DREF Operation Final Report Reveals

,,,,,,,As Climate Change Impact Cited

Story: Mohammed A. Abu

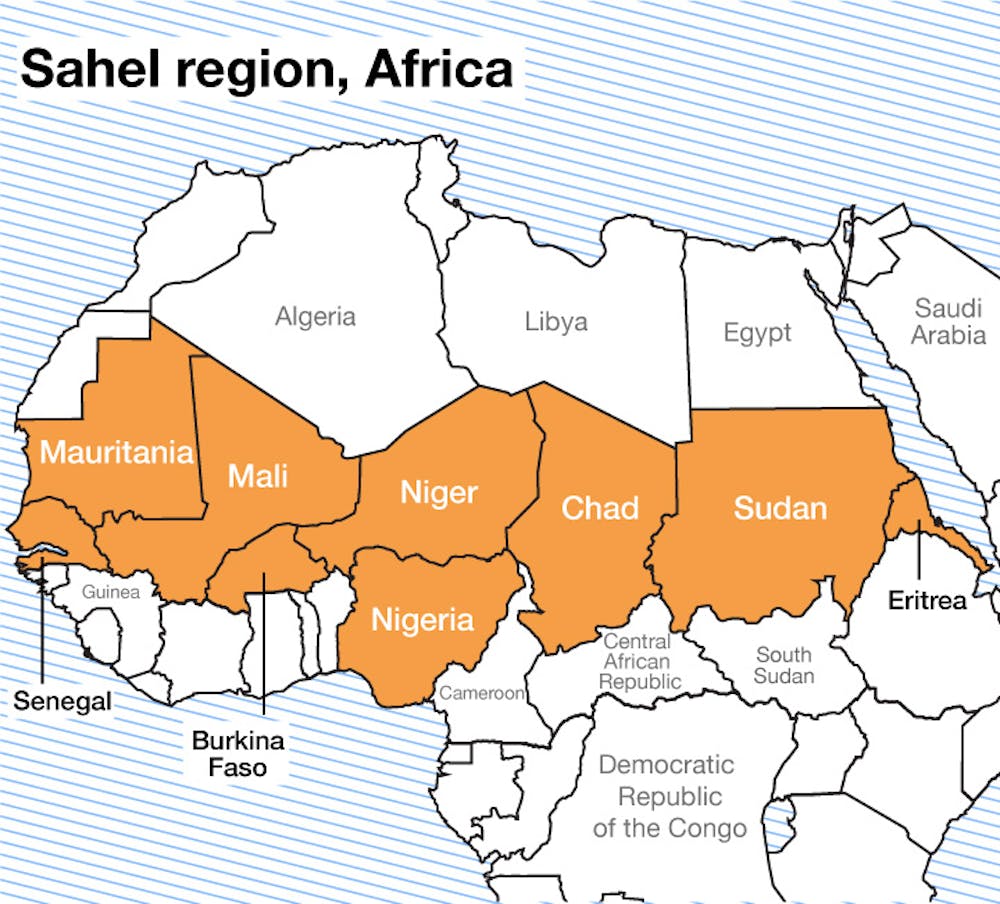

The International Federation of Red Cross Societies(IRFC) in its sixteen-page Disaster Response Emergency Fund(DREF) Operation-Final Report on Mauritania Food Insecurity, has noted that, the food crisis and hunger projections in the Sahel have become increasingly alarming over the past decade in all Sahelian countries, including Mauritania.

According to the projected situation for the next lean season (June-July-August 2023): five (5) wilayas(regions) are projected to be classified in the “Pressure” phase (IPC 2), namely Nouakchott, Nouadhibou, Adrar, Assaba and Inchiri the report hinted.

The six-month Operation which started on July 5, 2022 and ended on December 31, assisted 5,740 people among which were 2,927 males and 2,813 females out of a total 440,765 affected people.

The Host National Society, the Mauritania Red Crescent Society (MRCS) was supported by Red Cross Red Crescent Movement partners currently actively involved in the operation: Mauritanian Red Crescent, British Red Cross, French Red Cross, ICRC, IFRC, Kuwaiti Red Crescent, and Livelihoods Resource Centre

Other partner organizations actively involved in the operation: Government of the Islamic Republic of Mauritania through the CSA (Almaouna Programme) and WFP.

The report also notes the contribution of the Canadian Government to replenish the DREF for this operation. “On behalf of Mauritania Red Crescent Society (MRCS), the IFRC would like to extend gratitude to all for their generous contributions””.

Like other countries in the region, the report notes, food and nutrition insecurity is persistent in Mauritania despite the good spatial and temporal distribution and excess rainfall in most parts of the country during the 2022 rainy season.

In the latest period of 2022, it continues, (October-November-December 2022), one (1) wilaya (region) (Dakhlet Nouadhibou) was classified in the “Minimum” food security phase (IPC 1); two (2) wilayas (Gorgol and Guidimakha) were classified in the “Crisis” phase (IPC 3), and the country’s ten (10) other wilayas were classified in the “Pressure” phase (IPC 2).

“The size of the food insecure population was estimated to be 440,765 people, or 10% of the total population of Mauritania. Of this, 12% are in the “Emergency” phase (IPC 4) and 88% are in the “Crisis” phase (IPC 3).

“The food insecurity situation is taking a bigger scale with joint factors include economic challenges faced by households and overall market, climate changes, agricultural challenges, scarcity of rainy seasons, the migration challenges in the sub-regions etc. In addition, the rainfall of 2022 during the food security intervention of Mauritania Red Crescent has caused massive flooding that has affected crops and will impact agricultural production in these areas, which are mainly arid, with a higher level of drought compared to other countries in the Sahel.

“According to the projected situation for the next lean season (June-July-August 2023): five (5) wilayas are projected to be classified in the “Pressure” phase (IPC 2), namely Nouakchott, Nouadhibou, Adrar, Assaba and Inchiri.

“The eight (8) other wilayas are projected to be classified in “Crisis” phase (IPC 3). During the next lean season, the food insecure population is estimated to be 694,612 people, or 16% of the total population of Mauritania. Of this population, 17% are projected to be in the “Emergency” phase (IPC 4) and 83% are projected to be in the “Crisis” phase (IPC 3).” the report added.

The major donors and partners of the Disaster Response Emergency Fund (DREF) include the Red Cross Societies and governments of Belgium, Britain, Canada, Denmark, Germany, Ireland, Italy, Japan, Luxembourg, New Zealand, Norway, Republic of Korea, Spain, Sweden and Switzerland, as well as DG ECHO and Blizzard Entertainment, Mondelez International Foundation, Fortive Corporation and other corporate and private donors.

Photo: Credit: Françoise GUICHARD/Laurent KERGOAT/CNRS Photo Library