Last week we published part one (1) of this series and we are indeed thrilled with the positive feedback that came from our readers across the globe. It will interest you to know that over one hundred (100) people read the article within the first week of its publication according to our reading tracker.

This is good news and an encouragement for us to work harder in disseminating the information on the prospects of real estate investment in Africa to all prospective investors across the world; brought to you by the Africa Continental Engineering & Construction Network, a Ghana based Pan African Sustainable Built Environment Consultancy Firm (www.acecnltd.com).

In this second edition, we shall be examining the last three (3) indices which again like the first edition, is a comparative data-driven analysis that points to the fact that Ghana remains the most lucrative real estate investment destination in Africa.

But before we go into the intricacies of the data, we would like to have a recap of the first edition for the benefit of readers who may not have the opportunity to read the first edition. In the previous edition, we examined five (5) fundamental indices, and the data available for all five points to the fact that Ghana stood tall among its peers as the most lucrative real estate investment destination in Africa.

We looked at the current housing deficit which stood at 1.8 million and is projected to hit 4.2 million by 2030 if there are no conscious actions to bridge the gap as against the projected population growth of 39 million by the same year, that is one side and the other is the low supply side where it was observed that, the combined effect of the works of the state, individuals as well as the private institutional developers, was not significant enough to bridge the gap.

We also examined the Ghanaian political environment, known to be one of the most democratic and peaceful across the globe with the Global Peace Index (2022) ranking as the 2nd most peaceful country in sub-Saharan Africa among 46 countries, top six (6) most peaceful countries in Africa and 40th most peaceful country in the world.

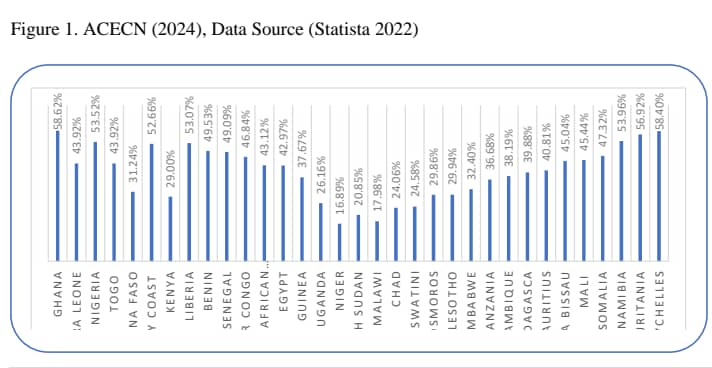

This presents a positive signal while guaranteeing the security of investments at all levels in Ghana including real estate. Urbanization was another index we examined, and it was found that among the thirty-three (33) African states purposively selected for our analysis, Ghana tops the urbanization rate with a staggering rate of 58.62%.

This we presume could be a significant contributory factor to the persistently high demand for housing and general infrastructure around the urban centers across the country thereby, increasing the real estate investment prospects.

The growing middle class which was found to be rising speedily hitting a height of about 46% as was reported by the African Development Bank in 2013, has also impacted the real estate investment prospects of Ghana significantly, despite the gains that have been eroded by the Covid-19 pandemic in recent past and finally, we also examined the rapid population growth which is said to have stood at 35 million currently and is projected to reach 39 million by 2030. In a nutshell, all the aforementioned indices explored are real estate demand-driven factors, and interestingly, all point to the fact that Ghana remains the most preferred destination for real estate investment in Africa.

Today, we shall be looking at the last three (3) indices and this will draw the curtains on the subject under discussion. Now, stay tuned, get a glass of fruit juice, and grab your reading lenses as we run you down yet another data-driven analysis of the real estate investment prospects in Africa using the final three (3) indices, crime rate, foreign direct investment and government policy.

1.Crime Ratings

To begin with, economic theory suggests that, crime rate has an inverse relationship with investment, particularly foreign direct investment, and what this means essentially is that, a higher crime rate threatens both human and property security.

This security threat leads to low foreign direct investment, holding other variables constant. On the other hand, low crime rates boost investor confidence, and the higher the level of investment, the bigger the expansionary growth of the economy.

The ripple effect most often under such circumstances, is higher demand for housing as it is the case in Ghana currently. During our analysis of global crime ranking, Ghana ranked 84 with a crime index of 43.9 among 146 countries according to Numbeo (2024), and 17 in Africa among 52 states (Africa Organized Crime Index, 2024).

The crime index of 43.9 is classified as moderate according to the Numbeo scale of measurement which grades crime levels between 41 to 60 as moderate. This gives confidence to the general investor community that, Ghana is comparatively one of the most conducive destinations to invest, of which real estate investment is not an exception.

2.FDI Record

Also, sight is not lost on the fact that foreign direct investment (FDI) is another driver of investment globally. Just like all other sectors of the economy, foreign direct investment has a direct relationship with demand for real estate.

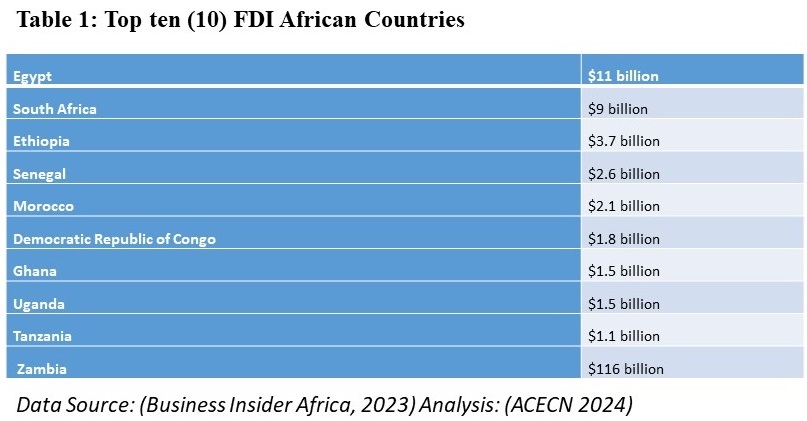

Interestingly, our exploration found that Ghana is among the top ten (10) countries in Africa with high levels of foreign direct investment with a total FDI value of US$1.5 billion according to Business Insider Africa (2023). Below is a diagram that depicts the top ten (10) African countries with the highest foreign direct investment.

