|

RIYADH, Saudi Arabia, May 1, 2024/ — The Islamic Development Bank Group Business Forum (THIQAH) (www.IDBGBF.org) and the World Association of Investment Promotion Agencies (WAIPA) have recently signed a Memorandum of Understanding (MoU) aimed at fostering collaboration to promote business and investment opportunities on a global scale. The signing ceremony, held in Jeddah, Saudi Arabia, signifies a strategic alliance between THIQAH and WAIPA, two prominent entities dedicated to facilitating economic growth and investment promotion. Under the MoU, THIQAH and WAIPA commit to cooperating through various initiatives such as promoting investment opportunities, organizing international business-related events, and facilitating access to information and resources for potential investors. The agreement underscores the shared vision of both organizations to enhance economic development and create mutually beneficial partnerships. Distributed by APO Group on behalf of Islamic Development Bank Group Business Forum (THIQAH).

Contact Us: Email: THIQAH@isdb.org |

Category: INVESTMENTS

-

Memorandum of Understanding Signed Between The Islamic Development Bank Group Business Forum (THIQAH) and World Association of Investment Promotion Agencies (WAIPA) to Boost Business and Investment Opportunities

-

Africa enters epic global AI innovation race, joining world’s tech capitals as an epicentre for digital advancement

Marrakech, Morocco: The AI mania that’s transforming business, government and society globally is also igniting waves of innovation across Africa, with the shape-shifting tech’s existential prospects powering a cross-continental investment surge at the AI Everything Expo by GITEX AFRICA in Morocco next month.

Africa’s epic AI opportunity is already disrupting digital advancements in diverse sectors from finance and agriculture, to healthcare and mobility, all fueling a booming AI market that, according to analysts Statista, will grow 30 percent annually over the next six years to value US$17 billion by 2030.

This massive AI rush combined with a rapidly growing population of 1.5 billion people – of which 70 percent are under the age of 30 – creates a potent recipe of AI acceleration, but highlights gaps in talent development, venture allocation, policy and infrastructure.

These crucial challenges and opportunities will be addressed when the world’s AI cognoscenti and pivotal power players of its widespread deployment unite to fast-track the continent’s next big tech shift at the AI Everything Expo by GITEX AFRICA, the year’s largest and most progressive platform for AI exploration and deep tech innovation.

Taking place from 29-31 May 2024 in Marrakech, Africa’s powerhouse tech showcase will feature the world’s tech titans spearheading the AI gold rush, including Microsoft, IBM, Huawei, Nvidia, and Google, along with hundreds of AI ambitious start-ups from across the globe with grand visions to change Africa via AI-infused products and services.

An AI continent ‘brimming with investment opportunity’

Microsoft, the world’s most valuable company, and GITEX AFRICA’s official AI Partner, is leading the way in the AI investment race, having forged partnerships with the world’s hottest makers of AI models, including the UAE’s G42, a global leader in visionary AI.

Microsoft’s recent US$1.5 billion strategic investment in G42 to accelerate AI development in growing economies such as Africa will be welcomed by big tech executives, government leaders, investors and tech entrepreneurs alike at GITEX AFRICA 2024, which will also feature Presight, G42’s big data analytics company powered by generative AI.

Lillian Barnard, President of Microsoft Africa, said AI can unlock a continent “brimming with investment opportunity.” “Africa has long been recognised for its formidable growth prospects and AI is the long-awaited key to help unlock that potential,” said Barnard, who will also be a headline speaker at GITEX AFRICA’s power-packed conference programme.

“The AI-powered innovation we’re seeing today is poised to reinvent every aspect of society from healthcare to financial services, manufacturing and beyond. If Africa is to benefit from the paradigm shift currently sweeping the globe, we must make the promise of AI real for people and organisations across the continent – and do so responsibly. GITEX provides us with a platform to come together and work towards fulfilling that commitment.”

Dr. Adel Alsharji, the COO of Presight, added that Africa is the second-fastest growing region globally in AI adoption. “Africa’s AI journey is gaining momentum, and this progress highlights the continent’s readiness to explore and harness the potential of AI for driving economic growth and addressing local challenges,” said Alsharji, adding that demand for AI-related jobs will increase two-fold over the next three years. “AI could add US$13 trillion to the global economy by 2030, while the number of AI-related jobs in Africa alone is expected to grow by 200 percent by 2025.”

A formidable African force in a world-changing AI revolution

The AI Everything Expo will gather the brightest minds and most innovative thinkers in the field of AI at the AI Everything Conference, one of 10 powerful conference stages at GITEX AFRICA, the continent’s largest tech and start-up show.

Headline speakers leading the AI phenomenon include Dragoș Tudorache, Vice-President of the Renew Europe Group; Mactar Seck, Chief of Technology and Innovation at the United Nations Economic Commission for Africa (UNECA); and Jepson Taylor, Former Chief AI Strategist, Dataiku.

AI and it’s far-reaching multisectoral impact will be evident on the exhibition floor, with exhibitors showcasing how the AI boom is turbocharging waves of innovation across industries, from education and agriculture, to transport, retail, energy, or logistics.

Clinify, a Nigerian start-up epitomises this movement in the healthcare sector, and is one of hundreds of global change-makers at GITEX AFRICA’s North Star Africa start-up showcase. Clinify, an electronic medical record (EMR) platform seeks to digitise patients’ medical records in Africa, where 90 percent of such information is still paper based.

CEO and Founder Michael Omidele, said there’s an urgent need for centralised and digitised medical records. “Africa’s healthcare sector faces several challenges; there’s only one doctor available for every 10,000 patients whereas the average in developed countries is one doctor for every 250 people,” said Omidele.

