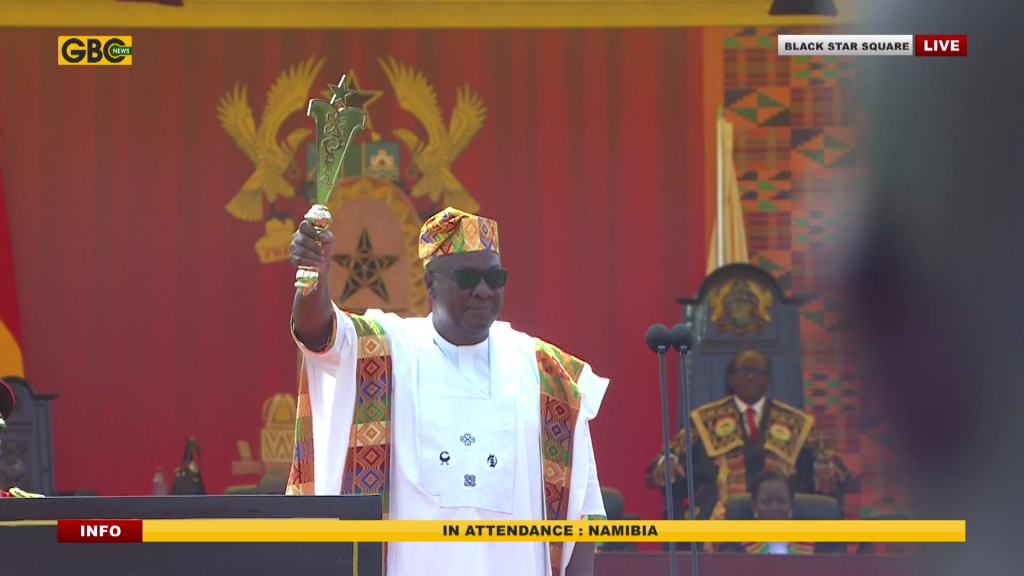

Coming against this democratic political background, Former President John Dramani Mahama and her running mate, Jane Naana Opoku-Agyemang following their party, the National Democratic Congress(NDC)’s victory in the 2024 elections, were yesterday sworn in as the country’s new President and her first ever female Vice President respectively.

The oath of allegiance and Presidential oaths were administered by Chief Justice Gertrude Torkornoo at the Black Star Square in the country’s capital city of Accra.

President Mahama in his inaugural address, promised to focus on economic recovery, governance reforms, and accountability, called for a national reset to rebuild faith in Ghana’s institutions and leadership, introduction of a 24-hour economy model to create jobs and stimulate industries and strengthening of regional and international partnerships.

He underscored the importance of tackling youth unemployment and gender equality celebrating Jane Naana Opoku-Agyemang’s historic role while also urging business leaders and entrepreneurs to join in building a business-friendly Ghana

“I feel greatly honoured that Ghanaians deemed me worthy to steer the affairs of this country at this critical stage,” Mahama said, expressing gratitude for the trust placed in him by the electorate.

President Mahama also recounted how far he and the outgoing President Nana Akoffu Addo have come together in their political careers that transcended into mutual respect for each other despite the fact that, they belong to two opposing political camps.

He also praised the election campaign of former Vice President Dr. Mahmudu Bawumia while also acknowledging his early conceding of defeat that helped defuse political tension that was building up in the country.

The Special Guest of Honour, President Tinubu of the Federal Republic of Nigeria wished President Mahama well in his national assignment the success of which he said was good for Nigeria, Ghana and Africa.

He also assured President Mahama of his unwavering support towards his commitment to strengthening of regional partnerships. Which he noted was good for Nigeria, Ghana and Africa as a whole.

External Patronage

Africa

The inauguration enjoyed patronage across the continent from the Western, Central, Eastern, Southern and Northern sub-regions. In attendance were over twenty-one sitting Presidents and former Presidents and Prime Ministers, representing their respective countries were at the ceremony.

Also in attendance were the President of Africa’s premier bank, the African Development Bank(AfDB) and President of the ECOWAS Bank for Investment and Development.

International

Also in attendance were the Mayor of Los Angeles, US, Prime Minister of Haiti, former German Vice President, and high profile representatives from China, Japan, Arab Gulf region, Russia, and Israel were in attendance. Also in attendance were also Envoys from the AU, EU and UN.

What to Expect?

President John Dramani Mahama has outlined focus areas of his new administration in the first 10 days.