Naturally, one would have expected that Zambia, Egypt, South Africa etc would have been projected as the most promising real estate investment destinations in this analysis, taking into consideration their volumes of FDI compared to others such as Ghana.

However, the broader scope of analysis taking into cognizance the eight indices examined so far, Ghana still appears to have a competitive advantage even though Zambia, Egypt South Africa have higher FDIs. This has had a direct impact on the Ghanaian economy and we presume it is one of the contributory factors that kept the demand for housing skyrocketing persistently till now.

3.Government Policy/Incentives

Finally, government policy and incentives are crucial to the real estate sector, unlike in the past when there were little or no incentives for the sector, today there are many more than we ever need to bridge the housing deficit of the continent.

Our exploration found that most African states use a combination of taxation, legal and regulatory regimes as incentives to boost private investment in the housing sector, for instance in Nigeria real estate investment companies approved by the Securities Exchange Commission are tax-exempted from rental and dividend income depending on some conditions (PwC 2024). Zero corporate income tax is declared for companies including real estate developers planning to relocate to Rwanda (Rwanda Development Board, 2024), whilst Kenya on the other hand offers a corporate tax exemption of 25% per annum for developers (Business Daily, 2024).

Tax Exemption Act of Ghana

Similarly, the tax exemptions Act, 2022 (Act, 1088) of the Republic of Ghana has several tax benefits and exemptions for developers, particularly, those within the affordable housing brackets. The purpose is to attract both local and foreign direct investments into the real estate and housing sector aimed at bridging the housing gap. Taxation shall be treated as a whole topic compared to other African states in subsequent series. Time will fail us to give the tax incentive accounts for all African countries, however, one observation that made Ghana different beyond the tax incentives is that, Ghana has consciously made available funds for developers interested in investing in the housing sector.

Funds for Developers-AfDB Loan Facility

Key among these is the US$75 million commercial loan facility secured from the African Development Bank for the Ghana Infrastructure Investment Fund (GIIF) to improve the financing and development of green and affordable housing units (African Development Bank, Oct. 27, 2022).

There are currently opportunities for private investors to leverage these public resources for housing delivery through the ongoing public-private partnership approach instituted by the government of Ghana.

DBG-Long Term Facility

Besides, the Development Bank of Ghana (DBG), established in June 2022, provides long-term financing at competitive rates for private sector developments, including the housing sector. Moreover, the Central Bank has committed an initial US$200 million to capitalize DBG for this purpose.

Gov’t/Develop’t Partners/DBG Support for Investors

The government has also leveraged another US$550 million from Development Partners to support the DBG to attract private sector investors and other international financiers. The housing sector stands to benefit from these measures as it takes advantage of guaranteed loans that will be provided by DBG.

Public Policy/Invectives-Funds

Last but not least on the public policy and incentives, is the Ghana National Home Ownership Fund, the Home Ownership Fund in partnership with the banking sector was also created in 2022.

This includes the Rent-to-Own Scheme of the Affordable Real Estate Investment Trust, as well as the affordable housing supported by Ghana Commercial Bank (GCB Capital). The funds mobilised will function as a mortgage refinancing mechanism for Private Financial Institutions (PFIs) to draw from in the form of mortgages to consumers or mortgage-backed securities for investors.

This in effect will improve the mortgage market and make it more fluid, hence reducing interest rates on mortgage facilities for prospective homeowners while improving housing delivery in Ghana. In conclusion, we call on all investors across the globe who are interested in investing in the African real estate sector to do so in Ghana. Subscribe to the Eco-environews magazine for subsequent series.

Author: Daniel Kontie

Email: d.kontie@acecnltd.com,

Contact: +233209032280)

Real Estate and Sustainable Construction Consultant, Ghana

CEO, Africa Continental Engineering & Construction Network Ltd (ACECN LTD)

National President, World Sustainable Built Environment and Generative Artificial Intelligence Forum (WSBE-GenAIF)

National president, Ghana Institution of Sustainable and Generative Artificial Intelligence (GhISBE-GenAIF)

Cover Photo

Credit Devtraco Ltd(Overview of Real Estate in Ghana)

Real estate investment in Ghana has become an increasingly attractive option for investors looking to diversify their portfolios and tap into the country’s promising real estate industry, the country with a stable political environment, a young and rapidly urbanizing population, and rising incomes, Ghana’s real estate sector presents exciting opportunities in all categories of real estate, the residential, commercial, and industrial properties. This is a series brought to you by the Africa Continental Engineering & Construction Network Ltd (

Real estate investment in Ghana has become an increasingly attractive option for investors looking to diversify their portfolios and tap into the country’s promising real estate industry, the country with a stable political environment, a young and rapidly urbanizing population, and rising incomes, Ghana’s real estate sector presents exciting opportunities in all categories of real estate, the residential, commercial, and industrial properties. This is a series brought to you by the Africa Continental Engineering & Construction Network Ltd (