“Clinify is a one of a kind African solution offering a digitally centralised and standardised interoperable aggregator of healthcare systems, a telemedicine platform, and an EMR solution giving patients access to their medical records. Our goal is to network with healthcare providers, to expand this innovation from Nigeria and export it across Africa.”

Under the High Patronage of His Majesty King Mohammed VI of the Kingdom of Morocco, GITEX AFRICA is held under the authority of the Moroccan Ministry of Digital Transition and Administration Reform, in partnership with Morocco’s Digital Development Agency. The 2nd blockbuster edition, organised by KAOUN International, follows its pioneering debut in 2023.

More information is available at www.gitexafrica.com.

-

More than 900+ Visionary and Influential Speakers to Grace 2024 AIM Congress in Abu Dhabi

Abu Dhabi, UAE, 22 April, 2024: The Annual Investment Meeting (AIM) Congress 2024 is gearing up to host some of the most influential voices and visionaries from around the globe.

Scheduled to take place from May 7 to 9 at the Abu Dhabi National Exhibition Centre (ADNEC), AIM Congress promises an unparalleled gathering of high-level speakers who will share their insights and expertise on navigating the evolving investment landscape.

Among those poised to share their insights and knowledge are esteemed figures H.E. Ahmed Aboul Gheit, the Secretary General of the League of Arab States, whose diplomatic prowess and strategic vision have contributed to regional cooperation and stability.

Dr. Khaled Hanafy, the Secretary General of the Union of Arab Chambers, will bring valuable perspectives on economic integration and collaboration across Arab nations, while Her Majesty Tirelo Molotlegi, the Princess of the Royal Bafokeng Nation, will offer insights into sustainable development and community empowerment.

The event will also feature distinguished government leaders such as H.E. Oh Se-Hoon, Mayor of Seoul City, H.E. Sergey Cheremin, the Minister of the Moscow City Government, who oversees external economic relations, and H.E. Khalid Ibrahim Humaidan, the Governor of the Central Bank of Bahrain, a key figure in shaping monetary policy and financial stability in the region.

Moreover, AIM Congress attendees will have the opportunity to engage with prominent figures from the private sector, including H.E. Jorge Arbache, Vice President for the Private Sector at the Development Bank for Latin America and the Caribbean (CAF), Kiho Park, CEO/President of LB Investment, Jeffrey Li, Managing Partner of Tencent Investment, and Islam Shawky, CEO and Co-founder of Paymob, recognized among Forbes’ Top 30 Fintech Companies.

Their expertise in technology and investment will provide valuable insights into the future of finance and innovation.

Additionally, the event will feature thought leaders such as Prof. Rae Kwon Chung, Chairman of the Global Energy Prize International Award Committee and Nobel Prize Winner, who will offer perspectives on sustainable energy solutions, and H.E. Zurab Pololikashvili, the Secretary General of the UN World Tourism Organization, who will share insights into the future of global tourism and its economic impact.

Joining them will be Her Excellency Armida Salsiah Alisiahbana, Under Secretary General of the United Nations and Executive Secretary of United Nations ESCAP, H.E. Wamkele Mene, Secretary General of the AfCFTA Secretariat, and H.E. Francesco La Camera, Director General of International Renewable Energy Agency.

These esteemed speakers represent a diverse array of industries and regions, reflecting the global reach and impact of AIM Congress as a premier investment platform. From technology and finance to energy and tourism, their expertise will provide invaluable insights into the opportunities and challenges facing the global economy.

AIM Congress 2024, an initiative of the AIM Global Foundation, is expected to draw over 12,000 delegates representing 175 countries worldwide.

To register for the 2024 AIM Congress, please visit:https://aimcongress.com/packages/PR22APR

-

Real Estate Investment Opportunities in Africa: A Systematic Data-driven Series-Part-2. (By Daniel Kontie)

Last week we published part one (1) of this series and we are indeed thrilled with the positive feedback that came from our readers across the globe. It will interest you to know that over one hundred (100) people read the article within the first week of its publication according to our reading tracker.

This is good news and an encouragement for us to work harder in disseminating the information on the prospects of real estate investment in Africa to all prospective investors across the world; brought to you by the Africa Continental Engineering & Construction Network, a Ghana based Pan African Sustainable Built Environment Consultancy Firm (www.acecnltd.com).

In this second edition, we shall be examining the last three (3) indices which again like the first edition, is a comparative data-driven analysis that points to the fact that Ghana remains the most lucrative real estate investment destination in Africa.

But before we go into the intricacies of the data, we would like to have a recap of the first edition for the benefit of readers who may not have the opportunity to read the first edition. In the previous edition, we examined five (5) fundamental indices, and the data available for all five points to the fact that Ghana stood tall among its peers as the most lucrative real estate investment destination in Africa.

We looked at the current housing deficit which stood at 1.8 million and is projected to hit 4.2 million by 2030 if there are no conscious actions to bridge the gap as against the projected population growth of 39 million by the same year, that is one side and the other is the low supply side where it was observed that, the combined effect of the works of the state, individuals as well as the private institutional developers, was not significant enough to bridge the gap.

We also examined the Ghanaian political environment, known to be one of the most democratic and peaceful across the globe with the Global Peace Index (2022) ranking as the 2nd most peaceful country in sub-Saharan Africa among 46 countries, top six (6) most peaceful countries in Africa and 40th most peaceful country in the world.

This presents a positive signal while guaranteeing the security of investments at all levels in Ghana including real estate. Urbanization was another index we examined, and it was found that among the thirty-three (33) African states purposively selected for our analysis, Ghana tops the urbanization rate with a staggering rate of 58.62%.

This we presume could be a significant contributory factor to the persistently high demand for housing and general infrastructure around the urban centers across the country thereby, increasing the real estate investment prospects.