In expectation are executive orders to address inflation, currency stabilization, and debt management, along with steps to review tax policies to ease the burden on businesses as economic stabilization measure, announcement of first wave of government appointments, including the Finance Minister, Attorney General, and other critical positions, focus on anti-corruption measures, empowering institutions to ensure transparency and recovery of public funds under an accountability drive, Presidential meeting with business leaders to reaffirm that Ghana is open for business and outline plans for a 24-hour economy,and the launching of job creation initiatives, with a focus on youth employment and entrepreneurship

Cover Photo: Credit,Ghana Broadcasting Corporation(GBC)

-

The Nation and Democracy Wins in Ghana

By: Mohammed A. Abu

Following the generally peaceful Presidential and Parliamentary elections held on December 7, in the West African nation of Ghana, the Chairperson of the country’s Electoral Commission(EC), Jean Mensa, on December.9, declared the country’s former President John Dramani Mahama as the winner of the country’s 2024 Presidential elections and President elect.

According to Jean Mensa, who is also the EC’s returning officer, Mr. John Mahama polled 6,328,397 representing 56.55% of the total ballot cast, while his main contestant, the vice president and presidential candidate of the governing New Patriotic Party (NPP), Dr Mahamudu Bawumia on his part, secured 4, 657, 304, representing 41.61%.

“As a commission, we have fulfilled our vowed aspiration to have transparency at the heart of our operations”, she said as she declared the results” adding, “voters choce as expressed in the polls are sacrosanct”.

President elect, Mr. John Dramani Mahama in his maiden post-election speech, vowed to “initiate important governance reforms and sometimes severe measures” over the next four years to reset the nation and bring it back on track as “the Black Star of Africa.”

“This mandate represents a call to action… This mandate marks a new beginning and sets the tone for a new direction for our beloved country. Ghana is not for one man or one family. It is for all of us, and we must not only be born and die here, but we must all live here with satisfaction,”

He also thanked Ghanaians both in Ghana and abroad for continuing to believe in Ghana’s democracy despite the challenges.

Prior to the official announcement of the Presidential election results by the EC Chairperson, Dr. Mahmud Bawumia, on December,7,had congratulated and conceded defeated to his main contestant, John Dramani Mahama now President elect of the National Democratic Congress(NDC).

Mahamudu Bawumia stated that his decision to concede ahead of the official announcement was aimed at reducing tension and upholding the country’s reputation as a beacon of democracy in Africa.

“I said during the signing of the peace pact that I was sure of two things: Ghana will win, and peace will reign,” Dr. Bawumia recounted.

“The people of Ghana have spoken. The people have voted for change at this time, and we respect that decision with all humility.”

“It is important that the world investor community continues to believe in the peaceful and democratic character of Ghana. These are our most important assets,” Dr. Bawumia intimated, while reiterating his commitment to the nation over personal political ambitions.

Dr. Bawumia expressed pride in his campaign and gratitude to the NPP for their support, while gracefully acknowledging the electoral outcome as part of the democratic process. “We put our best foot forward in the contest, explaining our policies and programs. However, it is sometimes the case that the voter would have other ideas,” he observed

He pledged the NPP’s support for a seamless transition to the new government and assured Ghanaians that the party would adopt a constructive approach as the opposition.

“We will not be a disruptive opposition, even though we will subject government actions and policies to strict scrutiny in the interest of our beloved nation,” Dr Bawumia stated.

-

Averting Inter-Ethnic War in Dagbon,Northern Ghana

Your Royal Highnesses;

Naa Bakpema Kari-Naa Abdulai Natogmah

Naa Bapira Demon Naa Alhassan

Naa Bapira Zangbalin-Naa

Naa Yeba Ngan-dana

Naa Bapira Gbungbali-Naa

Saboba Naa Ubor Bowan John Sakojim IV

Waapuli Naa

Naalongni Naa Ubor Biniyam Collins IV

Garimata Naa

Nkpegu Naa Kunji Tamanja

Kumakeek Naa Tangmee Majoriba

The Security

Elders, Chiefs and People of Mion Traditional Area

MediaLadies and gentlemen:

It is for peace that Your Royal Highnesses have paid a royal visit to me, my elders and the good people of Mion Traditional Area. Your visit isarightstep that traditional rulers must take to break the boundaries of our comfort and tradition to chart a path towards PEACE which is the most cherished need for our everyday normal functioning as a people.I am delighted that this step would speed up the clarion call for PEACE by the Yendi Peace Center, the REGSEC of Northern Region and the peoplewithinand without the Mion traditional enclave.Your Royal Highnesses, I understand you have paid a visit to our King and Overlord, N’dan Ya-Naa, from whom we all draw our powers and authority. I am sure we all agree that we would not allow anybody to disrespect the authority and reverence of our King and Lion of Dagbon.