The growing middle class which was found to be rising speedily hitting a height of about 46% as was reported by the African Development Bank in 2013, has also impacted the real estate investment prospects of Ghana significantly, despite the gains that have been eroded by the Covid-19 pandemic in recent past and finally, we also examined the rapid population growth which is said to have stood at 35 million currently and is projected to reach 39 million by 2030. In a nutshell, all the aforementioned indices explored are real estate demand-driven factors, and interestingly, all point to the fact that Ghana remains the most preferred destination for real estate investment in Africa.

Today, we shall be looking at the last three (3) indices and this will draw the curtains on the subject under discussion. Now, stay tuned, get a glass of fruit juice, and grab your reading lenses as we run you down yet another data-driven analysis of the real estate investment prospects in Africa using the final three (3) indices, crime rate, foreign direct investment and government policy.

1.Crime Ratings

To begin with, economic theory suggests that, crime rate has an inverse relationship with investment, particularly foreign direct investment, and what this means essentially is that, a higher crime rate threatens both human and property security.

This security threat leads to low foreign direct investment, holding other variables constant. On the other hand, low crime rates boost investor confidence, and the higher the level of investment, the bigger the expansionary growth of the economy.

The ripple effect most often under such circumstances, is higher demand for housing as it is the case in Ghana currently. During our analysis of global crime ranking, Ghana ranked 84 with a crime index of 43.9 among 146 countries according to Numbeo (2024), and 17 in Africa among 52 states (Africa Organized Crime Index, 2024).

The crime index of 43.9 is classified as moderate according to the Numbeo scale of measurement which grades crime levels between 41 to 60 as moderate. This gives confidence to the general investor community that, Ghana is comparatively one of the most conducive destinations to invest, of which real estate investment is not an exception.

2.FDI Record

Also, sight is not lost on the fact that foreign direct investment (FDI) is another driver of investment globally. Just like all other sectors of the economy, foreign direct investment has a direct relationship with demand for real estate.

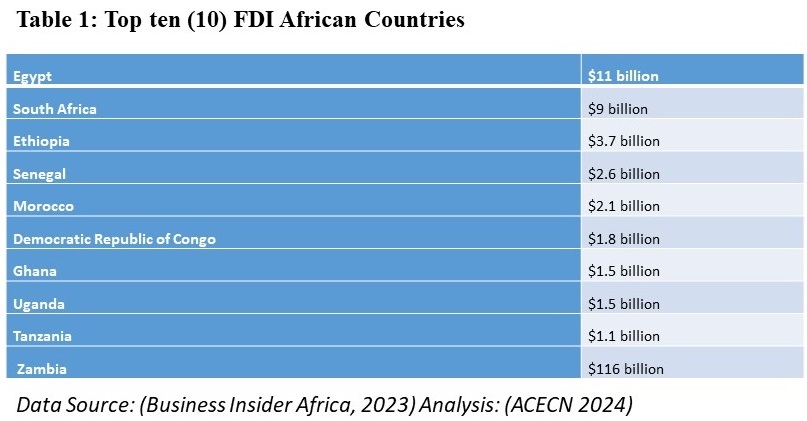

Interestingly, our exploration found that Ghana is among the top ten (10) countries in Africa with high levels of foreign direct investment with a total FDI value of US$1.5 billion according to Business Insider Africa (2023). Below is a diagram that depicts the top ten (10) African countries with the highest foreign direct investment.

Naturally, one would have expected that Zambia, Egypt, South Africa etc would have been projected as the most promising real estate investment destinations in this analysis, taking into consideration their volumes of FDI compared to others such as Ghana.

However, the broader scope of analysis taking into cognizance the eight indices examined so far, Ghana still appears to have a competitive advantage even though Zambia, Egypt South Africa have higher FDIs. This has had a direct impact on the Ghanaian economy and we presume it is one of the contributory factors that kept the demand for housing skyrocketing persistently till now.

3.Government Policy/Incentives

Finally, government policy and incentives are crucial to the real estate sector, unlike in the past when there were little or no incentives for the sector, today there are many more than we ever need to bridge the housing deficit of the continent.

Our exploration found that most African states use a combination of taxation, legal and regulatory regimes as incentives to boost private investment in the housing sector, for instance in Nigeria real estate investment companies approved by the Securities Exchange Commission are tax-exempted from rental and dividend income depending on some conditions (PwC 2024). Zero corporate income tax is declared for companies including real estate developers planning to relocate to Rwanda (Rwanda Development Board, 2024), whilst Kenya on the other hand offers a corporate tax exemption of 25% per annum for developers (Business Daily, 2024).

Tax Exemption Act of Ghana

Similarly, the tax exemptions Act, 2022 (Act, 1088) of the Republic of Ghana has several tax benefits and exemptions for developers, particularly, those within the affordable housing brackets. The purpose is to attract both local and foreign direct investments into the real estate and housing sector aimed at bridging the housing gap. Taxation shall be treated as a whole topic compared to other African states in subsequent series. Time will fail us to give the tax incentive accounts for all African countries, however, one observation that made Ghana different beyond the tax incentives is that, Ghana has consciously made available funds for developers interested in investing in the housing sector.

Funds for Developers-AfDB Loan Facility

Key among these is the US$75 million commercial loan facility secured from the African Development Bank for the Ghana Infrastructure Investment Fund (GIIF) to improve the financing and development of green and affordable housing units (African Development Bank, Oct. 27, 2022).

There are currently opportunities for private investors to leverage these public resources for housing delivery through the ongoing public-private partnership approach instituted by the government of Ghana.

DBG-Long Term Facility

Besides, the Development Bank of Ghana (DBG), established in June 2022, provides long-term financing at competitive rates for private sector developments, including the housing sector. Moreover, the Central Bank has committed an initial US$200 million to capitalize DBG for this purpose.

Gov’t/Develop’t Partners/DBG Support for Investors

The government has also leveraged another US$550 million from Development Partners to support the DBG to attract private sector investors and other international financiers. The housing sector stands to benefit from these measures as it takes advantage of guaranteed loans that will be provided by DBG.

Public Policy/Invectives-Funds

Last but not least on the public policy and incentives, is the Ghana National Home Ownership Fund, the Home Ownership Fund in partnership with the banking sector was also created in 2022.

This includes the Rent-to-Own Scheme of the Affordable Real Estate Investment Trust, as well as the affordable housing supported by Ghana Commercial Bank (GCB Capital). The funds mobilised will function as a mortgage refinancing mechanism for Private Financial Institutions (PFIs) to draw from in the form of mortgages to consumers or mortgage-backed securities for investors.

This in effect will improve the mortgage market and make it more fluid, hence reducing interest rates on mortgage facilities for prospective homeowners while improving housing delivery in Ghana. In conclusion, we call on all investors across the globe who are interested in investing in the African real estate sector to do so in Ghana. Subscribe to the Eco-environews magazine for subsequent series.

Author: Daniel Kontie

Email: d.kontie@acecnltd.com,

Contact: +233209032280)

Real Estate and Sustainable Construction Consultant, Ghana

CEO, Africa Continental Engineering & Construction Network Ltd (ACECN LTD)

National President, World Sustainable Built Environment and Generative Artificial Intelligence Forum (WSBE-GenAIF)

National president, Ghana Institution of Sustainable and Generative Artificial Intelligence (GhISBE-GenAIF)

Cover Photo

Credit Devtraco Ltd(Overview of Real Estate in Ghana)

-

Africa Finance Corporation’s year of impact sees major expansion of projects and investment

LAGOS, Nigeria, April 8, 2024/ — Africa Finance Corporation (AFC) (www.AfricaFC.org), Africa’s leading infrastructure solutions provider, has announced its most impactful year to date, with unprecedented expansion of projects and investments spanning energy, transportation, mining, food, textiles and climate resilience.

Underpinning robust growth in earnings and total assets, AFC successfully navigating the global geopolitical, inflationary and debt distress challenges of 2023 to implement critical infrastructure projects across multiple sectors that are central to Africa’s structural transformation and sustainable development.

Landmark initiatives include Djibouti’s first wind farm, with AFC as lead developer advancing plans to become the first African country wholly reliant on renewable sources for energy, and the Lobito Corridor rail project, with AFC again as lead developer working alongside the US, European Union and governments of Angola, DRC and Zambia to mobilise industry and connect the Atlantic and Indian oceans. Advancing industrialisation, value creation and livelihoods,

AFC with its partner Arise IIP expanded the Arise Special Economic Zones to 10 West and Central African countries, focusing on essential sectors including food security, textiles and minerals.

“At the heart of AFC’s mission is our commitment to deliver impactful solutions for Africa, and this guides each and every investment we undertake,” said Samaila Zubairu, AFC’s President and CEO. “AFC’s impact is evident in our solutions-oriented approach and unwavering commitment to realising transformative projects across Africa—infrastructure projects like the Red Sea Power Wind Farm in Djibouti, the Arise IIP industrial zones and the Lobito transport corridor that are reshaping the landscape, fostering sustainable development for local communities, and altering the economic trajectory of countries.”

Created through powerful international collaborations, AFC projects undertaken in 2023 also include a joint initiative with Xcalibur Multiphysics to advance the mapping and responsible utilisation of Africa’s natural mineral resources, enabling greater mineral beneficiation, diversified economies, and clean energy transition.

In DRC, the Corporation has committed to helping overhaul Kinshasa’s mass transit system to enhance mobility and reduce pollution through a partnership with Trans Connexion Congo.

A historic commitment of US$253 million from the Green Climate Fund to the AFC Capital Partners’ Infrastructure Climate Resilient Fund (ICRF) marked a significant step toward developing sustainable, climate-resilient infrastructure in Africa.

Each initiative blends meaningful development impact and environmental sustainability with strong risk-adjusted returns, leveraging AFC’s unique experience of de-risking project development to crowd in capital and accelerate completion.

“In a year marked by global economic and geopolitical complexities, AFC has stood as a beacon of resilience, delivering value to all stakeholders while creating jobs and prosperity through structural transformation across Africa,” said Mr. Zubairu. “Our robust financial results reflect AFC’s unwavering commitment to unlock practical solutions for projects that enhance local value capture and spur industrialisation.”

AFC’s annual profit rose 15.3% to US$329.7 million, while operating income increased 24.2% to US$497.5 million, and total assets expanded 17.3% to US$12.34 billion, surpassing the Corporation’s 5-year strategy target by US$2.3 billion.

Further significant financial highlights include:

- Return on average equity at 11.0% (2022: 12.1%)

- Net interest income up 31.3% to US$430.5 million (2022: US$327.9 million)

- Total comprehensive income up 14.6% to US$327.0 million (2022: US$285.3 million)

- Capital adequacy ratio increased to 34.5% (2022: 34.3%)

AFC’s high-profile exit from the Atlantic Terminal Port in Takoradi, Ghana, through a sale to major global ports operator Yilport exemplified strategic divestment.

The Corporation expanded its presence with three new member states—Ethiopia, Burundi, São Tomé and Príncipe—bringing the total to 43. Six new sovereign shareholders were also onboarded, including Turk Eximbank becoming the first non-African shareholder. Equity investments in addition from the governments of Côte d’Ivoire, Benin and Botswana, Cameroon’s Caisse Nationale de Prévoyance Sociale (CNPS), and SBM Capital Market Securities Ltd. in Mauritius helped increase AFC’s total equity by 26.7% to US$3.42 billion.