It is inlight of this that we as Divisional and Sub-Divisional Chiefs of Dagbon expect our people within our traditional jurisdictions to respect the authority of the Skins we occupy.

Anybody, or group of people, be they Dagombas, Konkombas, Basaris, Chekosis, Fulanis etc who grossly display any act of insubordination to any of us aa Divisional and Sub-Divisional Chiefs are doing so to the King of Dagbon and we must rise up against such development.

Your Royal Highnesses, permit me to explain to you the recent incident which nearly escalated into an inter-ethnic conflict.

We all know Mion traditional jurisdiction stretches from the west bank of Kulkpini River through Kulkpini- Duli and Zogbei all the way to other settlements dotted over the area. As allodial Landowner for and on behalf of His MajestytheYa-Naa, I allocated a parcel of land for development at Zogbei. The developer was on site on Tuesday 6th August 2024.

A group of youth whose population was several folds more than the total population of residents of Zogbei massed up to stop the developer from grading works on the allocated parcel of land. The population, I am told, were marshalled from nearby communities with the sole aim of fomenting trouble. I invited them and the Zogbei Residents to my palace to understand their concerns but the invitations were turned down.

On the third occasion of invitation, the youth had issue a word for me that I should contact theMionKonkomba Chief who happens to be a sub-chief of my palace.

When I invited the Mion Konkomba Chief to my Palace, his word was to the effect that neither him nor the Zogbei residents has any claim over that parcel of land and that those youth were only trying to “knock the head of some Konkombas and Dagombas”. This situation proved to me that this youth who wielded guns and machetes were nothing but rabble rousers with the sole aim of disrespecting not only my authority but that of my father, the King and Overlord of Dagbon.

Even if they had any concerns, their refusal tomy invitations predisposed them as miscreants who should not be tolerated in any traditional area. Even if there were crops on thesaidland, the farmer could have demanded compensation and this would have been paid to them as we usually do.

Upon my instruction to ensure that the grading work by the allottee is carried through, my palace guard swent to ensure the grading work goes through. It was in the process the marauded youth who had laid ambush in the distant bushes began targeting gunshots at my palace guards. My guards had the only option of retaliate in inequal or more measure to defend the grader and the operator.

It is this altercation which has led to casualties. The intervention of the Yendi Police Division, the REGSEC, the Yendi Peace Center as well as the Overlord of Dagbon has been so timely that this Zogbei incident did not escalate into a Konkomba-Dagomba inter-ethnic clashes.

I have since co-operated with these stakeholders because I do not fathom a situation where Dagombas and Konkombas could gointoawarsituation over petty issues such as what happened at Zogbei.

Your Royal Highnesses, permit me to narrate to you how Zogbei became a settlement. When late Mion-Lana Ziblim was on the skin, a Konkomba elder by name Sallah was chased out from Bachaboriya because he was believed to be a wizard in that village. Sallah came to late Mion-lana Ziblim to appeal to him to settle at the current place known as Zogbei. This then was uninhabited farmlands belonging to some Dagombas from Mion and Yendi.

lana. This bellicose attempt by these elites to radicalize some youthtoriseup against authorities are felt not only in the Mion area but other palaces. Ibelieve no traditional ruler would countenance a situation wherethehelperwould turn and be at the mercy of such radicalized youth. We needtofindlasting solution to the radicalization of the youth even in placeswherepeople can longer go to their farmlands. There is no doubt that this Zogbei incident had a potential of escalatinginto an inter-ethnic war situation.

Thankfully, Konkombas in Yendi, Tamale, Zabzugu, Gusheigu and many other places have not been targetedbyDagombas. This emphasizes the point that this is an isolated case between some Konkomba youth and me in the Mion area. I understand some Konkombas elsewhere are destroying people’s farms. Caution should be made to them to stop this with immediate effect.

I I wish to emphasize the point that i am fully committed to the PEACE we are all yearning for. I will do everything possible to work hand in hand with the major stakeholders including Your Royal Highnesses. The REGSEC, theYendi Peace Center with DAYA, KOYA and DF among other stakeholders have visited me to work hand-in-hand with us to ensure normalcy is restored.I believe one life lost is as though the whole of humanity is lost.

I will make sure all people in my traditional area live together in PEACE and go about their farming activities without hindrance. While we pray for PEACE, we must pray that the rains which have stopped for about a month ago returns.

Thank you.