Debt market transactions further broadened AFC’s investor base with significant global financial institutions participating in a record US$625 million syndicated loan, supported by a 62% oversubscription. The Corporation also received a US$350 million line of credit from the African Development Bank and a €50 million facility from Cassa Depositi e Prestiti, showcasing the Corporation’s ability to attract regional and international institutions.

“As AFC charts its course to further elevate our impact across the continent, we remain deeply appreciative of the unwavering support of our stakeholders and the dedication of our team, whose passion drives our mission forward,” said Mr. Zubairu. “With a refreshed strategic agenda emphasizing balanced portfolio growth, innovative financing, and enhanced operational capacity, AFC is well-positioned to shape a robust future for African infrastructure and development.”

Distributed by APO Group on behalf of Africa Finance Corporation (AFC).Media Enquiries:

Yewande Thorpe

Communications

Africa Finance Corporation

Mobile : +234 1 279 9654

Email : yewande.thorpe@africafc.org -

Addressing the Cost of Africa’s greater bulk of raw Minerals Exports to her Economic Growth

,,,,,,,,,,As Maiden Virtual Africa-Caribbean Achievers Summit Takes Off

Story: Mohammed A.Abu

Mr. Kwesi Abeasi, Chairmin, Non-Executive Director, InvestCorp has called on African governments to take endeavor to take seriously factoring of value addition into international agreements in relation to resource seeking investments, within the context of their Foreign Direct Investment(FDI) drives.

Lack of this most important singular act on the part of African governments Mr.Abeasi intimated, has led to host countries being short-changed by foreign investors as host countries earn a pittance from the exploitation of their rich natural resources endowment potential.

He said the lack of value addition in agreements with resource seeking investors, has created the situation whereby raw gold or ore is what is mainly exported from mineral resources rich African countries rather than processed and value added products from commercial refineries in the host countries.

Mr. Abeasi, cited the popular Niger incident to buttress his point on how African countries are being short-changed to the extent that the country was offered a pittance of €0.80 per Kilogram while the same quantity actually was sold for €200 on the international market.

Mr. Abeasi was delivering his Keynote Address, titled, “Economic Growth and Investment in Africa during the opening ceremony of a two-day (4th-5th March) maiden virtual Africa and Caribbean Achievers Summit, which took off yesterday Monday and ends today, Tuesday,5th March,2024...

The opening welcome address was delivered by Mr. Benjamin Acheampong, the Group President, WMG,UK, whiles goodwill messages was delivered by Dr. Joe Tackie, CEO, Global Entrepreneurship Solutions.

The event seeks to parade some of Africa and the Caribbean’s most powerful entrepreneurs, start-ups, and business owners on the theme “Corporate Africa, the 6th Region, AfCFTA, and Beyond.

The event seeks to discuss key strategies, processes, innovative ideas, skill sets, and funding opportunities they employ to make them successful at what they do. Discover from renowned business owners and entrepreneurs what your purpose, potential, business niche, and essential tactics are as an African or Caribbean

Other Speakers

Other key Speakers for the day were Mr. Paapa Bartels, Head Trade and Investments, Ghana High Commission, UK, who spoke on “The Role of Diasporans in Economic Development” Dr. June Soomer, on “Strengthening of Regional Integration and Cooperation in Africa and Caribbean”, Mr. Louis Yaw Afful, an international Trade Practitioner and Investment Consultant on “Domestication of AfCFTA Trade in Services Protocols whiles Mr. Charles Owusu, CEO, Ghana Petroleum Hub on his part, spoke on, “Creating Enabling Business Environment Through Good Governance & Leadership”.

Panel Session

A panel discussion, held under the theme, “Righting the Wrongs of Doing Business in Africa and the Caribbean” featured panelists namely, Dr. Errington J. Thompson, Chair & President, AACARI, Mr. John Rocha, Chief Director, AfCFTA, SA, Mrs Christine S. Ntim, CEO, Global Ecosystem Start-Up, Haiti, and Barrister Anthony Adiadi, Director, International Development & Strategy, Uwa Africa Group.

Africa’s Gargantuan Annual Wealth Leakage to Already Rich Nations

According to Paul Akiwumi, Director for Africa and Least Developed Countries, UNCTAD, in a feature article, published on the Organization’s website on the 29th September,2020, Africa loses at least $40 billion each year from the under invoicing of commodity exports from the continent, according to the latest comprehensive data available.

“The size of trade gaps varies by country, but is relatively consistent by commodity group, with gold exports representing 77% of the total, followed by diamonds (12%) and platinum (6%).

“The proceeds from trade under invoicing and other illicit financial flows (IFFs) contribute to an average of $88.6 billion per year of capital flight from Africa, which is wealth sent and held abroad.

“These outflows represent a considerable opportunity cost to development in Africa, draining the capital available to invest and create jobs, and reducing the potential tax revenues governments could use to spend on infrastructure and social programmes.

“By some estimates, improving tax collection, along with curbing capital fight and IFFs, could raise tax revenue in Africa by an additional 3.9% of GDP, or $110 billion a year”.

-

African Energy Week (AEW) Launches African Energy Finance Summit in Partnership with Afreximbank and S&P Global Commodity Insights

JOHANNESBURG, South Africa, February 28, 2024/ — Africa’s largest energy event – the African Energy Week (AEW): Invest in African Energy conference – will feature the African Energy Finance Summit during this year’s edition in Cape Town.The summit, hosted in partnership with multilateral financial institution the African Export-Import Bank and S&P Global Commodity Insights, offers a platform for project developers and financiers to sign deals and is poised to unlock a new era of growth across Africa’s oil, gas, critical mineral and renewable energy sectors.Africa requires over $200 billion in annual financing until 2030 to meet the Sustainable Africa Scenario’s energy and climate objectives, highlighting a growing opportunity for project developers, financiers and technology providers. Between 2012 and 2021, the continent received an average $35 billion in annual finance from G20 nations and multilateral development banks, underscoring a significant investment gap.

The African Energy Finance Summit aims to address this gap by galvanizing financial support for African energy growth alongside intra-African energy trade and a just energy transition.AEW: Invest in African Energy is the platform of choice for project operators, financiers, technology providers and government, and has emerged as the official place to sign deals in African energy. Visit www.AECWeek.com for more information about this exciting event.

The development of oil and gas has taken the forefront of many national development agendas in Africa, as countries move to monetize resources to make energy poverty history by 2030. In addition to expansion efforts across established oil and gas markets such as Angola, Nigeria, Algeria and Egypt, new frontiers are being revealed as discoveries showcase high-impact deposits.

In the last two years, Namibia made eight hydrocarbon discoveries in the Orange Basin, with reserves estimated to be as much as 11 billion barrels. Other discoveries such as the 20 trillion cubic feet (tcf) Yakaar-Teranga discovery in Senegal; the Orca find in Mauritania; the 650 billion cubic feet Eban-Akoma Complex find in Ghana; the Mukuyu-2 gas discovery in Zimbabwe and many more underscore the potential for million-dollar upstream investments in Africa.

Meanwhile, Africa is poised to be at the forefront of the global energy transition due to its critical mineral wealth. The continent has 85% of the world’s manganese resources; 80% of the world’s platinum and chromium; 47% of the world’s cobalt; 21% of the world’s graphite, among many other resources.

Investment in this industry will support both economic growth in Africa through revenue generation and infrastructure development as well as the world’s transition to a cleaner energy future. Projects such as Namibia’s Eisenberg Rare Earth Minerals project; the DRC’s Metalkol RTR mine; Zimbabwe’s Bikita Lithium Mine; and many more represent some of the largest in the world.Meanwhile, Africa’s hydropower potential is estimated at 340 GW; it’s wind potential is estimated at 180,000 TWh per year; while the continent owns approximately 40% of the globe’s potential for solar power generation.

Yet, only 11% of Africa’s hydropower is currently being exploited while the continent accounts for 1.48% of the world’s total solar capacity, highlighting lucrative opportunities for clean energy project developers.Policies such as South Africa’s Renewable Energy Independent Power Producer program pave the way for increased private capital in renewable energy while efforts to develop large-scale green hydrogen projects in Namibia and Mauritania are poised to transform the continent.The African Energy Finance Summit will not only showcase these emerging opportunities but connect the relevant investors to the projects themselves. By uniting global banking institutions, financial ministers and authorities, and international development platforms, the summit will see numerous deals signs that will further accelerate project growth in Africa.

At the same time, the summit promotes the need for integration across the finance and energy sectors, demonstrating the benefit and opportunity of industries working hand-in-hand to create attractive environments to do business.Across the continent, efforts are already well underway to attract energy investment through policy reform. Energy majors Total Energies and Shell are planning $6 billion and $5 billion in investment, respectively, in Nigeria over the coming years, owing largely to improved fiscal and monetary terms implemented through the Petroleum Industry Act (2021).

In Angola, Total Energies announced a multi-year strategy including the $850 million Begonia oil development while ExxonMobil is looking at investing $15 billion in the country. These commitments are as a result of improved upstream terms that encourage exploration and development spending.Going forward, the finance sector will continue to be key to improving an enabling environment for energy investment. Through forex, tariff and regulatory support, the finance sector will make it easier to do business in Africa, enabling the continent to benefit from its wealth of natural and mineral resources.

The African Energy Finance Summit will unite the finance and energy sectors to drive new opportunities across the continent.Distributed by APO Group on behalf of African Energy Chamber.SOURCE

African Energy Chamber -

Global Logistics Execs see coming Surge of African Investment

KUWAIT CITY, Kuwait, February 6, 2024/ — Nearly 62% of global logistics professionals say their companies are planning additional or first-time investments in Africa, according to a closely watched yearly industry survey.

The survey of 830 logistics executives is part of the 15th annual Agility Emerging Markets Logistics Index (https://apo-opa.co/4bD4lSW), a snapshot of industry sentiment and ranking of the world’s 50 leading emerging markets.

The Index ranks countries for overall competitiveness based on their logistics strengths, business climates and digital readiness — factors that make them attractive to logistics providers, freight forwarders, air and ocean carriers, distributors and investors. In the 2024 Index, the rankings of most African economies changed little from a year earlier, but businesses indicate they are looking ahead at massive population growth and trade expansion spurred by the African Continental Free Trade Area (AfCFTA).

“This is the most optimism we’ve seen about Africa in the 15 years of the Index,” says Agility Vice Chairman Tarek Sultan. “Africa’s population will double by 2050, when one in four people on the planet will be African. International businesses realize that the time is now for Africa — they need to invest, establish their brands, and develop the next generation of African talent if they’re going to ride the coming wave of growth.”

China and India were 1 and 2 in the 50-country Index rankings. In Africa, Egypt (20), Morocco (22), South Africa (24) and Kenya (25) were the top performers, followed by Ghana (31), Nigeria (36), Tunisia (37), Tanzania (41), Algeria (42), Uganda (43), Ethiopia (45), Mozambique (46), Angola (47), Libya (50).

Egypt has Africa’s highest-ranked domestic logistics opportunities — 13th in that category; South Africa (15) was tops in Africa for international logistics; Morocco (12) has Africa’s best business fundamentals; Kenya (9) is Africa’s most digitally ready – and the continent’s highest-ranked country in any category.

More than 63% of survey respondents say their companies continue overhauling supply chains by spreading production to multiple locations or relocating it to home markets and nearby countries. China, the world’s leading producer, stands to be most affected: 37.4% of industry professionals say they plan move production/sourcing out of China or reduce investment there.