Editor’s Note: Published Unedited

-

Dagomba-Konkonba Peaceful Co-Existence Spans 300 Years

Story: Abdul Razak Mohammed

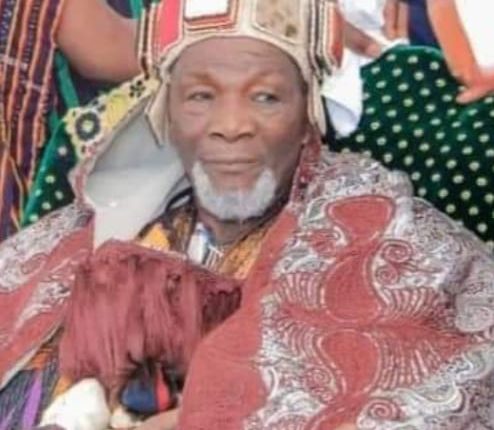

His Royal Majesty, ndan,Ya Naa Abukari I, the King of Dagbon (Dagomba Kingdom), Northern region of Ghana, says Dagombas and Konkombas have an age-long good neighborliness, mutual respect and peaceful co-existence track record.

This, he noted, spans a period of three hundred years until sadly and from nowhere, bad blood crept into their midst since the 1990s resulting into the first ever Dagbamba-Konkomba armed conflict.

His Royal Majesty said humans as they are, cannot once a while, escape misunderstandings and conflicts and should they happen to encounter such, it takes cool and level headedness employing dialogue not use of arms, in other to find a resolution and restore peace once again.

He therefore advised more interactions, and networking between Dagbamba and their Konkonba brethren in their efforts to repair the damages and reactivate the age-old peaceful co-existence they had once enjoined for centuries. Exposing of trouble mongers and enemies of peace from both sides for the law to take its course would also be prudent under the given circumstances he added.

Dagbon’s King, also reminded the security authorities about his previous call on them to arrest and prosecute youth using social media to make posts content of which is intended to offend other ethnic groups, beat false war drums, create fear and panic and to heighten ethnic tension.

Dagbamba and Konkonbas he noted, were one people, eat same food have similar cultural norms and values and should therefore build upon that to ensure sustainable peaceful co-existence between the two ethnic groups.

The Ya Naa was speaking during the visit of a Konkonba-Dagomba peace delegation to the Gbewaa Royal Palace in Yendi the seat of Dagbon Kingship on Saturday.

The delegation comprised members of Saboba, Wapuli and other Konkonba communities headed by His Royal Highness, the Paramount Chief of Saboba in the company of other Dagomba Paramount chiefs. The visit was as the byproduct of mutual consultation between the Konkonba side led by Saboba Paramount Chief,Saboba Naa Ubor Bowan John Sakojim IV.

and the Dagomba side the Paramount Chief of Karaga,Naa Bakpema Kari-Naa Abdulai Natogmah

His Royal Majesty appreciated the Paramount Chief of Saboba for the affirmative action that sought to nib in the bud the Zogbie menace which he said claimed seven lives, so it doesn’t escalate into another Dagbamba-Konkonba war.

Touching on the issue of land the source of the Zogbie incident, His Royal Majesty didn’t mince words in saying that by the laws of the country he as King of Dagbon is the custodian of all lands in Dagbon which he holds by trust on behalf of the people of Dagbon.

This, he said, had been categorically stated in the 1996 Kumasi Peace Accord signed between Dagombas and Konkombas after the most unfortunate first ever armed conflict between the two age-old neighbours.

The various paramount chiefs are responsible for the oversight responsibility of lands under their various jurisdictions.

His Royal Highness, Na Yeb Kug Na on his part, said that if a Dagomba and a Konkonba picks up a quarrel it should be treated as a quarrel between one Dagomba individual and another one Konkonba individual but not to be taken as a fight between the two tribes such that members from one tribe would just simply pick up guns and start killing each other leading to an inter-ethnic war as has become the sad practice today.

Dagombas and Konkombas he intimated, were like the twin halves of one splitted calabash in other words they are one and the same people

His Royal Highness also observed that land acquisition in Dagbon had laid down procedure which those interested in acquiring and utilizing land for any purpose, had to follow like all others do. Land acquisition through guns and spears are no more acceptable in this modern era.

The District Chief Executive(DCE) of Yendi, Hon Abubakar who represented government said President Nana Akufo Addo’s government was following the peace efforts with keen interest the efforts being made towards addressing the Zogbie incident.

The President he says also appreciates the peace efforts being pursued by His Royal Majesty,ndan Yaa Naa Abukari I,since his coronation up till date.

Hon Abubakar said President Nana Addo says he takes cognizance of the fact that, His Royal Majesty’s peace efforts is not limited to Dagbon alone,but it extends as far as Nanum and Kpandai.

The President,Hon Abubakar assed,also highly appreciates His Royal Highness,the Paramount Chief of Saboba for his untiring and selfless efforts to ensure that the Zogbie incident doesn’t escalate into another inter-ethnic war.