Shipping and logistics costs that soared during the COVID pandemic and its aftermath are still climbing but at a slower rate, the survey found. One way shippers expect to cope is by increasing use of digital freight forwarding from 37.8% today to 52% in five years.

2024 Index Highlights

SURVEY

- Supply chain restructuring – India, Europe and North America rank ahead of China as destinations executives expect to move production to in 2024 and onwards.

- China – 40% expect their businesses to be less reliant on China in five years. Leading factors in decisions to de-risk in China: difficulty of doing business; U.S.-China trade friction; a slowing economy; the harshness of China’s COVID restrictions.

- Climate change – 66% say climate change is something they’re planning for or already affecting their businesses.

- Emerging markets – the largest percentage sees increased risk/decreased rewards in emerging markets.

- India – many see India growing in importance as a producer and market, but cite inadequate infrastructure and corruption as the biggest obstacles there.

COUNTRY RANKINGS

- In the Middle East and North Africa, overall rankings were: UAE (3); Saudi Arabia (6); Qatar (7); Turkey (11); Oman (15); Bahrain (16); Jordan (17); Egypt (20); Kuwait (21); Morocco (22); Tunisia (37); Lebanon (38); Iran (40); Algeria (42); Libya (50).

- Rankings in Sub-Saharan Africa: South Africa (24); Kenya (25); Ghana (31); Nigeria (36); Tanzania (41); Uganda (43); Ethiopia (45); Mozambique (46); Angola (47).

- Index rankings in Asia: China (1); India (2); Malaysia (4); Indonesia (5); Vietnam (8); Thailand (10); Philippines (18); Kazakhstan (23); Sri Lanka (26); Pakistan (29); Cambodia (32); Bangladesh (33); Myanmar (49).

- Rankings for Latin America: Mexico (9); Chile (12); Brazil (14); Uruguay (19); Peru (28); Colombia (27); Argentina (30); Ecuador (35); Paraguay (39); Bolivia (44); Venezuela (48).

- In Europe: Russia (13); Ukraine (34).

Transport Intelligence (https://apo-opa.

co/4bp0Ijf) (Ti), a leading analysis and research firm for the logistics industry, has compiled the Index since it was launched in 2009. John Manners-Bell, Chief Executive of Ti, said: “Supply chain managers are still coming to terms with the political and economic instability characterising the post-COVID global economy. Geopolitical relationships are changing rapidly, and this is having a major impact on international trade and risk profiles. Businesses need to be alive to the opportunities and threats that exist in emerging markets and use data, such as that the Agility Emerging Market Logistics Index, to inform agile decision-making.”

2024 Agility Emerging Markets Logistics Index: https://apo-opa.co/

3SlOmzK Distributed by APO Group on behalf of Agility.PhotoCredit Deposit Photo -

From COP28 to a circular world: Investments need to focus on the circular economy alongside renewables

In the wake of COP28, which called upon parties to transition away from fossil fuels, the World Circular Economy Forum 2024 (WCEF2024) emerges as a landmark event that highlights the circular economy as the premier post-fossil fuel investment frontier. WCEF2024 will take place in Brussels, Belgium from 15-18 April, and convenes thousands of experts to explore the vast opportunities that the circular economy presents.

HELSINKI, 24 January 2024 – The transition from fossil fuels to renewables is imperative, yet alongside this, a strong focus on circularity is also needed. This means we must commit to manage all materials more sustainably, reducing dependence on fragile supply chains and alleviating pressure on nature.

The opportunities in the circular economy are enormous. According to Circle Economy Foundation’s global “Circularity Gap Report 2024” which was published today, the global economy is currently only 7.2% circular, emphasising the untapped economic potential in this transformational shift.

“We are convinced that the next big play in the investment arena we’ll see is around circular solutions,” states Atte Jääskeläinen, president of the Finnish Innovation Fund Sitra, the initiator of WCEF. “Regulations are essential for steering investment flows towards circularity, which is crucial for the sustainable development of societies. This shift is necessary to tackle overconsumption of natural resources.”

This year, the landmark event of the circular economy underlines the world’s extraordinary opportunities after the decisions made in the UN’s Climate Change Conference COP28 in Dubai last December. The final outcomes of COP28 noted circular economy approaches as a tool in the transition to sustainable patterns of consumption and production.

The co-chair of the UN’s International Resource Panel (IRP) Janez Potočnik notes that it is possible to mitigate growth in resource use while growing the economy, reducing inequality, improving well-being, and significantly reducing environmental impacts. “Our economic system is wasteful and unjust. Material (over)use is a main element of global sustainability and equality challenges deserving proper policy attention.”

Initial findings of the IRP’s upcoming flagship report, the “Global Resources Outlook 2024”, show the undeniable need for a circular economy: The use of new (virgin) materials has continued to grow on average over 2.3 per cent per year. Without urgent and concerted action to change the way resources are used, material resource extraction could increase by almost 60 per cent from current levels by 2060, from 100 to 160 billion tonnes.

“After decisions made in the COP28, there is plenty of room for wiser, circular solutions among global systems – for example in agrifood, mobility and consumables”, says Ivonne Bojoh, CEO of Circle Economy Foundation. “We must reform our finance and labour policies to put in place lasting and impactful changes that address the root cause of climate change and social inequity.”

The World Circular Economy Forum WCEF is a global initiative of Finland and Sitra. This year marks the 8th iteration of WCEF. As a collaboration platform for circular economy thinkers and doers from all over the world, the forum strengthens its science-based approach through new partnerships with the International Resource Panel (as a science partner) and Circle Economy Foundation (as a programme partner). WCEF2024 is organised also in collaboration with several other international partners.

In addition to showcasing solutions from around the world, WCEF2024 offers plenaries, parallel sessions and hands-on workshops. The forum also collaborates with two major players in Brussels: the European Circular Economy Stakeholder Platform who delivers a European track to the main event, and the Belgian Presidency of the Council of the European Union who curates a full day of accelerator sessions on 17 April, including site visits to circular economy companies in Belgium.

If you are interested in learning more about the event and taking action to build a sustainable, circular future, please visit the WCEF2024 website.Further information on the event

Mika Sulkinoja, Project Director of WCEF, Finnish Innovation Fund Sitra, mika.sulkinoja@sitra.fi, tel. +358 50 357 1723

Rebecca Nohl, Sherpa to Janez Potočnik (co-chair of IRP), Systemiq, rebecca.nohl@systemiq.earth

Ilektra Kouloumpi, Senior Innovation and Global Alliances Lead, Circle Economy Foundation, ilektra@circle-economy.com

Media contacts

Samuli Laita, Media liaison of the WCEF, Sitra, the Finnish Innovation Fund, samuli.laita@sitra.fi, tel. +358 40 5368650

Amy Kummetha, Communications Manager, Circle Economy Foundation, amy@circle-economy.com

Media accreditation, the media kit and online briefing

Accreditation for media participants is open. Please find the registration form as well as the media kit at www.wcef2024.com/media.

An online media briefing will be held for journalists on 8 April from 14:00 (CEST). To register, please follow the WCEF2024’s media website and subscribe to the newsletter!

-

From Africa to Europe: Securing investment for gas export infrastructure

PARIS, France, January 24, 2024/ — Africa’s abundant natural gas reserves represent an attractive opportunity for monetization and export, aligning with Europe’s growing demand for cleaner and more energy. This synergy has set the stage for heightened Africa-Europe trade and partnership, with a focus on gas-directed investments.The upcoming Invest in African Energy (IAE) forum in Paris on May 14–15 will serve as a focal point of this topic, bringing together African nations with European investors who are eager to tap into Africa’s gas resources and unlock new sources of power.Assessing the current infrastructure for gas transportation from Africa and Europe reveals a need for foreign direct investment in several strategic areas. These include the expansion and upgrade of existing pipelines, the establishment of advanced liquefied natural gas (LNG) terminals, and the development of efficient compression and decompression facilities. Additionally, investment in digital infrastructure for real-time monitoring and optimization is imperative to ensure the reliability and safety of an extended gas transportation network.

Given the expense of gas projects and the need for maintenance and expansion, diverse funding sources are necessary. Large-scale projects typically require investments in the range of millions to billions for successful development.

In Central Africa, Equatorial Guinea – holding 1.5 trillion cubic feet of natural gas reserves – is positioning itself as a regional Gas Mega Hub (GMH) and global exporter. The country’s Alba Liquefied Petroleum Gas and Punta Europa facilities serve as processing platforms for both domestic and regional gas reserves.

Leveraging its strategic location on Africa’s west coast and utilizing the African Continental Free Trade Agreement, Equatorial Guinea’s expanding LNG export networks and potential connection to Europe-bound pipelines align with Europe’s search for alternative gas supplies. The country also presents opportunities to tap into new export routes, such as the Trans-Saharan gas pipeline, through new gas transport infrastructure linking Africa and Europe.Much like the Trans-Saharan gas pipeline, the Nigeria-Morocco Gas Pipeline, scheduled to begin construction in 2024 at an estimated cost of $25 billion, represents one of the world’s most extensive energy projects. Spanning 5,600 km, it aims to benefit 13 African countries, providing energy access to around 400 million people along the West African coast.

The pipeline, financially supported by organizations such as OPEC, demonstrates the importance of international collaboration when it comes to infrastructure development. Not only is it set to facilitate intra-African gas trade, but also deliver gas from Nigeria to Europe, serving as a key link in the global gas supply chain.Meanwhile, the $4.6-billion Greater Tortue Ahmeyim (GTA) LNG project, encompassing the Tortue and Ahmeyim gas fields, holds approximately 15 trillion cubic feet of recoverable gas reserves. Upon completion, GTA LNG will produce up to 10 million tons of LNG annually. Positioned along the maritime border between Senegal and Mauritania, the project requires substantial investment to support critical infrastructure, including liquefaction, transportation and associated facilities.

In Southern Africa, South Africa’s Virginia Phase 2 project is set to produce commercial quantities of LNG and liquid helium for global export, while the Port of Ngqura floating LNG project will involve the installation of a floating storage and regasification unit, gas-to-power infrastructure, cryogenic pipelines, and a terminal for the processing, storing, on-site exploitation, and distribution of gas acquired from the country’s on– and offshore fields.

Similarly, the Kudu Conventional Gas Development in Namibia’s Orange Basin – set to commence commercial production in 2026 – involves collaboration among the Namibian Government, TotalEnergies, Shell and BW Energy. Representing an $880-million investment, the project is currently in the Front-End Engineering and Design phase, with a Final Investment Decision expected in 2024.

European stakeholders can support this venture by investing in essential infrastructure for successful gas extraction, meeting regional energy needs while enabling exports to Europe.In short, Africa’s leading gas export projects require substantial investments to support the development of critical infrastructure, including extraction facilities, pipelines and associated support systems, highlighting a strategic opportunity for engagement with European financiers, investors and project developers.

Organized by Energy Capital & Power, the Invest in African Energy (IAE) 2024 summit is an exclusive forum designed to foster collaboration between European investors and African energy markets.

Taking place May 14-15, 2024 in Paris, the event offers delegates two days of intensive engagement with industry experts, project developers, investors and policymakers. For more information, please visit www.Invest-Africa-Energy.com.Distributed by APO Group on behalf of Energy Capital & Power.SOURCE

Energy Capital & Power